FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

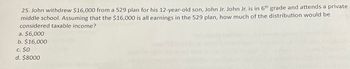

Transcribed Image Text:25. John withdrew $16,000 from a 529 plan for his 12-year-old son, John Jr. John Jr. is in 6th grade and attends a private

middle school. Assuming that the $16,000 is all earnings in the 529 plan, how much of the distribution would be

considered taxable income?

a. $6,000

b. $16,000

c. $0

d. $8000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 7-19Education Tax Credits (LO 7.5) Janie graduates from high school in 2021 and enrolls in college in the fall. Her parents (who file a joint return) pay $4,000 for her tuition and fees. Question Content Area a. Assuming Janie's parents have AGI of $172,000, what is the American Opportunity tax credit they can claim for Janie?$fill in the blank a7afe900d02b00c_1 Question Content Area b. Assuming Janie's parents have AGI of $75,000, what is the American Opportunity tax credit they can claim for Janie?$fill in the blank 827b93f69fa7ff5_1arrow_forwardA5 please help.....arrow_forwardQuestion 27 of 50. Mark and Carrie are married, and they will file a joint return. They both work full-time, and their 2021 income totaled $89,000, all from wages. They have one dependent child, Aubrey (5). During the year, they spent $9,000 for Aubrey's child care. Neither Mark nor Carrie received any dependent care benefits from their employer. What amount may they use to calculate the Child and Dependent Care Credit? $0 $3,000 $8,000 $9,000 Mark for follow uparrow_forward

- Problem 7-19 Education Tax Credits (LO 7.5) Janie graduates from high school in 2021 and enrolls in college in the fall. Her parents (who file a joint return) pay $4,000 for her tuition and fees. a. Assuming Janie's parents have AGI of $172,000, what is the American Opportunity tax credit they can claim for Janie? b. Assuming Janie's parents have AGI of $75,000, what is the American Opportunity tax credit they can claim for Janie?arrow_forwardQuestion:3 Richard, a single taxpayer, has a wage income of $75,000. He also has a short-term capital loss of $9,000, a short-term capital gain of $1,000, and a long-term capital gain of $2,000. What is Reuben's AGI for the current year? A. $78,000 B. $72,000 C. $75,000 D. $69,000arrow_forwardc. How much will the family receive (to the nearest dollar)? 647.51/1-6 1-(1.005264 .OOS 647.51.146.4 = 94795.46 150000-94795.46-55204.54₁,6 = 33122.72 4. A couple are planning for retirement. They plan to retire at age 70. At that time they wish to be able to withdraw $7500 per month from their retirement account for a period of 25 years, reducing the balance to zero. How much should they start saving now in an account that pays 7.54% compounded monthly to achieve their goal? Assume that they will be able to earn at least 7.54% interest compounded monthly from now until they are age 95. nt How much interest is earned over the 65 year period? A = P(1 + £ ) m² FV= PMT ((1+1)^-1) 7500 (1.076+25-1)arrow_forward

- Problem 10-36 (LO. 6, 8) In December of each year, Eleanor Young contributes 10% of her gross income to the United Way (a 50% organization). Eleanor, who is in the 24% marginal tax bracket, is considering the following alternatives for satisfying the contribution. Fair Market Value (1) Cash donation $23,000 (2) Unimproved land held for six years ($3,000 basis) $23,000 (3) Blue Corporation stock held for eight months ($3,000 basis) $23,000 (4) Gold Corporation stock held for two years ($28,000 basis) $23,000 Eleanor has asked you to help her decide which of the potential contributions listed above will be most advantageous tax-wise. Evaluate the four alternatives and complete a letter to Eleanor. Determine the amount of the charitable contribution for each option. CharitableContribution Cash donation $fill in the blank 1 Unimproved land held for six years ($3,000 basis) $fill in the blank 2 Blue Corporation stock held for eight months ($3,000…arrow_forwardQuestion 8 of 75. Linda, age 54, takes a $12,500 distribution from her traditional IRA. She uses the distribution to pay qualified education expenses for her husband's grandson, Noah. Noah is attending a state university, and his tuition expenses alone were more than $20,000 in 2022. Neither Linda nor her husband will claim him as a dependent. How much of Linda's distribution is subject to the 10% additional tax on early distributions? $0 $2,500 $10,000 $12,500arrow_forwardProblem 18-35 (LO. 5) Using property she inherited, Lei makes a 2022 gift of $16,200,000 to her adult daughter, Doris. Neither Lei nor her spouse, Greg, have made any prior taxable gifts. Assuming that a flat 40% tax rate applies, determine the Federal gift tax liability if (a) the election to split gifts is not made and (b) the election to split gifts is made. (c) What are the tax savings from making the election? The unified transfer tax exclusion amount for 2022 is $12,060,000. If an amount is zero, enter "0". a. If the election to split gifts is not made, the taxable gift is $ b. If the election to split gifts is made, then the taxable gift from Lei is $ due from Lei is $ and from Greg is $ c. The tax savings from making the election is $ and gift tax due on the gift is $ and from Greg is $ . Gift taxarrow_forward

- Valaarrow_forwardLarry purchased an annuity from an insurance company that promises to pay him $6,500 per month for the rest of his life. Larry paid $626,340 for the annuity. Larry is in good health and is 72 years old. Larry received the first annuity payment of $6,500 this month. Use the expected number of payments in Exhibit 5-1 for this problem. Problem 5-59 Part-c (Algo) c. What are the tax consequences if Larry dies just after he receives the 100th payment?arrow_forwardPlease don't provide handwriting solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education