ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:The Federal Reserve System and Open

Market Operations_ Ask FRED

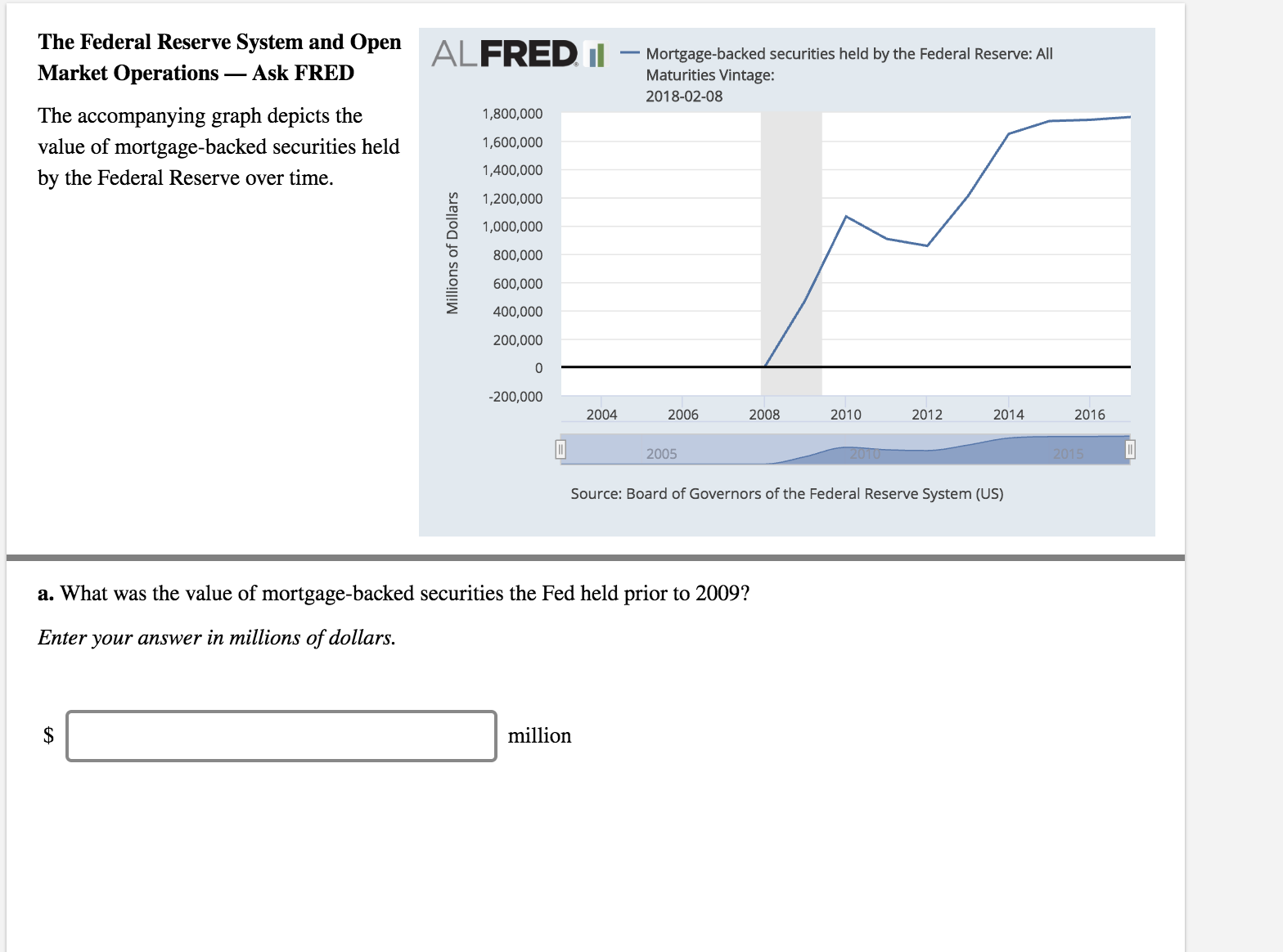

The accompanying graph depicts the

value of mortgage-backed securities held

by the Federal Reserve over time.

ALFRED IlMorgage-backed securities held by the Federal Reserve: All

Maturities Vintage

2018-02-08

1,800,000

1,600,000

1,400,000

1,200,000

O 1.000,000

800,000

600,000

400,000

200,000

-200,000

2004

2006

2008

2010

2012

2014

2016

2005

Source: Board of Governors of the Federal Reserve System (US)

a. What was the value of mortgage-backed securities the Fed held prior to 2009?

Enter your answer in millions of dollars

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- 9.arrow_forward8arrow_forwardXYZ Corporation is trying to decide whether it should buy money market instruments or leave its funds on deposit at a commercial bank. Which of the following is an advantage of buying money market instruments over leaving funds on deposit at a commercial bank that XYZ should be aware of? a. Money market instruments offer a higher yield than leaving funds on deposit at a commercial bank. b. Money market instruments are more liquid than funds on deposit at a commercial bank. c. Money market instruments are safer than leaving funds on deposit at a commercial bank. d. Money market instruments involve a financial middleman.arrow_forward

- Why do you think the Fed maintains 5-year terms for Federal Reserve district bank presidents? O The terms are 5 years or less depending on when the district bank president in question reaches age 65. O Maintaining the 5-year terms helps ensure that the presidents are not unduly influenced by politicians. O Maintaining the 5-year terms helps to achieve the Fed's aim of confusing market participants about the stance of policy. O There is no deliberate strategy behind maintaining the 5-year terms.arrow_forwardQuestion 2 B A commercial bank has capital of $5000 and a leverage ratio of 10. If the value of the bank’s assets increases by 5%, then its capital has _____ to ______. Select one: a. increased / $5,250 b. increased / $5,500 c. decreased / $4,500 d. decreased / $4,000 e. decreased / $2,500 Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forward. A well-known bank has specialized in adjustable-rate mortgages. They have originated 7 billion USD in adjustable-rate mortgages. This bank generally raises money by borrowing with shorter term loans and issuing fixed-interest rate Certificates of Deposit. The bank has 6 billion in short-term adjustable-rate loans to partly help fund the loan portfolio. The federal reserve has announced an increase in their target interest rate of 50 basis points (0.5%). What is the equation and solution.arrow_forward

- Mearrow_forwardQuestion 6 Which of the following is NOT an operating instrument? O nonborrowed reserves federal funds interest rate discount ratearrow_forward2. What is the effect of a Federal Reserve open market sale? What happens to interest rates in the money market and federal funds market as a result? Provide a graph of the money market and federal funds market to illustrate.arrow_forward

- 9. Which of the following is not an administered rate? a. Discount rate b. ON RRP offering rate c. Federal funds rate d. Interest on reserve balances ratearrow_forwardPlease describe a shadow bank/define shadow banking and explain why thesefinancial institutions pose a problem to customers and/or the financial systemas a wholearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education