Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

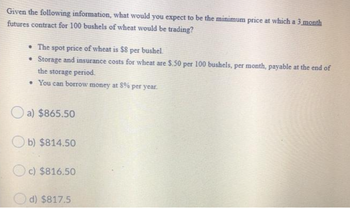

Transcribed Image Text:Given the following information, what would you expect to be the minimum price at which a 3 month

futures contract for 100 bushels of wheat would be trading?

The spot price of wheat is $8 per bushel.

Storage and insurance costs for wheat are $.50 per 100 bushels, per month, payable at the end of

the storage period.

• You can borrow money at 8% per year.

a) $865.50

b) $814.50

c) $816.50

d) $817.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 5. On June, an investor bought five (10 tons per contract) of soybean futures at $3,000 per ton. Assume the exchange set an initlal margin of 10% and a maintenance margin of 8%. If its settlement price falls to $2800 per ton, the variation margin should be ()? A. 6000 B. 6200 C. 9000 D. 10000arrow_forwardA one year gold futures contract is selling for $1,754. Spot gold prices are $1,600 and the one-year risk free rate is 3.4%. The arbitrage profit per contract implied by these prices is____________arrow_forwardSuppose that you bought two one-year gold futures contracts when the one-year futures price of gold was US$1,340.30 per troy ounce. You then closed the position at the end of the sixth trading day. The initial margin requirement is US$5,940 per contract, and the maintenance margin requirement is US$5,400 per contract. One contract is for 100 troy ounces of gold. The daily prices on the intervening trading days are shown in the following table. Day Settlement Price 0 1340.30 1 1345.50 2 1339.20 3 1330.60 4 1327.70 5 1337.70 6 1340.60 Assume that you deposit the initial margin and do not withdraw the excess on any given day. Whenever a margin call occurs on Day t, you would make a deposit to bring the balance up to meet the initial margin requirement at the start of trading on Day t+1, i.e., the next day. c. What is your total profit after you closed out your position?arrow_forward

- The spot price of corn is $5.85 per bushel. The effective interest rate for an investor is 0.5% per month. If storage costs of $0.04 per bushel per month are factored in, what is the likely price of a 4-month no-arbitrage forward contract? O$5.808 O $6.059 $5.968 $6.129arrow_forwardAssume oat forward prices over the next 3 years are $2.30, $2.40, and $2.33, respectively. Effective annual interest rates over the same period are 5.5%, 5.8%, and 6.1%. What is the 3-year swap price if the delivery in year 1 is 100,000 bushels, the delivery in year 2 is 125,000 bushels and the delivery in year 3 is 175,000 bushels?arrow_forwardIf the spot price for silver is $18.56 per ounce, what should the futures contract price be for a three-month contract at an annual interest rate of 3.5%?arrow_forward

- Suppose that on September 05, 2021, a company takes a short position in one April 2022 live - cattle futures contract. One contract is for the delivery of 50,000 pounds of cattle. The initial margin for each contract is \(\$ 3, 000 \) and the maintenance margin is \(\$ 2,000 \). The futures price (per pound) is 180.00 cents when it enters into the contract.(a) If the company receives a margin call at the end of the third day to deposit a variation margin of $1250, what is the settlement price at the end of the day?arrow_forwardA “three-against-nine” FRA has an agreement rate of 4.76 percent. You believe six-month LIBOR in three months will be 5.14 percent. You decide to take a speculative position in a FRA with a $7,000,000 notional value. There are 182 days in the FRA period. Determine what your expected profit will be if your forecast is correct about the six-month LIBOR rate. (USD with cents)arrow_forwardA trader bought two July futures contracts. Each contract is for the delivery of 1,000 barrels. The initial margin is $11,250 per contract and the maintenance margin is $9,000. Calculate the daily gain and loss and margin account balance from April 13, 2020 to April 15, 2020 and explain when the investor will receive a margin call and how much does he need to top up?arrow_forward

- Suppose that March oil futures have the price of $65/barrel, and the size of the contract is 1,000 barrels. When the contract matures in March, what will be the profit of a single long futures contract if the spot price is $68.50/barrel? Only typed Answer and give Answer fastarrow_forward8. Assume that the spot price of crude oil is $20 a barrel and the annual interest rate equals 4%. The cost of storing and insuring oil for one year is 1%. (a) What is the price of the 1- year forward contract for crude oil? (b) What should you do if the forward crude oil price is $20? (c) What if the crude oil forward price is $25?arrow_forwardSuppose that your company is planning to sell 1.25 million litres of fuel in two years. Thecurrent price of fuel is £1.60 per litre. a) Suppose there is a two-year heating oil futures contract available. The futuresprice is £1.63 per litre. How many contracts would you need to fully eliminate yourrisk exposure over the next two years? How many contracts would you need ifyour optimal hedging ratio was 0.75? What position in these contracts would youtake today? Explain. b) Evaluate the outcomes of your hedging strategy if the price of fuel in two years is(1) £1.72 per litre, and (2) £1.58 per litre. In each case assume the heating oilfutures price to be equal to that of the fuel. Comment on your results.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education