ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

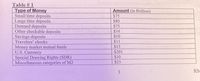

Transcribed Image Text:Table # 1

Type of Money

Small time deposits

Large time deposits

Demand deposits

Other checkable deposits

Savings deposits

Travelers' checks

Money market mutual funds

U.S. Currency

Special Drawing Rights (SDR)

Miscellaneous categories of M2

Amount (in $billion)

$75

$80

$75

$14

$10

$11

$15

$201

$10

$25

3

RM

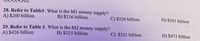

Transcribed Image Text:28. Refer to Table1. What is the M1 money supply?

A) $200 billion.

B) $216 billion.

C) $226 billion.

D) $301 billion

29. Refer to Table 1. What is the M2 money supply?

A) $426 billion.

B) $325 billion.

C) $351 billion.

D) $471 billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- answer quicklyarrow_forward3. What would be the effect of increasing the banks' reserve requirements on the money supply?arrow_forwardn the table below, the money supply, defined by M3, is equal to ........ Currency held by the non-bank public ($ billion) Current deposits at banks ($, billion) Other deposits at banks and other deposits held by other deposit -taking institutions ($, billion) 60 240 1500 Select one: a. 1200 billion b. 1800 billion c. 1500 billion d. 1740 billionarrow_forward

- 5. Consider the T-table of the Bank of Boston. Suppose the Federal Reserve Bank buys an additional $2 million in government bonds from the Bank of Boston. Assume (1) the required reserve ratio is 10 percent, and (2) the Bank of Boston issues all excess reserves in loans (I.e., there are no excess reserves). The new money supply equals $ million. Submit Balance sheet of the Bank of Boston Liabilities -55,000,000 Checkable deposits +$5,000,000 Assets Government bonds Currency (= bank reserves) +$5,000,000 Loans $0arrow_forward4. What components of money are counted as part of M1? A) currency, M2 and checking accounts. B) currency, travelers' checks, checking accounts and M2 O c. C) C) currency, travelers' checks and checking accounts. D) currency, travelers' checks and money market accounts 10. Explain what will happen to the money multiplier process if there is an increase in the reserve requirement? A) An increase in the reserve requirement means that banks will be less likely to have your money when you demand it, but it would increase the money multiplier B) An increase in the reserve requirement means that banks will be more likely to have your money when you demand it, increasing the money multiplier C) Since a greater portion of each deposit is being lent out, the multiplier will increase. This means more loans lent and more economic growth. D) Since a smaller portion of each deposit is being lent out, the multiplier will decrease. This means fewer loans lent and less economic growth.arrow_forward4) Listen If the money multiplier decreased from 20 to 4, then the Fed increased the reserve ratio from 5 percent to 8 percent. the Fed increased the fed funds rate from 5 percent to 8 percent. the Fed increased the reserve ratio from 5 percent to 25 percent. the Fed decreased the fed funds rate from 8 percent to 5 percent. Question 30 (1 point) )Listen The FOMC is able to increase the money supply when it buys US government securities. The increase will be larger, the larger is the reserve ratio. buys US government securities. The increase will be larger, the smaller is the reserve ratio. sells US government securities. The increase will be larger, the smaller is the reserve ratio. sells US government securities. The increase will be larger, the larger is the reserve ratio.arrow_forward

- What happens to M1 when Serena withdraws $1000 from a checking account and places it in her purse? a.It increases by $1000 b.It increases by more than $1000 because of the money multiplier effect c.Nothing. It does not change. d.It decreases by more than $1000 because of the money multiplier effect e.It decreases by $1000arrow_forwardSuppose the Fed decided to purchase $100 billion worth of government securities in the open market. Assume all payments are directly deposited into or withdrawn from the banking system. What impact would this action have on the economy? Specifically, answer the following questions. Instructions: Enter your responses as a whole number. a. How will M1 be affected initially? O Decrease by $100 billion O Increase by $100 billion O Not enough information to answer O No initial change to M1 b. By how much will the banking system's lending capacity increase if the reserve requirement is 20 percent? $ billion c. Must interest rates rise or fall to induce investors to utilize this expanded lending capacity? O Rise O Fall d. By how much will aggregate demand initially increase if investors borrow and spend all the newly available credit? $ billion e. Under what circumstances would the Fed be pursuing such an open market policy? O Inflation O Recession f. To attain those same objectives, what…arrow_forward2. Assume the reserve requirement forya banking system is 20%. Under the typical assumptions corresponding with the money multiplfer, if an autonomous injection of $10,000 is made, how will it affect: (a) The initial required reserves of the individual bank into which this deposit is made? (b) The initial excess reserves of the individual bank into which this deposit is made? (c) Total deposits in the entire banking system after all of the repercussions of this injection?. (d) Are there any factors that might not allow this to work in the real world in the way economic theory might suggest? If so, what are they?arrow_forward

- 9. How can banks create money? A) By lending required reserves B) By borrowing excess reserves C) By telling the Fed they need more money; and the Fed creates it D) By lending excess reserves 10. What is the formula for figuring the total possible change in the money supply from excess reserves? A) (1/Excess reserves) × / Total Reserves B) (R/1) × A Reserves C) / Excess Reserves / Total Reserves D) (1/R)x A Reservesarrow_forward8. The reserve requirement, open market operations, and the moneysupply Consider a banking system where the Federal Reserve uses required reserves to control the money supply. (This was the case in the U.S. prior to 2008.) Assume that banks do not hold excess reserves and that households do not hold currency, so the only form of money is demand deposits. To simplify the analysis, suppose the banking system has total reserves of $500. Determine the money multiplier and the money supply for each reserve requirement listed in the following table. Reserve Requirement (Percent) 5 10 Simple Money Multiplier A lower reserve requirement is associated with a Money Supply (Dollars) money supply. Suppose the Federal Reserve wants to increase the money supply by $200. Again, you can assume that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is 10%, the Fed will use open-market operations to worth of U.S. government bonds. Now, suppose that,…arrow_forward8. The money multiplier declined significantly during the period 1930–1933 and alsoduring the recent financial crisis of 2008–2010. Yet the M1 money supply decreasedby 25% in the Depression period but increased by more than 20% during the recentfinancial crisis. What explains the difference in outcomes?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education