FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

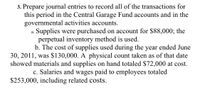

Transcribed Image Text:3. Prepare journal entries to record all of the transactions for

this period in the Central Garage Fund accounts and in the

governmental activities accounts.

Supplies were purchased on account for $88,000; the

perpetual inventory method is used.

b. The cost of supplies used during the year ended June

30, 2011, was $130,000. A physical count taken as of that date

showed materials and supplies on hand totaled $72,000 at cost.

c. Salaries and wages paid to employees totaled

а.

$253,000, including related costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- General City's general fund reported a supplies inventory costing $200,000 at the beginning of the fiscal year. During the year, General City purchased materials and supplies on account for $15,000,000; $900,000 remains unpaid at year-end. Materials and supplies costing $125,000 are on hand at the end of the fiscal year. Prepare the journal entries made this year using the consumption method and purchases method.arrow_forwardDuring the month of July, the Town of Lynton recorded the following information related to purchases: General government Public safety Public works Culture and recreation Total purchase orders and invoices At the end of the month, several purchase orders remained outstanding for all functions except Culture and Recreation. Public Works in particular had a large amount of purchase orders outstanding because it had put in an order for delivery of paving materials to be delivered over the months of July and August. For all but Culture and Recreation, consider the amounts for purchase orders received the same as the actual cost of the items. Req a1 Required a. (1) Prepare the general journal entry to record the issuance of the purchase orders. (2) Show entries in subsidiary ledger accounts. b. (1) Prepare the general journal entries to record the receipt of the goods ordered at the actual cost shown and the related payable. (2) Show entries for the subsidiary ledger accounts including the…arrow_forwardOhio University has a $150 change fund for each shift. The following is a summary of today’s register activity: The case drawer contains $725.95 cash, paid-out slips totaling $10.50 and a customer charge of $7.75. The register readings show sales of $590 and sales tax of $31. Determine the cash overage or shortage for the day.arrow_forward

- Prepare the general journal entries required to record each of the following transactions. The Interstate Fur Trading Commission received a warrant from the Treasury for a $2,000,000 appropriation from Congress for the fiscal year beginning October 1, 20X7. The OMB apportioned to the commission $500,000 of its appropriation. The commission head allotted $400,000 to specific purposes. Salaries incurred and paid for the quarter totaled $120,000. Purchase orders for equipment estimated to cost $50,000 were requested. Equipment estimated to cost $33,000 was ordered. The equipment was received along with an invoice for its cost, $32,890.arrow_forwardQuality Move Company made the following expenditures on one of its delivery trucks: Mar. 20 Replaced the transmission at a cost of $1,990. June 11 Paid $1,455 for installation of a hydraulic lift. Nov. 30 Paid $57 to change the oil and air filter. Prepare journal entries for each expenditure. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTSQuality Move CompanyGeneral Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 114 Interest Receivable 115 Notes Receivable 116 Merchandise Inventory 117 Supplies 119 Prepaid Insurance 120 Land 123 Delivery Truck 124 Accumulated Depreciation-Delivery Truck 125 Equipment 126 Accumulated Depreciation-Equipment 130 Mineral Rights 131 Accumulated Depletion 132 Goodwill 133 Patents LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Owner's…arrow_forward73. Meadows Company headquarters records all of its branch equipment in its own general ledger. Prepare the journal entries in the horne office books and in the branch books as a result of the following transactions: (a) At the beginning of 1986, the branch office purchased branch inventory for $2,500, terms of purchase 2/10, n/30. (b) Head office pays invoices within the discount period. (c) Depreciation on equipment is recorded at the end of the year at a rate of 10%. (d) In earty 1987, the branch's old inventory was exchanged for new inventory for $4,000; A trade-in of $1,500 is received on the old inventory and headquarters pays the balance.arrow_forward

- need help with full working and steps thanks answer in text Listed below are selected transactions of Solution Department Store for the current year ending December 31. a. On December 5, the store received $500 from the Jackson Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. b. During December, cash sales totaled $798,000, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. c. On December 10, the store purchased for cash three delivery trucks for $120,000. The trucks were purchased in a state that applies a 5% sales tax. d. The store determined it will cost $100,000 to restore the area (considered a land improvement) surrounding one of its store parking lots, when the store is closed in 2 years. Solution’s estimates the fair value of the obligation at December 31 is $84,000. Required: Prepare all the journal entries necessary to record the…arrow_forwardPresented below is a partial trial balance for the Messenger Corporation on December 31, 2024. Account Title Debits Credits Cash and cash equivalents 30,000 Accounts receivable 195,000 Raw materials inventory 36,000 Notes receivable 120,000 Interest receivable 4,000 Interest payable 7,000 Investments 48,000 Land 100,000 Buildings 1,500,000 Accumulated depreciation–buildings 740,000 Work in process inventory 38,000 Finished goods inventory 98,000 Equipment 400,000 Accumulated depreciation–equipment 230,000 Franchise (net of amortization) 120,000 Prepaid insurance (for the next year) 60,000 Deferred revenue 48,000 Accounts payable 240,000 Notes payable 500,000 Salaries payable 6,000 Allowance for uncollectible accounts 24,000 Sales revenue 900,000 Cost of goods sold 500,000 Salaries expense 48,000 Additional information: The notes receivable, along with any accrued interest, are due…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education