Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

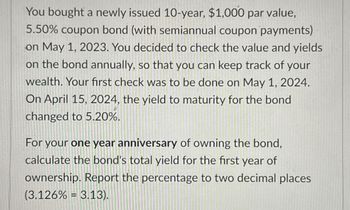

Transcribed Image Text:You bought a newly issued 10-year, $1,000 par value,

5.50% coupon bond (with semiannual coupon payments)

on May 1, 2023. You decided to check the value and yields

on the bond annually, so that you can keep track of your

wealth. Your first check was to be done on May 1, 2024.

On April 15, 2024, the yield to maturity for the bond

changed to 5.20%.

For your one year anniversary of owning the bond,

calculate the bond's total yield for the first year of

ownership. Report the percentage to two decimal places

(3.126% = 3.13).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A bond was initially issued on January 1, 2018. It had a face value of $1000 to be repaid in six years on December 31, 2023, and promised coupon payments of 5% at the end of each of the six years. Aaron bought the bond in January 2018 and owned it for four years, receiving the coupon payment. He sold it to Corey in January 2022 at which time the market interest rate had increased to 6%. Which of the following calculations would you use to find out the market price Corey paid?arrow_forwardOn January 1, 2020, Sabond issued a 5-year 12%, P10,000,000. Interest is payable annually every January 1. The yield rate for similar bonds is 15%. What is the interest expense for 2022?arrow_forwardcan you please explain these answers simply with every step explainedarrow_forward

- Prepare the journal entries at the time of issuance, at the end of years 1, 2, and 3 for the issuance of a 3 year bond. the bond has the value of 1000,000, a stated coupon rate of 5% and a market rate of 3%. Cash coupon interest payments are made at the end of years 1, 2, 3 debit credit Journal entry at issuance, journal entry at end of year1 , journal entry at end of year 2, journal entry at end of year 3,arrow_forwardMartha purchases a $1,100 bond on November 19, 2024 when the yield-to- maturity is 5.65% compounded semi- annually. The bond has a coupon rate of 6.40% and is redeemable on December 31, 2028. a. What is the purchase price of the bond? b. What is the amount of discount or premium on the bond?arrow_forwardOn September 30, 2019, Stinky Bank issued 10-year bonds at an annual simple interest rate of 4.25%, with interest paid twice a year. Pepe le Pew purchases a $10,000 bond. How much interest will Pepe earn every six months? How much interest will he earn over the 10-year life of the bond?arrow_forward

- On September 30, Stinky Bank issued 10-year bonds at an annual simple interest rate of 4.25%, with interest paid twice a year. Pepe le Pew purchases a $10,000 bond. a. How much interest will Pepe earn every 6 months? b. How much interest will he earn over the 10-year life of the bond?arrow_forwardA company has just issued (2024 1st Jan) a $100000 ten-year bond. The bonds pay 10% per annum. Coupons are paid every 31st December of each year. The yield to maturity at issue was 9%. The company uses the effective interest rate to amortize any discounts or premiums on bonds. Identify which accounts should reflect the events that take place this first year(2024) and the amounts for all 3 financial statements ( balance sheet, Income statement, statement of cashflows)arrow_forwardJoseph purchased a $500 bond every year on March 1 from 2011 to 2019. All bonds earn a 6% coupon annually, and coupons were deposited into a bank account with 4% annual effective interest rate. All bonds matured at $500 on March 1, 2020. Calculate the accumulated value as of March 1, 2020. Round the answer to the nearest ten dollars.arrow_forward

- Suppose a Puerto Rico government bond pays $3,255.80 in 4 years at 4% interest. Calculate the present value of the bond. Determine the value of the bond assuming it will mature in 6 years at 5% interest.arrow_forwardWhat is the present worth of a $25,000 bond that was purchased for $23,750 and has an interest of 10% per year, payable semiannually? The bond matures in 15 years. The interest rate in the marketplace is 8% per year, compounded quarterly.arrow_forwardIn January of 2023, an investor purchased a corporate bond for $925 that pays 4.25% interest. The bond matures in January of 2028. Calculate the bond's yield to maturity, assume the investor holds the bond until maturity.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education