Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

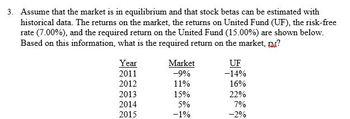

Transcribed Image Text:3. Assume that the market is in equilibrium and that stock betas can be estimated with

historical data. The returns on the market, the returns on United Fund (UF), the risk-free

rate (7.00%), and the required return on the United Fund (15.00%) are shown below.

Based on this information, what is the required return on the market, ?

Year

2011

2012

2013

2014

2015

Market

-9%

11%

15%

5%

-1%

UF

-14%

16%

22%

7%

-2%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- . E(RI) = .15(.11) + .55(.18) + .30(.08) Using CAPM to determine the expected rate of return for risky assets, consider the following example stocks, assuming that you have already compute the betas Stock Beta WND 0.80 STA 1.35 CTE 1.15 DUY 1.20 EVN -0.20 Stock WND the economy’s RFR to be 6 percent (0.06) and the expected return on the market portfolio (E(RM)) to be 8 percent (0.08) Stock STA, the economy’s RFR to be 5percent (0.05) and the expected return on the market portfolio (E(RM)) to be 7 percent(0.07) Assume that all the other stocks is as follows since we expect the economy’s RFR to be 5 percent (0.05) and the expected return on the market portfolio (E(RM)) to be 9 percent (0.09),arrow_forwardExcel Online Structured Activity: Historical Return: Expected and Required Rates of Return You have observed the following returns over time: Year Stock X Stock Y Market 2011 14 % 12 % 10 % 2012 20 7 9 2013 -13 -2 -13 2014 3 1 2 2015 19 9 12 Assume that the risk-free rate is 4% and the market risk premium is 6%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet What is the beta of Stock X? Do not round intermediate calculations. Round your answer to two decimal places. fill in the blank 2 What is the beta of Stock Y? Do not round intermediate calculations. Round your answer to two decimal places. fill in the blank 3 What is the required rate of return on Stock X? Do not round intermediate calculations. Round your answer to one decimal place. fill in the blank 4 % What is the required rate of return on Stock…arrow_forward13. Changes to the security market line The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC). Based on the graph, complete the table that follows. REQUIRED RATE OF RETURN (Percent) REQUIRED RATE OF RETURN (Percent) 20.0 16.0 20 12.0 16 8.0 12 4.0 0 0 CAPM Elements Risk-free rate (TRF) Market risk premium (RPM) Happy Corp. stock's betal Required rate of return on Happy Corp. stock 0 Happy Corp.'s new required rate of return is F 0.6, 7.6 HC's Stock ☐ 0.5 An analyst believes that inflation is going to increase by 2.0% over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pricing Model (CAPM). The following graph plots the current SML. Calculate Happy Corp.'s new required return. Then, on the graph, use the green points (rectangle symbols) to plot the new SML suggested by this analyst's prediction. 0 1.0 RISK (Beta) Tool tip: Mouse over the…arrow_forward

- USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM Investment Beta Analyst's Estimated Return Stock X 2.3 15.5% Stock Y 1.2 13.6% Market Portfolio 1.0 11.5% Risk-free rate 4.0% What is the required rate of return for Stock X based on the capital asset pricing model (CAPM)?arrow_forward11. Changes to the security market line The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC). Based on the graph, complete the table that follows: CAPM Elements Value Risk-free rate (rRFrRF) ________? Market risk premium (RPMRPM) __________? Happy Corp. stock’s beta ___________? Required rate of return on Happy Corp. stock ___________? An analyst believes that inflation is going to increase by 3.0% over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pricing Model (CAPM). The following graph plots the current SML.arrow_forward4arrow_forward

- You have observed the following returns over time: Year Stock X Stock Y Market 2015 14% 13% 12% 2016 19 7 10 2017 −16 −5 −12 2018 3 1 1 2019 20 11 15 Assume that the risk-free rate is 6% and the market risk premium is 5%. What are the betas of Stocks X and Y? What are the required rates of return on Stocks X and Y? What is the required rate of return on a portfolio consisting of 80% of Stock X and 20% of Stock Y?arrow_forward4arrow_forwardI need help with Carrow_forward

- You are given the following partial covariance and correlation tables from historical data: Securities J K Market Securities J K Market 1.24 1.11 1.17 1.03 Covariance Matrix K 0.90 J 0.0020480 0.0021600 Also, you have estimated that the market's standard deviation is 4.3 percent. For the coming year, the expected return on the market is 14.0 percent and the risk-free rate is expected to be 4.0 percent. Given this information, determine the beta for Security K for the coming year, assuming CAPM is the correct model for required returns. Correlation Matrix K 0.60 1.00 0.90 1.00 0.60 0.80 Market 0.0020480 0.0021600 Market 0.80 0.90 1.00 Ston sharing Hidel lines Wearrow_forwardYou are given the following information concerning a stock and the market: Returns Year Market Stock 2014 10 % 25 % 2015 12 28 2016 13 4 2017 −14 −22 2018 37 16 2019 15 23 a. Calculate the average return and standard deviation for the market and the stock. (Use Excel to complete the problem. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) b. Calculate the correlation between the stock and the market, as well as the stock’s beta. (Use Excel to complete the problem. Do not round intermediate calculations. Round your correlation answer to 2 decimal places and beta answer to 4 decimal places.)arrow_forwardReview the following market information: Current Stock Market Return 11.25% Current T-Bill Price $979.43 Historic T-Bill Average Return 2.80% Historic Stock Market Average Return 8.10% Stock Beta 1.23 What is the required return (rounded to two places)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education