Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

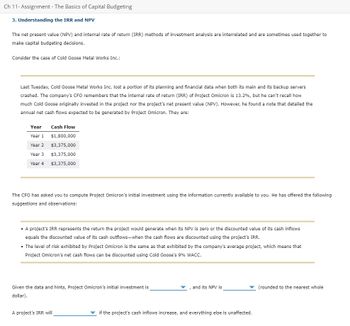

Transcribed Image Text:Ch 11- Assignment - The Basics of Capital Budgeting

3. Understanding the IRR and NPV

The net present value (NPV) and internal rate of return (IRR) methods of investment analysis are interrelated and are sometimes used together to

make capital budgeting decisions.

Consider the case of Cold Goose Metal Works Inc.:

Last Tuesday, Cold Goose Metal Works Inc. lost a portion of its planning and financial data when both its main and its backup servers

crashed. The company's CFO remembers that the internal rate of return (IRR) of Project Omicron is 13.2%, but he can't recall how

much Cold Goose originally invested in the project nor the project's net present value (NPV). However, he found a note that detailed the

annual net cash flows expected to be generated by Project Omicron. They are:

Year Cash Flow

Year 1

Year 2

Year 3

Year 4

$1,800,000

$3,375,000

$3,375,000

$3,375,000

The CFO has asked you to compute Project Omicron's initial investment using the information currently available to you. He has offered the following

suggestions and observations:

• A project's IRR represents the return the project would generate when its NPV is zero or the discounted value of its cash inflows

equals the discounted value of its cash outflows-when the cash flows are discounted using the project's IRR.

• The level of risk exhibited by Project Omicron is the same as that exhibited by the company's average project, which means that

Project Omicron's net cash flows can be discounted using Cold Goose's 9% WACC.

Given the data and hints, Project Omicron's initial investment is

dollar).

A project's IRR will

and its NPV is

if the project's cash inflows increase, and everything else is unaffected.

(rounded to the nearest whole

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The payback method helps firms establish and identify a maximum acceptable payback period that helps in their capital budgeting decisions. Consider the case of Green Caterpillar Garden Supplies Inc.: Green Caterpillar Garden Supplies Inc. is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Alpha’s expected future cash flows. To answer this question, Green Caterpillar’s CFO has asked that you compute the project’s payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table and compute the project’s conventional payback period. For full credit, complete the entire table. (Note: Round the conventional payback period to two decimal places. If your answer is negative, be sure to use a minus sign in your answer.) Year 0 Year 1 Year 2 Year 3 Expected cash flow -$4,500,000…arrow_forwardI'm not sure if I am doing this correctly, also not sure which ones to choose for the last question.arrow_forwardNow that Hurd has more specifically located the source of the economic exposure, Unit B, it is considering ways to hedge this exposure. Since Unit B finances some of its operations, one idea being considered by Hurd management is a change the financial structure of Unit B to a mix of financing in dollars and financing in pounds. Note: Assume the interest rate on pounds is approximately equal to the interest rate on dollars. Career Success Tips ates, Unit B will need revenue of Unit B. TOTAL SCORE: 2/3 more fewer dollars for loan payments, which would partially offset the effect of this appreciation on the Grade Final Steparrow_forward

- Understanding the IRR and NPV The net present value (NPV) and internal rate of return (IRR) methods of investment analysis are interrelated and are sometimes used together to make capital budgeting decisions. Consider the case of Blue Hamster Manufacturing Inc.: Last Tuesday, Blue Hamster Manufacturing Inc. lost a portion of its planning and financial data when both its main and its backup servers crashed. The company’s CFO remembers that the internal rate of return (IRR) of Project Delta is 11.3%, but he can’t recall how much Blue Hamster originally invested in the project nor the project’s net present value (NPV). However, he found a note that detailed the annual net cash flows expected to be generated by Project Delta. They are: Year Cash Flow Year 1 $1,800,000 Year 2 $3,375,000 Year 3 $3,375,000 Year 4 $3,375,000 The CFO has asked you to compute Project Delta’s initial investment using the information currently available to you. He has offered the…arrow_forwardA company puts together a set of cash flow projections and calculates an IRR of 25% for the project. The firm's cost of capital is about 10%. The CEO maintains that the favorability of the calculated IRR relative to the cost of capital makes the project an easy choice for acceptance and urges management to move forward immediately. i. Should this project be evaluated using different standards? ii. How does the possibility of bankruptcy as a result of the project affect the analysis? iii. Are capital budgeting rules still appropriate?arrow_forwardDuring the past few years, Super Technologies has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining and the company has decided to look seriously at a major expansion program that had been proposed by the marketing department. As the assistant to the financial vice-president, it is your task is to estimate Super’s weighted average cost of capital (WACC). The VP has provided you with the following information: The firms’ tax rate is 40%. The current market price of Super’s outstanding bonds is $1,153.72. The bonds have an annual coupon rate of 12% and make coupon payments semiannually. The bonds mature in 15 years and have a par value of $1,000. The current price of the firm’s preferred stock is $113.10 per share. The stock has a $100 par value and a 10% annual dividend rate (paid annually). The current price of the firm’s common stock is $50 per share.…arrow_forward

- Which of the following would you NOT consider when making a capital budgeting decision? A. the change in direct labor expense due to the purchase of a new machine B. the cost of a marketing study completed last year C. the opportunity to lease out a warehouse instead of using it to house a new production line D. the additional taxes a firm would have to pay in the next yeararrow_forwardThe payback period The payback method helps firms establish and identify a maximum acceptable payback period that helps in capital budgeting decisions. There are two versions of the payback method: the conventional payback method and the discounted payback method. Consider the following case: Green Caterpillar Garden Supplies Inc. is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Delta’s expected future cash flows. To answer this question, Green Caterpillar’s CFO has asked that you compute the project’s payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table and compute the project’s conventional payback period. Round the payback period to the nearest two decimal places. Be sure to complete the entire table—even if the values exceed the point at which the cost of the project is…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education