Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

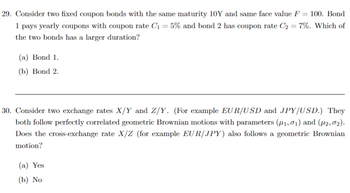

Transcribed Image Text:**Question 29:**

Consider two fixed coupon bonds with the same maturity of 10 years and the same face value \( F = 100 \). Bond 1 pays yearly coupons with a coupon rate \( C_1 = 5\% \) and Bond 2 has a coupon rate \( C_2 = 7\% \).

Which of the two bonds has a larger duration?

- (a) Bond 1.

- (b) Bond 2.

---

**Question 30:**

Consider two exchange rates \( X/Y \) and \( Z/Y \). (For example, EUR/USD and JPY/USD.) They both follow perfectly correlated geometric Brownian motions with parameters \((\mu_1, \sigma_1)\) and \((\mu_2, \sigma_2)\).

Does the cross-exchange rate \( X/Z \) (for example EUR/JPY) also follow a geometric Brownian motion?

- (a) Yes

- (b) No

---

*Note: There are no graphs or diagrams provided in this text.*

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1. If a company's bonds are selling at a discount, then Select one: a. The coupon interest rate is equal to the going interest rate b. The going rate of interest is above the coupon rate c. The current interest rates are below the coupon rate d. The YTM is below the coupon interest ratearrow_forwardBond A sells for $990. Bond B sells for $1010. Both bonds have a coupon rate of 4%. Which bond has the higher yield? (All else equal.) Select one: a. not enough information to determine b. B c. they will both have the same yield d. Aarrow_forwardA bond is currently selling for $880. This indicates that this bond is _____, and you would expect that the coupon rate would be _____ than the current market rate. Attractive; greater than Attractive; less than Unattractive; greater than Unattractive; less thanarrow_forward

- Two bonds, bond A and bond B, are identical except that bond A is convertible and bond B is not. Which bond will have the higher price? Whyarrow_forwardSolve this practice problemarrow_forwardWhich of the following statements is/are most CORRECT? O 11 A yield curve depicts the relationship between bond's 'time to maturity and its yield to maturity. 2) A premium bond's price will decline over time if the required return remains unchanged. 3) A discount bond's price will decline over time if the required return remains unchanged. 4) Both a and b are correct.arrow_forward

- a) All things being equal If a bond's coupon rate is higher than its yieldto maturity (YTM), is the bond selling at a discount, premium or par?b) All things being equal If a bond's coupon rate is lower than its yield tomaturity (YTM), is the bond selling at a discount, premium or par?c) All things being equal If a bond's coupon rate is equal to its yield tomaturity (YTM), then is the bond selling at a discount, premium or par?d) All else being equal, the longer the term to maturity, the greater orthe lower the duration?f) All else being equal, the higher the coupon rate on the bond, theshorter or the longer the duration of the bond?arrow_forwardAll else the same, if interest rates fall, then 1. bond prices will rise II. coupon payments on floating rate bonds will fall III. the percentage price change for short-term bonds will be greater than for long-term bonds IV. the percentage price change for high coupon bonds will be greater than for low coupon bonds Select one: O a. I, III, and IV only O b.ll and IV only Ocland Il only O d. Ill and IV only O e.1, 1l and Ill onlyarrow_forwardA dual-currency bond makes coupon interest payments in one currency and the principal repayment at maturity in another currency. Select one: True Falsearrow_forward

- Consider two pairs of bonds; A and B, and C and D. A and B are both coupon bonds, they have the same coupon rate, but A has a longer time-to-maturity than B, and at the prevailing rate they sell at the same price. C is a coupon bond and D is a zero coupon bond, they both have the same time-to-maturity, and at the prevailing rate they sell at the same price. If interest rates rise by the same amount for all of the bonds, which bond in each pair will fall by the greater amount in price? A and D OB and C O If bonds are priced in an efficient market, their price is not altered by transitory events. OB and D OA and C 4arrow_forwardUnder what situation might a bond discount arise when issuing bonds? Select one: a. The coupon rate is less than the effective or yield rate. b. The effective or yield rate is less than the coupon rate. c. The coupon rate is less than the cash rate of interest. d. The effective or yield rate is less than the market rate of interest.arrow_forwardWhich of the following statements is correct assuming same market rates for all maturities (flat yield curve)? e a Extendible bonds allow bond issuer to extend the maturity date. O b. Callable bonds give the bond issuer an option to call the bond back before the maturity date at a predetermined price. Oc. When the market yield is equal to a bond's stated coupon rate, the bond's current yield is greater than its coupon yield. Od. The cash price plus the accrued interest on the bond is the quoted price of the bond. Current yield is the ratio of annual coupon payment divided by the par value. o e.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education