Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

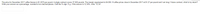

Transcribed Image Text:The price for December 2017 coffee futures is $1.2575 per pound. A single contract covers 37,500 pounds. The margin requirement is $4,950. If coffee prices close in December 2017 at $1.27 per pound and I am long 1 future contract, what is my return? Write your answer as a percentage, rounded to two decimal places. Omit the % sign. E.g., if the answer is 12.34%, write "12.34".

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Godoarrow_forwardA trader bought two July futures contracts. Each contract is for the delivery of 1,000 barrels. The initial margin is $11,250 per contract and the maintenance margin is $9,000. Calculate the daily gain and loss and margin account balance from April 13, 2020 to April 15, 2020 and explain when the investor will receive a margin call and how much does he need to top up?arrow_forwardPlease answer the next question based on the following Chase Bank's direct spot and forward markets quotes for MXN right now (1/1/XX), and expected quotes three months later (4/1/XX), and six months later (7/1/XX). Current Quotes 1/1/XX 0.2015 MXN Spot 3 Month Forward 0.2076 6 Month Forward 0.2107 On 1/1/XX, Dell bought a 6-month to Chase, Chase will pay. USD 225,800, MXN 1,000,000 O MXN 225,800; USD 210,700 USD 210,700; MXN 1,000,000 O MXN 1,000,000; USD 225,800 Expected Quotes 4/1/XX 7/1/XX 0.2034 0.216 0.2096 0.2225 0.2127 0.2258 forward contract of MXN 1,000,000 from Chase. Based on this contract, on 7/1/XX, Dell will pay to Dell. www.arrow_forward

- The average rate of return on a 182-day Government of Canada treasury bill sold on June 18, 2021, was 1.03%. A client sold the $100,000 T-bill after 69 days. What rate of return (per annum) did the client realize while holding the T-bill, if the short-term interest for this maturity had risen to 1.15% by the date of sale? Do not include the dollar sign in your answer. Do not include the comma usually used to denote thousands. Do not include the percent sign in your answer. a.) How much did the client pay for the T-bill on its issue date? b.) How much did the client sell the T-bill for? c.) What rate of return did the client realize on the T-bill? (Correct to exactly 4 decimal places.)arrow_forwardA debt of $3726.12 is due August 1, 2022. What is the value of the obligation on February 1, 2015, if money is worth 9% compounded monthly? The value of the obligation is $ (Round to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardact. The detalls of the contract are given below Date of contract 1 September 2015 Close out date (maturity 4 September 2015 date) Contract price Size of contract R975 per ounce 10 futures contract, each contract represents 100 troy ounces The initial margin Maintenance margin R12,000 per contract RI1,200 per contract Over the four trading days, the gold prices were as follows Date Spot price 1* September 2015 2nd September 2015 R964 R960 3rd September 2015 R970 4th September 2015 R980 Required 1. Explain whether Chill Ltd is buying or selling futures as a hedge. 2. Demonstrate the concept of marking to market using the 10 gold futures. Do that for the buyer and the seller. Clearly show the balance in the margin account at the end of each of the four trading days. 3. Under what circumstances is (a) a short hedge and (b) a long hedge appropriate?arrow_forward

- On December 1, 2015, the U.S. Treasury issued a $1,000, 10-year inflation indexed notes with a coupon rate of 2% (paid semi-annually on Dec 1 and June 1). On the date of issue, the consumer price index (CPI) was 231, but had increased to 259 on December 1, 2020. What was the amount of the coupon payment made on December 1, 2020? Select one: a. $10.46 b. $11.21 c. $20.00 d. $22.42 e. None of the above.arrow_forwardAs of March 9, 2021, the price of GameStop Corp. (ticker: GME) is $246.90 and its closing price on March 10, 2020 is $4.23. You believe GME is overvalued and decide to short-sell GME. You have $156,912 worth of Treasury Bills in your brokerage account that can be used as collateral. Your broker requires an initial margin of 50% and a maintenance margin of 43%. You must also set aside 100% of the cash proceeds as collateral. You decide to short as many shares as you can with the collateral you have. Pay special attention that you cannot purchase/sell/trade fractional shares. How much cushion (in dollars) do you have before you receive a margin call from your broker? That is, by how much the stock price could move in the "wrong" direction before you receive a margin call? Enter a number with two decimal points.arrow_forwardi will 10 upvotes urgent both answersarrow_forward

- A 60-day $500 note with interest at 9.5% was written on July 15. The maker approaches the payee on August 9 to propose an early settlement. What amount should the payee be willing to accept on August 9 if short-term investments can earn 7.25%? Multiple Choice O O O O O $502.30 $503.40 $584.30 $502.50 $504.30arrow_forwardAssume that the price of December 2021 corn futures is $4.65/bushel in February and $4.50 in October. If spot cash price in October is $4.55, what is the farmer's total revenue? Assume he entered into 20 contracts. Each corn contract is 5000 bushels.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education