Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

General Accounting Question please solve this problem

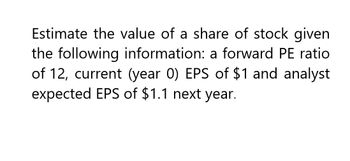

Transcribed Image Text:Estimate the value of a share of stock given

the following information: a forward PE ratio

of 12, current (year 0) EPS of $1 and analyst

expected EPS of $1.1 next year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Perferred Stock valuation. Stock that sells for $30.00 a share and pays dividend of $2.75 at the end of a year. What is the required rate of return?arrow_forwardPlease Provide answerarrow_forwardWhat was X-Co stock’s annual total return (ATR) for 2022 if you bought it for $20 on 1/1; received a $.40 dividend on 3/1 when the stock closed at $18; received a $.40 dividend on 9/1 when the stock closed at $20; and on 12/31 sold the stock for $22? (Express your answer as a percent carried to 1 decimal place.)arrow_forward

- Consider a stock whose value increases across an 8-year period as shown in the table. Instructions: Round your answers to two decimal places. a. Calculate the percentage change in the value of the stock from year to year. Percent Change Year 1 2 3 4 5 6 7 8 Stock Value $80.00 92.00 107.00 128.00 145.00 250.00 400.00 670.00 % V b. Calculate the percentage change in the value of the stock across the entire 8-year period. c. Do you think this qualifies as a bubble? & % 4 V N % O Yes, because the percentage change in the stock value is positive every year. O No, because the percentage change in the stock value has not increased. O Yes, because the percentage change in the stock value has increased greatly. O No, because the percentage change in the stock value fluctuates up and down across the 8 years.arrow_forwardConsider a stock that will pay out a dividends over the next 3 years of $1.4, $1.9, and $2.4, respectively. The price of the stock will be $51.81 at time 3. The interest rate is 13%. What is the current price of the stock? Enter your response below rounded to 2 DECIMAL PLACES.arrow_forwardAssume you purchase a share of stock for $50 at time t=0, and another share at $65 at time t= 1, and at the end of year 1 and year 2, the stock paid a $2.00 dividend. Also, at the end of year 2 you sold both shares for $70 each. What is the time-weighted rate of return? Give typing answer with explanation and conclusionarrow_forward

- A stock will pay a dividend of $3.5 and is expected to sell for $87.8 in one year. If the current price is$19.4, what is the return. Answer as a percent. Answer:arrow_forwardAn investor bought a stock for $18 (at t=0) and one year later it paid a $0 dividend (at t=1). Just after the dividend was paid, the stock price was $15 (at t=1). Inflation over the past year (from t=0 to t=1) was 6% pa, given as an effective annual rate. Which of the following statements is NOT correct? The stock investment produced a: Select one: a.Nominal capital return of -16.666667% pa. b.Nominal income return of -16.666667% pa. c.Real capital return of -21.383648% pa. d.Real income return of 0% pa. e.Real total return of -21.383648% pa.arrow_forwardA stock had retums of 1 percent, 26 percent, 8 percent, and -38 percent annually for the past 4 years. What ts the mean and varlance of these returns? Multiple Choice O 175K, 057319 O 175K 076425 O 150N O62833 O 250 076425 O 150N 057310arrow_forward

- An analyst gathered the following information for a stock and market parameters: stock beta = 1.42; expected return on the Market = 11.41%; expected return on T-bills = 2.12%; current stock Price = $9.64; expected stock price in one year = $12.81; expected dividend payment next year = $1.54. Calculate the required return for this stock. Please share your answer as a percentage rounded to 2 decimal places.arrow_forwardAn investor purchases a stock for $50 and over the next year, receives a $0.75 dividend. At the end of the year, the stock is priced at $53. In the second year, the stock pays a $1.00 dividend and at the end of the year the stock is priced at $51. a. Compute the dollar return for each year. b. Compute the percentage return for each year.arrow_forwardAt the beginning of the year, you purchased a stock for $35. Over the year the dividends paid on the stock $2.75 per share. a. Calculate the return if the price of the stock at the end of the year is $30 b. Calculate the return if the price of the stock at the end of the year is $40arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub