ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

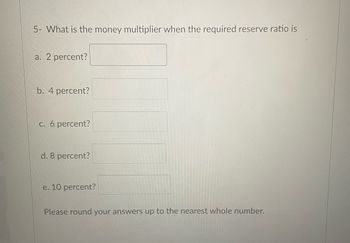

Transcribed Image Text:5- What is the money multiplier when the required reserve ratio is

a. 2 percent?

b. 4 percent?

c. 6 percent?

d. 8 percent?

e. 10 percent?

Please round your answers up to the nearest whole number.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 13. Refer to Table 1. First Commercial bank’s excess reserves equal $__________.a) 150,000b) 250,000c) 100,000d) 50,00014. Refer to Table 1. First Commercial Bank’s total loans equal $______________.a) 1,050,000b) 1,180,000c) 1,150,000d) 1,250,000arrow_forward2arrow_forwardInterest rate 2% 4 6 8 C) 6 percent. D) 8 percent. 10 Transaction demand for money $220 220 220 220 220 Asset demand for money $300 280 260 240 220 1. Refer to the above table. The equilibrium interest rate is: B) 4 percent. Money supply $460 460 460 460 460 A) 2 percent.arrow_forward

- 7. Suppose the Federal Reserve wants to stimulate the economy, thereby increasing GDP. Which of the following policy change should be implemented? Raising the reserve requirement ratio Sell bonds through open market operations Lower the discount rate Only a & c are correctarrow_forward17. Assume that the required reserve ratio is 25%. If the Fed buys $5 million worth of government bonds from the public, the maximum change in the money supply is: a) -$20 million. (b) -$12.5 million. (c) $12.5 million. (d) $20 million.arrow_forward8. The reserve requirement, open market operations, and the money supply Consider a system of banking in which the Federal Reserve uses required reserves to control the money supply (as was the case in the United States before 2008). Assume that banks do not hold excess reserves and that households do not hold currency, so the only money exists in the form of demand deposits. To further simplify, assume the banking system has total reserves of $400. Determine the money multiplier as well as the money supply for each reserve requirement listed in the following table. Reserve Requirement Simple Money Multiplier Money Supply (Percent) (Dollars) 20 10 A higher reserve requirement is associated with a money supply. Suppose the Federal Reserve wants to increase the money supply by $200. Maintain the assumption that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is 10%,…arrow_forward

- 23. Identify the four major methods the Fed uses to control the money supply. Give two examples of situations in which the Fed might use one of these methods and explain why that method is best for the given situation.arrow_forward5. If reserves are scarce, how would the federal funds rate change (increase or decrease) if the Fed: 1) sells mortgage-backed securities 2) decreases the (minimum) reserve requirements 3) conducts overnight repo operations 4) conducts overnight reverse repo operationsarrow_forwardIf the required reserve ratio were 10%, how much of this bank's reserves would qualify as excess reserves? A) 200,000 B) 300,000 C) 400,000 D) 550,000 E) 3,000,000arrow_forward

- 5. Consider the T-table of the Bank of Boston. Suppose the Federal Reserve Bank buys an additional $2 million in government bonds from the Bank of Boston. Assume (1) the required reserve ratio is 10 percent, and (2) the Bank of Boston issues all excess reserves in loans (I.e., there are no excess reserves). The new money supply equals $ million. Submit Balance sheet of the Bank of Boston Liabilities -55,000,000 Checkable deposits +$5,000,000 Assets Government bonds Currency (= bank reserves) +$5,000,000 Loans $0arrow_forward9. Which of the following is not an administered rate? a. Discount rate b. ON RRP offering rate c. Federal funds rate d. Interest on reserve balances ratearrow_forwardTable 13.1: FIRST COMMERCIAL BANK Asset Liabilities S150,000 S100,000 Total Reserves: $1,000,000 $200,000 Deposits Net Worth Required Reserves ? Excess Reserves ? Loans $1,200,000 Total $1,200,000 Total 15. Refer to Table 13. 1. First Commercial bank's excess reserves equal $ a) 150,000 b) 250,000 c) 100,000 d) 50,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education