MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

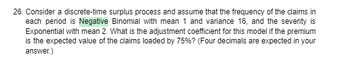

Transcribed Image Text:26. Consider a discrete-time surplus process and assume that the frequency of the claims in

each period is Negative Binomial with mean 1 and variance 16, and the severity is

Exponential with mean 2. What is the adjustment coefficient for this model if the premium

is the expected value of the claims loaded by 75%? (Four decimals are expected in your

answer.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- You've observed the following returns on Mary Ann Data Corporation's stock over the past five years: 38.50 percent, 20.50 percent, 23.50 percent, -25.50 percent, and 12.50 percent. a. What was the arithmetic average return on Mary Ann's stock over this five-year period? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Arithmetic average return b-1. What was the variance of Mary Ann's returns over this period? (Do not round intermediate calculations. Round the final answer to 6 decimal places.) Variance b-2. What was the standard deviation? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Standard deviation %arrow_forwardGraduation Rates. Regarding the relationship between college graduation rate and the predictor variables student-to-faculty ratio, percentage of freshmen in the top 10% of their high school class, and percentage of applicants accepted. a. Perform a residual analysis to assess the assumptions of linearity of the regression equation, constancy of the conditional standard deviation, and normality of the conditional distributions. Check for outliers and influential observations. b. Does your analysis in part (b) reveal any violations of the assumptions for multiple regression inferences? Explain your answer.arrow_forwardSuppose your expectations regarding the stock price are as detailed in the table below. Compute the mean and standard deviation of the holding period returns on stocks. State of the Market Probability Ending Price HPR (including dividends)Boom 0.23 $140 52.0%Normal growth 0.24 $110 19.0% Recession 0.53 $80 −11.5%arrow_forward

- 17. A risk manager would like to simulate the price of a stock using the discretized GBM, where St+At = St + µS{At+√ã$£€ where μ and o denote, respectively, the stock annual mean return and annual volatility. The data suggest that the weekly mean return on the stock is 0.5% and the weekly volatility is 4%. Assuming a weekly time step of At = 1/52 (in terms of annual units), what is the appropriate estimate of μ? (a) = 26.4% (b) û = 30.16% (c) û = 4.5% (d) û = 17.94% 18. Suppose that the price of an asset obeys geometric Brownian motion (GBM) with an annual drift μ = 0.01 and an annual volatility of o= 0.25. If today's price is $100, what is the probability that the price two years from now will drop below $80? Hint: Recall that under GBM, the future price at T, i.e. ST, given today's spot price, St, is with TT-t and €~ = (a) 21.51% (b) 35.48% (c) 51.1% (d) 30.47% ST= St x exp (μ x exp [(μ-27 ) XT + √F X 0 Xe] N (0, 1).arrow_forward6. True or False? Assume the below life table was constructed from following individuals who were diagnosed with slow-progressing form of prostate cancer and decided not to receive treatment of any form. The calculated survival probability for year 3, if the Kaplan-Meir approach is used to calculate the survival probability, is approximately 0.7438. Time in years Number at risk Nt Number of deaths, Dt Number of censored Ct Survival Probability 0 20 1 1 20 3 2 17 1 3 16 2 1arrow_forward1. The data in Table 7–6 were collected in a clinical trial to evaluate a new compound designed to improve wound healing in trauma patients. The new compound was com- pared against a placebo. After treatment for 5 days with the new compound or placebo, the extent of wound healing was measured. Is there a difference in the extent of wound healing between the treatments? (Hint: Are treatment and the percent wound healing independent?) Run the appropriate test at a 5% level of significance. Use the data in Problem 1. Pool the data across the treatments into one sample of size n = 250. Use the pooled data to test whether the distribution of the percent wound healing is approximately normal. Specifically, use the following distribution 30%, 40%, 20%, and 10% and a = 0.05 to run the appropriate test. Percent Wound Healing Treatment 0-25% 26-50% 51-75% 76-100% New compound (n=125) 15 37 32 41 Placebo (n=125) 36 45 34 10arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman