FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

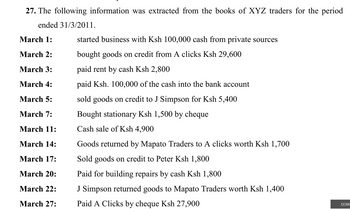

Transcribed Image Text:27. The following information was extracted from the books of XYZ traders for the period

ended 31/3/2011.

March 1:

March 2:

March 3:

March 4:

March 5:

March 7:

March 11:

March 14:

March 17:

March 20:

March 22:

March 27:

started business with Ksh 100,000 cash from private sources

bought goods on credit from A clicks Ksh 29,600

paid rent by cash Ksh 2,800

paid Ksh. 100,000 of the cash into the bank account

sold goods on credit to J Simpson for Ksh 5,400

Bought stationary Ksh 1,500 by cheque

Cash sale of Ksh 4,900

Goods returned by Mapato Traders to A clicks worth Ksh 1,700

Sold goods on credit to Peter Ksh 1,800

Paid for building repairs by cash Ksh 1,800

J Simpson returned goods to Mapato Traders worth Ksh 1,400

Paid A Clicks by cheque Ksh 27,900

DOW

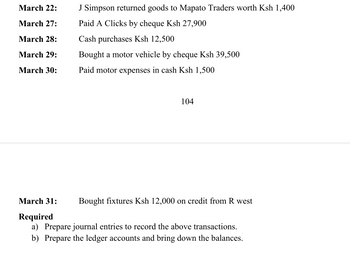

Transcribed Image Text:March 22:

March 27:

March 28:

March 29:

March 30:

J Simpson returned goods to Mapato Traders worth Ksh 1,400

Paid A Clicks by cheque Ksh 27,900

Cash purchases Ksh 12,500

Bought a motor vehicle by cheque Ksh 39,500

Paid motor expenses in cash Ksh 1,500

104

March 31:

Required

a) Prepare journal entries to record the above transactions.

b) Prepare the ledger accounts and bring down the balances.

Bought fixtures Ksh 12,000 on credit from R west

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 18 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jan 1: 711 sold Beverage products to a customer for $200 cash. The cost of the bevarage products is $75. What is the correct Journal Entry to record the Revenue? A. Debit Cash 200, Credit Sale Revenue 200 B. Debit Cost of Goods Sold 200, Credit Inventory 200 C. Debit Account Receivable 200, Credit Sale Revenue 200 D. Debit Cost of Goods Sold 75, Credit Inventory 75arrow_forwardPlease answer the question correctly. Thank youarrow_forwardKerr Co.'s accounts payable balance at December 31, 2010 was $1,500,000 before considering the following transactions: • Goods were in transit from a vendor to Kerr on December 31, 2010. The invoice price was $70,000, and the goods were shipped f.o.b. shipping point on December 29, 2010. The goods were received on January 4, 2011. • Goods shipped to Kerr, f.o.b. shipping point on December 20, 2010, from a vendor were lost in transit. The invoice price was $50,000. On January 5, 2011, Kerr filed a $50,000 claim against the common carrier. In its December 31, 2010 balance sheet, Kerr should report accounts payable of O$1.620,000. $1,570,000. $1,550,000. O $1.500,000.arrow_forward

- Jan 1: 711 sold Beverage products to a customer for $200 cash. The cost of the bevarage products is $75. What is the correct Journal Entry to record the Revenue? A. Debit Cash 200, Credit Sale Revenue 200 B. Debit Cost of Goods Sold 200, Credit Inventory 200 C. Debit Account Receivable 200, Credit Sale Revenue 200 D. Debit Cost of Goods Sold 75, Credit Inventory 75arrow_forward1. During October, the company had several transactions. Prepare journal entries for the transactions below and post them to the t-accounts. a. Sold merchandise with an original cost of $73,000 on account for a total selling price of $170,000. DR Accounts Receivable CR Revenue DR COGS CR Inventory DR Inventory DR PP&E I b. Purchased merchandise inventory on account from various suppliers for $92,600. 92,600 CR Accounts Payable Paid rent of $23,500 for the month of October. CR Cash 170,000 23,500 73,000 23,500 170,000 73,000 92,600arrow_forwardSales-Related Transactions, Including the Use of Credit Cards Journalize the entries for the following transactions: a. Sold merchandise for cash, $22,060. The cost of the merchandise sold was $13,240. (Record the sale first.) fill in the blank 36fbb5ffffdef81_2 fill in the blank 36fbb5ffffdef81_3 fill in the blank 36fbb5ffffdef81_5 fill in the blank 36fbb5ffffdef81_6 fill in the blank 36fbb5ffffdef81_8 fill in the blank 36fbb5ffffdef81_9 fill in the blank 36fbb5ffffdef81_11 fill in the blank 36fbb5ffffdef81_12 b. Sold merchandise on account, $13,920. The cost of the merchandise sold was $8,350. (Record the sale first.) fill in the blank e95153f82fd6002_2 fill in the blank e95153f82fd6002_3 fill in the blank e95153f82fd6002_5 fill in the blank e95153f82fd6002_6 fill in the blank e95153f82fd6002_8 fill in the blank e95153f82fd6002_9 fill in the blank e95153f82fd6002_11 fill in the blank e95153f82fd6002_12…arrow_forward

- Please help mearrow_forwardConsider the following transactions of Johnson Software: Mar. 31 Apr. 6 Journalize the transactions for the company. Ignore cost of goods sold. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Recorded cash sales of $160,000, plus sales tax of 7% collected for the state of New Jersey. Sent March sales tax to the state. Mar. 31: Recorded cash sales of $160,000, plus sales tax of 7% collected for the state of New Jersey. (Prepare a single compound entry for this transaction.) Accounts and Explanation Date Mar. 31 Debit Creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education