Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Hi,

How do I solve these questions using formulas?

Additional info for the questions: Unless otherwise stated, assume the effective interest rate per year is 12%

Thanks

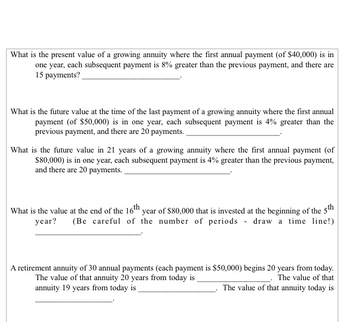

Transcribed Image Text:What is the present value of a growing annuity where the first annual payment (of $40,000) is in

one year, each subsequent payment is 8% greater than the previous payment, and there are

15 payments?

What is the future value at the time of the last payment of a growing annuity where the first annual

payment (of $50,000) is in one year, each subsequent payment is 4% greater than the

previous payment, and there are 20 payments.

What is the future value in 21 years of a growing annuity where the first annual payment (of

$80,000) is in one year, each subsequent payment is 4% greater than the previous payment,

and there are 20 payments.

What is the value at the end of the 16th year of $80,000 that is invested at the beginning of the 5th

year? (Be careful of the number of periods draw a time line!)

A retirement annuity of 30 annual payments (each payment is $50,000) begins 20 years from today.

The value of that annuity 20 years from today is

The value of that

annuity 19 years from today is

The value of that annuity today is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- At a growth (interest) rate of 24 percent annually, how long will it take for a sum to double? To triple? Use Appendix A for an approximate answer, but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answers to 2 decimal places.)arrow_forwardplease do the following questions with full workingarrow_forwardSuppose the term structure of risk-free interest rates is as shown here: a. Calculate the present value of an investment that pays $1,000 in 2 years and $4,000 in 5 years for certain. b. Calculate the present value of receiving $900 per year, with certainty, at the end of the next 5 years. To find the rates for the missing years in the table, linearly interpolate between the years for which you do know the rates. (For example, the rate in year 4 would be the average rate in year 3 and year 5.) c. Calculate the present value of receiving $2,700 per year, with certainty, for the next 20 years. Infer rates for the missing years using linear interpolation. (Hint: Use a spreadsheet.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) 2 years 3 years 5 years 7 years 1 year 2.06 2.44 2.64 3.22 3.74 Term Rate (EAR, %) Print Done 10 years 4.25 20 years 5.09 I X t cent.)arrow_forward

- Assume that at time 0 a sum L is lent for a series of n yearly payments. The rth payment, of amount xr, is due at the end of the rth year. Let the effective annual interest rate for the rth year be ir. Give an identity which expresses L in terms of the xr and ir.arrow_forwardSuppose Snli 40 and (1 + i)n = 3.7, where i is an effective annual interest rate. What is the present value of an annuity-immediate which has annual payments of 150 for 3n years?arrow_forwardG. Find the interest rate (APR) on a 27-year mortgage with a initial loan amount of $358,000, if the monthly payment is $2229.45 Let's use references for input values; and be sure to annualize the rate! INPUTS: OUTPUT: Period Rate is APR Payment Loan amountarrow_forward

- (Ch 11 #9) There is a loan obligation to pay $1000 one year from today and another $1000 two years from today. Assuming the annual effective rate of interest is 10%, find the following: a) Macaulay duration of the loan. b) Modified duration of the loan. c) Convexity of the loan.arrow_forwardFor each of the following cases, indicate (a) what interest rate columns and (b) what number of periods you would refer to in looking up the future value factor. (1) In Table 1 (future value of 1): Number of Annual Rate Years Invested Compounded Case A 5% 5 Annually Case B 8% 6 Semiannually Case A Case B . (a) % % (2) In Table 2 (future value of an annuity of 1): Annual Rate Number of Years Invested Compounded Case A 6% 9 Annually Case B 8% 5 Semiannually Case A Case B (b) periods periods (a) (b) % periods % periodsarrow_forward(Related to Checkpoint 5.6) (Solving for i) At what annual interest rate, compounded annually, would $520 have to be invested for it to grow to $1 comma 977.46 in 12 years? Question content area bottom Part 1 The annual interest rate, compounded annually, at which $520 must be invested for it to grow to $1 comma 977.46 in 12 years isarrow_forward

- Please use a handrawn timeline to solve thisarrow_forwardCan you provide the excel formula that can used to caculate the attached using an excel spread sheet? I have attempted this on my excel and come up something completely different.arrow_forwardPlease answer this question: What is the value at the end of Year 3 of the following cash flow stream if interest is 4% compounded semiannually? (Hint: you can use the EAR and treat the cash flows as an ordinary annuity or use the periodic rate and compound the cash flows individually.) What is the PV? What would be wrong with your answer to parts I(1) and I(2) if you used the nominal rate, 4%, rather than the EAR or the periodic rate, I sow /2=4%/2=2%, to solve the problems?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education