ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

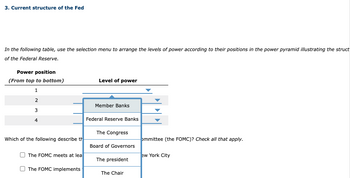

Transcribed Image Text:3. Current structure of the Fed

In the following table, use the selection menu to arrange the levels of power according to their positions in the power pyramid illustrating the struct

of the Federal Reserve.

Power position

(From top to bottom)

1

2

3

4

Which of the following describe th

The FOMC meets at lea

The FOMC implements

Level of power

Member Banks

Federal Reserve Banks

The Congress

Board of Governors

The president

The Chair

ommittee (the FOMC)? Check all that apply.

ew York City

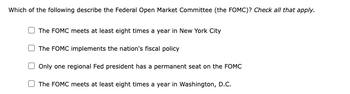

Transcribed Image Text:Which of the following describe the Federal Open Market Committee (the FOMC)? Check all that apply.

The FOMC meets at least eight times a year in New York City

The FOMC implements the nation's fiscal policy

Only one regional Fed president has a permanent seat on the FOMC

The FOMC meets at least eight times a year in Washington, D.C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Why do you think the Fed maintains 5-year terms for Federal Reserve district bank presidents? O The terms are 5 years or less depending on when the district bank president in question reaches age 65. O Maintaining the 5-year terms helps ensure that the presidents are not unduly influenced by politicians. O Maintaining the 5-year terms helps to achieve the Fed's aim of confusing market participants about the stance of policy. O There is no deliberate strategy behind maintaining the 5-year terms.arrow_forwardI need answer typing clear urjent no chatgpt i will give upvotearrow_forward5. If reserves are scarce, how would the federal funds rate change (increase or decrease) if the Fed: 1) sells mortgage-backed securities 2) decreases the (minimum) reserve requirements 3) conducts overnight repo operations 4) conducts overnight reverse repo operationsarrow_forward

- The Federal Reserve System and Open Market Operations_ Ask FRED The accompanying graph depicts the value of mortgage-backed securities held by the Federal Reserve over time. ALFRED IlMorgage-backed securities held by the Federal Reserve: All Maturities Vintage 2018-02-08 1,800,000 1,600,000 1,400,000 1,200,000 O 1.000,000 800,000 600,000 400,000 200,000 -200,000 2004 2006 2008 2010 2012 2014 2016 2005 Source: Board of Governors of the Federal Reserve System (US) a. What was the value of mortgage-backed securities the Fed held prior to 2009? Enter your answer in millions of dollars millionarrow_forwardWhich of the current parts of the Federal Reserve System was not a part of the Federal Reserve Act of 1913? O a. State chartered banks who choose to be members of the System O b. Nationally chartered banks Oc. Reserve Banks Od. Board of Governorsarrow_forward8arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education