FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

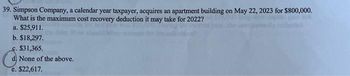

Transcribed Image Text:39. Simpson Company, a calendar year taxpayer, acquires an apartment building on May 22, 2023 for $800,000.

What is the maximum cost recovery deduction it may take for 2022?

a. $25,911.

b. $18,297.

c. $31,365.

None of the above.

e. $22,617.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The depreciated value of the washing machine can be modeled by the equation V= _______ + __________t. $ 1045 Washing machine is depreciated for tax purposes $ 95 per year. V = depricated value and t number of years since purchse datearrow_forwardnki.3arrow_forwardSubject:accounting Green Bank Corporation claimed $300,000 in Sec.179 epxense and $200000 in bonus depreciation in 2020 and the following is the remaining basis for each asset purchased in 2020 after applying Sec 179 and bonus depreciation: Desks and chairs purchasd on March remaining basis 150,000 and Computers purchased in April remaining basis 250000What is the TOTAL depreciation expense for the taxpayer in 2020?arrow_forward

- A taxpayer places a $1,050,000 5-year recovery period asset in service in 2020. This is the only asset placed in service in 2020. Assuming half-year convention, an election to expense under Section 179, and no income limitation, what is the amount of total cost recovery deduction (no bonus depreciation)? a.$210,000 b.$1,040,000 c.$1,026,000 d.$1,050,000 e.$1,042,000arrow_forwardH6. A taxpayer places a $53,000 5-year recovery period asset (not an auto) in service in 2022. This is the only asset placed in service in 2022. Assuming no special elections (e.g., election to expense), what is the amount of total cost recovery deduction? a. $17,490 b. $53,000 c. $10,600 d. $5,300arrow_forwardIn 2021, Peter Quill had a 5 179 deduction carryover of $40,000. In 2022, Peter elected 5 179 for an asset acquired at a cost of $120,000. Peter's $ 179 business income imitation for 2022 is $130.000. Determine Peter's § 179 deduction for 2022 O a $25,000 Ob $115,000 Oc$130,000 Od $140,000arrow_forward

- Craig’s Cars, a car dealership founded in 2020, had taxable income and net operating losses as follows (before any NOL deduction): Tax Year Taxable Income/(NOL) 2020 $90,000 2021 ($50,000) 2022 $60,000 2023 $55,000 What is the amount of Craig’s Cars 2022 NOL deduction? Enter as a positive number. Hint: make sure not to confuse the NCL (net capital loss) carryover rules with the NOL (net operating loss) carryover rules. answer is not 12,000arrow_forwardTax Drill - Section 179 For his business, McKenzie purchased qualifying equipment that cost $212,000 in 2022. The taxable income of the business for the year is $5,600 before consideration of any § 179 deduction. If an amount is zero, enter "0". a. McKenzie's § 179 expense deduction is $ for 2022. His § 179 carryover to 2023 is $ b. How would your answer change if McKenzie decided to use additional first-year (bonus) depreciation on the equipment? McKenzie's § 179 expense deduction is $ for 2022. His § 179 carryover to 2023 is $arrow_forwardam.304.arrow_forward

- Arndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses Pretax accounting income (income statement) Taxable income (tax return) 760 800 $ 128 $ 116 $ 180 $ 200 Tax rate: 25% a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint View this as two temporary differences-one reversing in 2021; one originating in 2021. d. 2021 expenses included a $14 million unrealized loss from reducing…arrow_forward2022 tax rulesarrow_forwardN3. Accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education