FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

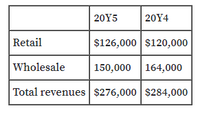

Segment analysis

McHale company does business in two customer segments, Retail and

wholesale. The following annual revenue information was determined

from the accounting system's invoice information:

prepare horizontal and vertical analyses of the segment. Round to one

decimal place.

Transcribed Image Text:20Y5

20Υ4

Retail

$126,000 $120,000

Wholesale

150,000 164,000

Total revenues $276,000 $284,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Manjiarrow_forwardRevenue and expense data for Bluestem Company are as follows: Administrative expenses Cost of goods sold Income tax expense Sales Selling expenses Year 2 $37,000 350,000 40,000 800,000 150,000 Year 1 a. Prepare a comparative income statement, with vertical analysis, stating each item for both years as a percent of sales. Round percents to one decimal point. Bluestem Company Total operating expenses $ $ There was Comparative Income Statement For Years Ended December 31, Year 2 and Year 1 $20,000 320,000 32,000 700,000 110,000 Year 2 Year 2 Amount Percent 11% % Year 1 Year 1 Amount Percent %%$ % $ %$ % % % % % % % b. Comment upon significant changes disclosed by the comparative income statement. in the cost of goods sold, and in cost of goods sold and contributed greatly to the in administrative expenses. However, the more significant in net income. in selling expenses offset thearrow_forwardAyayai Company had the following account balances at year-end: Cost of Goods Sold $63,840; Inventory $14,610; Operating Expenses $30,650; Sales Revenue $121,130; Sales Discounts $1,130; and Sales Returns and Allowances $1,850. A physical count of inventory determines that merchandise inventory on hand is $13,080.arrow_forward

- a. A company had the following balances at year end: sales discounts $3,400, sales returns and allowances $2,000 and cost of goods sold $320,500. Close the accounts to income summary. View transaction list Journal entry worksheet < 1 A company had the following balances at year end: sales discounts $3,400, sales returns and allowances $2,000 and cost of goods sold $320,500. Close the accounts to income summary. Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardThe following is select account information for August Sundries: Sales: $850,360; Sales Returns and Allowances: $148,550; Cost of Goods Sold: $300,840; Operating Expenses: $45,770; and Sales Discounts: $231,820. PLEASE NOTE: All dollar amounts will have "$" and commas, where needed (i.e. $12,345). If August Sundries uses a multi-step income statement format, what is their gross margin?arrow_forwardAssume Martinez Company has the following reported amounts: Sales revenue $ 610,000, Sales returns and allowances $ 30,000, Cost of goods sold $ 396,500, and Operating expenses $ 84,000. (a) Compute net sales. Net sales (b) Compute gross profit. Gross profit (c) Compute income from operations. Income from operations (d) Compute the gross profit rate. (Round answer to 1 decimal place, e.g. 25.2%.) Gross profit rate %24arrow_forward

- The Income Statement columns of the August 31 (year-end) work sheet for Ralley Company are shown here. To save time and space, the expenses have been grouped together into two categories. INCOME STATEMENT ACCOUNT NAME DEBIT CREDIT Income Summary 31,100.00 31,130.00 Sales 324,360.00 Sales Returns and Allowances 13,970.00 Sales Discounts 7,620.00 Purchases 126,210.00 Purchases Returns and Allowances 1,020.00 Purchases Discounts 1,110.00 Freight In 8,460.00 Selling Expenses 61,470.00 General Expenses 51,751.00 300,581.00 357,620.00 Net Income 57,039.00 357,620.00 357,620.00 From the information given, prepare an income statement for the company. Ralley CompanyIncome StatementFor Year Ended August 31, 20-- (See images)arrow_forwardWhat is the amount of Income from Operations that a company should report on its current year multiple-step income statement based on the following data? Cost of goods sold PHP 250,000 Net sales PHP 600,000 Income taxes expense PHP 50,000 Selling, general & Interest expense PHP 25,000 Administrative expenses PHP 150,000arrow_forwardRevenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill's data are expressed in dollars. The electronics industry averages are expressed in percentages. Electronics Tannenhill Industry Company Average Sales $2,320,000 100 % Cost of merchandise sold 1,624,000 73 Gross profit $696,000 27 % Selling expenses $394,400 15 % Administrative expenses 162,400 Total operating expenses $556,800 21 % Income from operations $139,200 6 % Other revenue and expense: Other revenue 46,400 2 Other expense (23,200) Income before income tax expense $162,400 7 % Income tax expense 69,600 Net income $92,800 3 %arrow_forward

- Sheridan Co. uses a perpetual inventory system and both an accounts receivable and an accounts payable subsidiary ledger. Balances related to both the general ledger and the subsidiary ledgers for Sheridan are indicated in the working papers presented below. Also following are a series of transactions for Sheridan Co. for the month of January. Credit sales terms are 2/10, n/30. The cost of all merchandise sold was 60% of the sales price.Jan.3 Sell merchandise on account to B. Corpas $3,000, invoice no. 510, and to J. Revere $1,500, invoice no. 511. 5 Purchase merchandise from S. Gamel $5,000 and D. Posey $2,900, terms n/30. 7 Receive checks from S. Mahay $3,500 and B. Santos $2,000 after discount period has lapsed. 8 Pay freight on merchandise purchased $245. 9 Send checks to S. Meek for $8,000 less 2% cash discount, and to D. Saito for $12,000 less 1% cash discount. 9 Issue credit of $300 to J. Revere for merchandise returned. 10 Daily cash sales from January 1 to…arrow_forwardThe following Income statement was drawn from the records of Fanning Company, a merchandising firm: Sales revenue (7,000 units x $160) Cost of goods sold (7,000 units * $87) Gross margin Sales commissions (5% of sales) Administrative salaries expense Required For the Year Ended December 31, Year 1 Advertising expense Depreciation expense Shipping and handling expenses (7,000 units * $1) Net income FANNING COMPANY Income Statement Req A a. Reconstruct the Income statement using the contribution margin format. b. Calculate the magnitude of operating leverage. c. Use the measure of operating leverage to determine the amount of net Income Fanning will earn If sales Increase by 20 percent. Complete this question by entering your answers in the tabs below. Reg B and C FANNING COMPANY Income Statement For the Year Ended December 31, Year 1 Less: Variable costs Reconstruct the income statement using the contribution margin format. Less: Fixed costs $1,120,088 (609,000) 511,000 (56,000)…arrow_forwardSellall Department Stores reported the following amounts as of its December 31 year-end: Administrative Expenses, $2,400; Cost of Goods Sold, $22,728; Income Tax Expense, $3,000; Interest Expense, $1,600; Interest Revenue, $200; General Expenses, $2,600; Net Sales, $37,880; and Delivery (freight-out) Expense, $300. Required: 1. Calculate the gross profit percentage. 2. How has Sellall performed, relative to the 24.5 percent gross profit percentage reported for Walmart in 2019? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.)check all that apply Sellall Department Stores earned a higher gross profit percentage than Walmart. Walmart earned a higher gross profit percentage than Sellall Department Stores. Sellall includes more mark-up in the prices it charges customers than Walmart. Walmart includes more mark-up in prices it…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education