FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:39

40

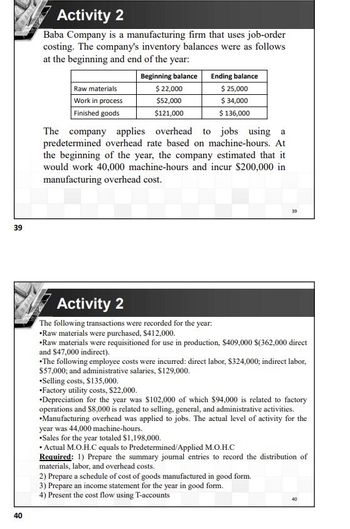

Activity 2

Baba Company is a manufacturing firm that uses job-order

costing. The company's inventory balances were as follows

at the beginning and end of the year:

Beginning balance

Ending balance

Raw materials

$ 22,000

$ 25,000

Work in process

$52,000

$ 34,000

Finished goods

$121,000

$ 136,000

The company applies overhead to jobs using a

predetermined overhead rate based on machine-hours. At

the beginning of the year, the company estimated that it

would work 40,000 machine-hours and incur $200,000 in

manufacturing overhead cost.

39

Activity 2

The following transactions were recorded for the year:

•Raw materials were purchased, $412,000.

•Raw materials were requisitioned for use in production, $409,000 $(362,000 direct

and $47,000 indirect).

•The following employee costs were incurred: direct labor, $324,000; indirect labor,

$57,000; and administrative salaries, $129,000.

*Selling costs, $135,000.

Factory utility costs, $22,000.

Depreciation for the year was $102,000 of which $94,000 is related to factory

operations and $8,000 is related to selling, general, and administrative activities.

•Manufacturing overhead was applied to jobs. The actual level of activity for the

year was 44,000 machine-hours.

•Sales for the year totaled $1,198,000.

• Actual M.O.H.C equals to Predetermined/Applied M.O.H.C

Required: 1) Prepare the summary journal entries to record the distribution of

materials, labor, and overhead costs.

2) Prepare a schedule of cost of goods manufactured in good form.

3) Prepare an income statement for the year in good form.

4) Present the cost flow using T-accounts

40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Green Company's costs for the month of August are as follows: Direct materials used $27,000 Direct labour $34,000 Sales salaries $14,000 Indirect labour $10,000 Indirect materials $15,000 General corporate administrative costs $12,000 Property taxes on manufacturing facility $2,000 Rent on factory $17.000 The beginning work-in-process inventory is $16,000 and the ending work-in-process inventory is $9,000. What is the cost of goods manufactured for the month? a. $112,000 b. $105,000 C. $132,000 d. $138,000arrow_forwardsarrow_forwardHarris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 33,000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $525,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. Harris's actual manufacturing overhead cost for the year was $688,730 and its actual total direct labor was 33,500 hours. Required: Compute the company's plantwide predetermined overhead rate for the year. (Round your answer to 2 decimal places.) Predetermined overhead rate per DLHarrow_forward

- Yamishi Production had the following inventories for the first quarter of 2022: MaterialsWork in process Finished goods Beginning $606,600 312,100 416,100 Ending $522,100 280,800 540,200 Purchases of materials during the quarter were $427,800. Total direct labor costs were incurred in the amount of $1,482,000. Actual overhead costs were incurred as follows: operating supplies used, $17,100; janitorial and maintenance, $87,300; employee benefits, $26,400; utilities, $162,000; depreciation of factory, $43,200; property taxes, $24,000; factory insurance, $29,000. Net sales for the quarter were $3,562,200. Selling and administrative expenses were $508,000. Income taxes should be computed at 40 percent. Calculate cost of goods manufactured. 6. Company produces small boats. Each boat uses 2 sheets of direct materials at $3 a sheet, it takes 2 hours to finish one boat and hourly rate is $5, factory utilities and supervision cost $6 per boat and variable cost amounts to $2 per direct labor…arrow_forwardimmy Author Company has the following data for the past year: Actual overhead $512,000 Applied overhead: Work-in-process inventory $125,000 Finished goods inventory 170,000 Cost of goods sold 150,000 Total $445,000 Calculate the overhead variance for the year and close it to cost of goods sold. Provide all the details and working outs.arrow_forwardYour Company applies manufacturing overhead to jobs using a predetermined overhead rate of 75% of direct labor cost. Any underapplied or overapplied manufacturing overhead cost is closed out to Cost of Goods Sold at the end of the month. During March, the following transactions were recorded by the company: Direct labor costs $20,000 Actual manufacturing costs: $17,000 How much overhead was applied for the period?arrow_forward

- Valdosta Company is working on its costing information for January. Using normal costing, they use one overhead control account and charges overhead to production at 75% of direct labor cost. The company does not formally close the account until the end of the year. The beginning and ending inventories for the month of August are August 1 August 31 Direct Materials $62,000 $67,000 Work in Process $171,000 $145,000 Finished Goods $78,000 $85,000 Production data for the month of August follows: Direct labor $250,000 Actual manufacturing overhead $195,500 Direct materials purchased $163,000 Transportation in $2,000 Valdosta Company's cost of goods transferred to finished goods inventory for August is Group of answer choices $484,000 $495,000 $577,000 $623,500arrow_forwardHarris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 42,000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $571,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. Harris's actual manufacturing overhead cost for the year was $773,298 and its actual total direct labor was 42,500 hours. Required: Compute the company's plantwide predetermined overhead rate for the year. (Round your answer to 2 decimal places.) Predetermined overhead rate per DLHarrow_forwardApplying Factory Overhead Salinger Company estimates that total factory overhead costs will be $90,000 for the year. Direct labor hours are estimated to be 15,000. a. For Salinger Company, determine the predetermined factory overhead rate using direct labor hours as the activity base. If required, round your answer to two decimal places. $4 per direct labor hour b. During May, Salinger Company accumulated 660 hours of direct labor costs on Job 200 and 620 hours on Job 305. Determine the amount of factory overhead applied to Jobs 200 and 305 in May. $4 c. Prepare the journal entry to apply factory overhead to both jobs in May according to the predetermined overhead rate. If an amount box does not require an entry, leave it blank. 88arrow_forward

- Valdosta Company is working on its costing information for January. Using normal costing, they use one overhead control account and charges overhead to production at 75% of direct labor cost. The company does not formally close the account until the end of the year. The beginning and ending inventories for the month of August are August 1 August 31 Direct Materials $62,000 $67,000 Work in Process $171,000 $145,000 Finished Goods $78,000 $85,000 Production data for the month of August follows: Direct labor $250,000 Actual manufacturing overhead $195,500 Direct materials purchased $163,000 Transportation in $2,000 Valdosta Company's manufacturing overhead control balance for the month of August is Group of answer choices $8,000 credit, overapplied $8,000 debit, underapplied $8,000 debit, overapplied $8,000 credit, underappliedarrow_forwardHarris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 31,000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $517,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. Harris's actual manufacturing overhead cost for the year was $670,239 and its actual total direct labor was 31,500 hours. Required: Compute the company's plantwide predetermined overhead rate for the year. (Round your answer to 2 decimal places.) X Answer is complete but not entirely correct. Predetermined overhead rate $ 22.13 X per DLHarrow_forwardHarris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 27,000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $579,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. Harris's actual manufacturing overhead cost for the year was $720,347 and its actual total direct labor was 27,500 hours. Required: Compute the company's plantwide predetermined overhead rate for the year. (Round your answer to 2 decimal places.) Predetermined overhead rate per DLHarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education