Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Need help pls. Thank you!

Transcribed Image Text:### Bond Yield Question

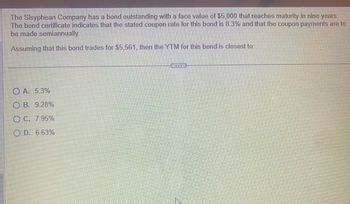

The Sisyphian Company has a bond outstanding with a face value of $5,000 that reaches maturity in nine years. The bond certificate indicates that the stated coupon rate for this bond is 8.3% and that the coupon payments are to be made semiannually.

Assuming that this bond trades for $5,561, then the YTM (Yield to Maturity) for this bond is closest to:

- **A. 5.3%**

- **B. 9.28%**

- **C. 7.95%**

- **D. 6.63%**

![**Question:**

An annuity pays $49 per year for 16 years. What is the future value (FV) of this annuity at the end of those 16 years, given that the discount rate is 9%?

**Options:**

- A. $1,940.60

- B. $1,617.17

- C. $970.30

- D. $2,264.04

**Explanation:**

To solve this question, one would use the Future Value of Annuity formula, which calculates the future value of a series of equal payments at regular intervals, taking into account a specified interest or discount rate. The formula is:

\[ FV = P \times \frac{(1 + r)^n - 1}{r} \]

Where:

- \( P \) is the payment amount ($49),

- \( r \) is the interest rate (9% or 0.09),

- \( n \) is the number of periods (16 years).

By plugging in the values:

\[ FV = 49 \times \frac{(1 + 0.09)^{16} - 1}{0.09} \]

\[ FV = 49 \times \frac{3.6042 - 1}{0.09} \]

\[ FV ≈ 49 \times 28.9355 \]

\[ FV ≈ 2,264.04 \]

Therefore, the correct answer is D. $2,264.04.](https://content.bartleby.com/qna-images/question/3f8a7250-9137-47ef-be98-4b87422d4696/98d416b9-1eaf-4ace-9f99-5786eee65626/ybnr0hi_thumbnail.jpeg)

Transcribed Image Text:**Question:**

An annuity pays $49 per year for 16 years. What is the future value (FV) of this annuity at the end of those 16 years, given that the discount rate is 9%?

**Options:**

- A. $1,940.60

- B. $1,617.17

- C. $970.30

- D. $2,264.04

**Explanation:**

To solve this question, one would use the Future Value of Annuity formula, which calculates the future value of a series of equal payments at regular intervals, taking into account a specified interest or discount rate. The formula is:

\[ FV = P \times \frac{(1 + r)^n - 1}{r} \]

Where:

- \( P \) is the payment amount ($49),

- \( r \) is the interest rate (9% or 0.09),

- \( n \) is the number of periods (16 years).

By plugging in the values:

\[ FV = 49 \times \frac{(1 + 0.09)^{16} - 1}{0.09} \]

\[ FV = 49 \times \frac{3.6042 - 1}{0.09} \]

\[ FV ≈ 49 \times 28.9355 \]

\[ FV ≈ 2,264.04 \]

Therefore, the correct answer is D. $2,264.04.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Help neededarrow_forwardAtlas Corp. is considering two mutually exclusive projects. Both require an initial investment of $11,500 at t = 0. Project S has an expected life of 2 years with after-tax cash inflows of $6,000 and $7,600 at the end of Years 1 and 2, respectively. Project L has an expected life of 4 years with after-tax cash inflows of $4,283 at the end of each of the next 4 years. Each project has a WACC of 9.00%, and Project S can be repeated with no changes in its cash flows. The controller prefers Project S, but the CFO prefers Project L. How much value will the firm gain or lose if Project L is selected over Project S, i.e., what is the value of NPVL - NPVS? a. $1,501.42 b. $1,014.46 c. $ 1,783.84 d. $1,636.55 e. $1,313.76arrow_forwardPlease don't provide handwrittin solution....arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education