ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

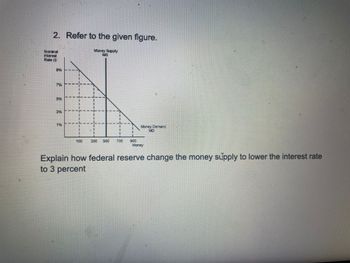

Transcribed Image Text:2. Refer to the given figure.

Money Supply

US

g

Nominal

Interes

946

786

5%

3%

14

100 300 500 700

Money Demand

VO

Money

Explain how federal reserve change the money supply to lower the interest rate

to 3 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- When bankers hold excess reserves: A. The size of the monetary multiplier increases B. The money- creating potential of the banking system increases c. The money-creating potential of the banking system decreases D. There is no change in the money-creating potential of the banking systemarrow_forwardview picturearrow_forwardFigure 3: MSo MS1 Interest Rate (%) 10% 8% 6% MD 100 200 Money (S million) 26. Refer to Figure 3. The money supply curve will shift from MS. to MS1, if: a) the Fed increases the reserve requirement. b) the price level increases. c) the equilibrium level of output decreases. d) the Fed buys U.S. government bonds in the open market.arrow_forward

- 3. Money held by the public that includes demand deposits is measured as (A) M1 (B) M2 (C) MO (D) Fiat money (E) Commodity moneyarrow_forwardFigure 34-3. Interest Rate 1 T₁ Price Level 3 P₂ P₁ Quantity of Money t Quantity of Y₂ Y₁ Output 4 Refer to Figure 34-3. What quantity is represented by the vertical line on the left- hand graph? the rate of inflation the demand for money the quantity of bonds that was most recently sold or purchased by the Federal Reserve the supply of moneyarrow_forward23. Identify the four major methods the Fed uses to control the money supply. Give two examples of situations in which the Fed might use one of these methods and explain why that method is best for the given situation.arrow_forward

- No written by hand solutionarrow_forward7. The four major instruments (or tools) of monetary policy are: 1) Open market operations 2) The Discount Rate 3) The reserve ratio 4) Interest on Reserves The Fed uses four major tools to control the reserves of banks and the size of the money supply. 1) The Federal Reserve can buy or sell government securities in the open market to change the lending ability of the banking system: (a) buying government securities in the open market from either banks or the public ( increases, decreases ) the excess reserves of banks; (b) selling government securities in the open market to either banks or the public ( increases, decreases ) the excess reserves of banks. 2) The Fed can raise or lower the reserve ratio: (a) raising the reserve ratio ( increases, decreases ) the excess reserves of banks and the size of the monetary (checkable-deposit) multiplier; (b) lowering the reserve ratio (increases, decreases) the excess reserves of banks and the size of the monetary multiplier. 3) The Fed can…arrow_forward1. If the demand for money curve shifts from Md1 to Md0 the equilibrium interest rate will.. Increase from 5% to 10% Decrease from 7% to 5% Increase from 5% to 7% Remain at 7% 2. If the demand for money curve shifts from Md1 to Md0 and the interest rate remains at 5% there will be An equilibrium in the money market An excess demand for money An equilibrium in the bond market An excess supply of moneyarrow_forward

- -The Golden State Bank has total cash reserves of $110,000, deposits of $200,000, and loans of $90,000. The reserve requirement is 5 percent. This bank can make additional loans up to the amount of: $10,000 $5,500 $100,000 $190,000arrow_forward39. Which of the following are ways in which banks can help businesses in the United States? Choose all that apply. Banks can reduce the money supply through the use of the money multiplier. Banks can serve as a stopgap to save struggling businesses from bankruptcy with small loans. Bank loans remove personal liability from company owners. O Bank loans are tax-deductible for businesses.arrow_forwardDuring the Covid crisis, the Fed issued a large quantity of money supply and interest rate has great pressure to fall below zero. What did Fed do to maintain the interest rate above zero and how does this approach work? (refer to image)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education