Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

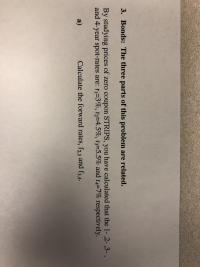

Transcribed Image Text:3. Bonds: The three parts of this problem are related.

By studying prices of zero coupon STRIPS, you have calculated that the 1- ,2- ,3-,

and 4-year spot-rates are: ri-3%, 12-4.5 %, r3-5.5% and r4-7% respectively.

a)

Calculate the forward rates, f23 and f3,4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Suppose the average return on FTSE TMX Canada long-term bonds is 7.00% and the standard deviation is 9.00% and the average return and standard deviation on T-bills are 3.30% and 2.50%, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) a. What is the probability that in any given year, the return on long-term corporate bonds will be greater than 9% ? Less than 0% ? Greater than 9% Less than 0% % % b. What is the probability that in any given year, the return on T-bills will be greater than 9%? Less than 0%? Greater than 9% Less than 0% % % c-1. In 1981, the return on FTSE TMX Canada long-term bonds was -4.29%. How likely is it that such a low return will recur at some point in the future? Probability % c-2. T-bills had a return of 9.00% in this same year. How likely is it that such a high return on IT-bills…arrow_forwardIf possible, please calculate using excel and show formulas. The spot interest rates in the following downward-sloping term structure are: r1 = 4.6%, r2 = 4.4%, r3 = 4.2%, and r4 = 4.0%, r5=2%. Assume face value is $1,000. Calculate bond prices of a 5% coupon bond.arrow_forwardUnlike the coupon interest rate, which is fixed, a bond's yield varies from day to day depending on market conditions. To be most useful, it should give us an estimate of the rate of return an investor would earn if that investor purchased the bond today and held it for its remaining life. There are three different yield calculations: Current yield, yield to maturity, and yield to call. A bond's current yield is calculated as the annual interest payment divided by the current price. Unlike the yield to maturity or the yield to call, it does not represent the actual return that investors should expect because it does not account for the capital gain or loss that will be realized if the bond is held until it matures or is called. This yield was popular before calculators and computers came along because it was easy to calculate; however, because it can be misleading, the yield to maturity and yield to call are more relevant. The yield to maturity (YTM) is the rate of return earned on a…arrow_forward

- am. 11.arrow_forward13. Consider a coupon bond with coupon payment=4.25, M=100, and n=2. Suppose ?1 = 4% and ?2 = 4.24%. Consider a forward contract for the delivery of the coupon bond in one period from today. Calculate the forward price using the following two approaches: 1) use the forward rate to price the forward contract; 2) use the cost of carry approach: spot-forward parity adjusted for the coupons.arrow_forward3. Interest rate swap. Consider a portfolio of floating-rate bonds that all mature in three years. What is the fixed coupon rate for a fairly priced fixed-for-floating interest rate swap given the following discount factors? Years 2. 0.,95 06'0 0.86arrow_forward

- There are four similar coupon bonds.If the only differences are their maturities and YTMs.which one would have the most volatile market price when there is a fluctuation in the market interest rate?Please carefully explain. 7-year maturity with a 8% YTM 15-year maturity with a 4% YTM 7-year maturity with a 6% YTM 15-year maturity witth a 2% YTMarrow_forwardBond A and Bond B are zero coupon bonds. Bond A has a maturity of 10 years and Bond B has a maturity of 15 years. This would mean that Bond B has more interest rate risk as compared to Bond A. Group of answer choices True Falsearrow_forwardBond j has a coupon of 6.2 percent. Bond k has a coupon of 10.2 percent. Both bonds have 20 years to maturity and have a YTM of 6.9 percent. a. If interest rates suddenly rise by 1 percent, what is the percentage price change of these bonds? Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. \table[[,%delta in Price],[Bond j,,%arrow_forward

- Suppose Baa-rated bonds currently yield 6.8%, while Aa-rated bonds yield 4.8 %. Now suppose that due to an increase in the expected Inflation rate, the yields on both bonds increase by 1.2%. What would happen to the confidence Index? (Round your answers to 4 decimal places.) Confidence index from toarrow_forwardPlease help with this problem thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education