FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

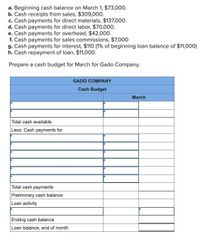

Transcribed Image Text:a. Beginning cash balance on March 1, $73,000.

b. Cash receipts from sales, $309,000.

c. Cash payments for direct materials, $137,000.

d. Cash payments for direct labor, $70,000.

e. Cash payments for overhead, $42,000.

f. Cash payments for sales commissions, $7,000

g. Cash payments for interest, $110o (1% of beginning loan balance of $11,000)

h. Cash repayment of loan, $11,00o.

Prepare a cash budget for March for Gado Company.

GADO COMPANY

Cash Budget

March

Total cash available

Less: Cash payments for

Total cash payments

Preliminary cash balance

Loan activity

Ending cash balance

Loan balance, end of month

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Marie's Clothing Store had an accounts receivable balance of $410,000 at the beginning of the year and a year-end balance of $610,000. Net credit sales for the year totaled $3,000,000. The average collection period of the receivables was: (Round any intermediary calculations to two decimal places and your final answer to the nearest day) OA 74 days OB. 50 days OC. 12 days OD. 62 daysarrow_forwardThe following data was generated as of December 31Accounts receivable, Jan 1 550,000.00Accounts receivable collected 875,000.00Cash Sales 350,000.00Inventory, January 1 450,000.00Inventory, December 31 275,000.00Purchases 950,000.00Gross Margin on Sales 375,000.00 a.) How much is the total sales?b.) How much is the cost of sales?c.) How much is the ending Receivable as of Dec 31?d.) How is the credit sales?arrow_forwardK Dirk Ward borrowed $13,000 00 for investment purposes on May 16 on a demand note providing for a variable rate of interest and payment of any accrued interest on December 31. He paid $1000 on June 10, $200 on September 21, and $800 on November 16. How much is the accrued interest on December 31 if the rate of interest was 7% on May 16, 7.5% effective August 1, and 7.8% effective November 12 The accrued interest on December 31 is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed)arrow_forward

- K Dirk Ward borrowed $13,000 00 for investment purposes on May 16 on a demand note providing for a variable rate of interest and payment of any accrued interest on December 31. He paid $1000 on June 10, $200 on September 21, and $800 on November 16. How much is the accrued interest on December 31 if the rate of interest was 7% on May 16, 7.5% effective August 1, and 7.8% effective November 12 The accrued interest on December 31 is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed)arrow_forwardDuring March, Sam Company had cash sales of $35,000 and sales on account of $210,000. In April, payments on account totaled $175,000. The journal entry prepared by Sam to record the March sales would include a debit to: A. Cash for $35,000, debit to accounts receivable for $210,000, and credit to sales revenue for $245,000 B. Cash for $35,000, debit to deferred revenue for $210,000, and credit to sales revenue for $245,000 C. Cash for $35,000, debit to accounts payable for $210,000, and credit to sales revenue for $245,000 D. Cash and credit to sales revenue for $35,000arrow_forwardYork Company engaged in the following transactions for Year 1. The beginning cash balance was $86,000 and the ending cash balance was $59,100. 1. Sales on account were $548,000. The beginning receivables balance was $128,000 and the ending balance was $90,000. 2. Salaries expense for the period was $232,000. The beginning salaries payable balance was $16,000 and the ending balance was $8,000. 3. Other operating expenses for the period were $236,000. The beginning other operating expenses payable balance was $16,000 and the ending balance was $10,000. 4. Recorded $30,000 of depreciation expense. The beginning and ending balances in the Accumulated Depreciation account were $12,000 and $42,000, respectively. 5. The Equipment account had beginning and ending balances of $44,000 and $56,000, respectively. There were no sales of equipment during the period. 6. The beginning and ending balances in the Notes Payable account were $36,000 and $44,000, respectively. There were no payoffs of…arrow_forward

- Need answerarrow_forwardK Accounts receivable management This table, shows that Blair Supply had an end-of-year accounts receivable balance of $300,000. The table also shows how much of the receivables balance originated in each of the previous six months. The company had annual sales of $2.40 million and it normally extends 30-day credit terms to its customers. a. Use the year-end total to evaluate the firm's collection system. b. If 70% of the firm's sales occur between July and December, would this affect the validity of your conclusion in part a? Explain. a. The average collection period is days. (Round to two decimal places.)arrow_forwardA 182-day, $250,000 Treasury Bill originally issued at 6.6% was sold at 5.9%, 82 days after it was issued. What was the selling price? A. $245,560 B. $250,000 C. $246,730 D. $246,347 E. $246,023arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education