Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

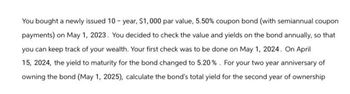

Transcribed Image Text:You bought a newly issued 10-year, $1,000 par value, 5.50% coupon bond (with semiannual coupon

payments) on May 1, 2023. You decided to check the value and yields on the bond annually, so that

you can keep track of your wealth. Your first check was to be done on May 1, 2024. On April

15, 2024, the yield to maturity for the bond changed to 5.20%. For your two year anniversary of

owning the bond (May 1, 2025), calculate the bond's total yield for the second year of ownership

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- It is now January 1, 2021, and you are considering the purchase of an outstanding bond that was issued on January 1, 2019. It has a 9.5% annual coupon and had a 20-year original maturity. (It matures on December 31, 2038.) There is 5 years of call protection (until December 31, 2023), after which time it can be called at 108—that is, at 108% of par, or $1,080. Interest rates have declined since it was issued, and it is now selling at 120.08% of par, or $1,200.80. What is the yield to maturity? Do not round intermediate calculations. Round your answer to two decimal places. _____ % What is the yield to call? Do not round intermediate calculations. Round your answer to two decimal places. ____ %arrow_forward4 What is counter party risk? Which financial contracts does it apply to?arrow_forwardSingtel recently issued a graded investment bond. The bond has a $1,000 par value which will mature in 12 years’ time. It has a coupon interest rate of coupon of 11% and pays interest annually. As an investor, you are to determine the following: i. Calculate the value of the bond if the required rate of return is 11 percent. ii. Calculate the value of the bond if the required rate of return is 15 percent. iii. Based on the above findings in part (i) and (ii) above, and discuss the relationship between the coupon interest rate on a bond and the required return and the market value of the bond relative to its par value. iv. Identify two possible reasons that could cause the required return to differ from the coupon interest rate.arrow_forward

- Adama's Fish Market Inc. issued a bond that will mature in 15 years. The bond has a face value of $1,000 and an 7% coupon rate, paid semiannually. The price of the bond is currently $1,165. The bond is callable in 5 years at a call price of $1,050. What is the bond's yield to maturity? What is the bond's yield to call?arrow_forwardIt is now January 1, 2021, and you are considering the purchase of an outstanding bond that was issued on January 1, 2019. It has a 9% annual coupon and had a 20-year original maturity. (It matures on December 31, 2038.) There is 5 years of call protection (until December 31, 2023), after which time it can be called at 108—that is, at 108% of par, or $1,080. Interest rates have declined since it was issued, and it is now selling at 114.12% of par, or $1,141.20. What is the yield to maturity? Do not round intermediate calculations. Round your answer to two decimal places. % What is the yield to call? Do not round intermediate calculations. Round your answer to two decimal places. % If you bought this bond, which return would you actually earn? Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. Investors would not…arrow_forwardYou purchase a 20-year bond that has a par value of $1,000 and pays an annual coupon of $100 ($50 every six months). The yield to maturity was 6.0 percent when you purchased this bond. Now, right after you purchased this bond, the yield (reinvestment rate) went up to 13.0 percent (6.5 percent every six months). Determine your realized compounded yield if you hold this bond for 10 years, then sell it, and reinvestment rates stay at 13.0 percent for the entire 10-year period. The yield-to-maturity when you sell the bond is also 13.0 percent. Enter your answer in decimal format, to four decimal places. For example, if your answer is 3.11%, enter "0.0311". Note that Canvas will delete trailing zeros, if entered.arrow_forward

- Loïc is planning to purchase a Treasury bond paying a (j2) coupon rate of 4.94% p.a. The face value of the bond is $100. Its maturity date is 15 March 2033; the bond matures at par. If Loïc purchased this bond on 8 March 2020, what is his purchase price (rounded to four decimal places)? Assume a yield rate of 9.32% p.a., compounded half-yearly. Loïc needs to pay 11.1% of coupon payments and capital gains in tax. Assume that all tax payments are delayed by a half-year.arrow_forwardToday is 1 July, 2022, Georg plans to purchase a corporate bond with a coupon rate of j2 = 1.8% p.a. and a face value of $100. This corporate bond matures at par. Its maturity date is 1 January, 2025. The yield rate is assumed to be j2 = 11.9% p.a. Assume that this corporate bond has a 5% chance of default in any six-month period during its term. Assume, also, that, if default occurs, Georg will receive no further payments at all. Calculate Georg's purchase price. Round your answer to three decimal places. O a. O b. $79.790 O c. $61.241 O d. $55.718 a. $78.509arrow_forwardYou bought a newly issued 10-year, $1,000 par value, 5.50% coupon bond (with semiannual coupon payments) on May 1, 2023. You decided to check the value and yields on the bond annually, so that you can keep track of your wealth. Your first check was to be done on May 1, 2024. On April 15, 2024, the yield to maturity for the bond changed to 5.20%. For your one year anniversary of owning the bond, calculate the bond's total yield for the first year of ownership. Report the percentage to two decimal places (3.126% = 3.13).arrow_forward

- It is now January 1, 2021, and you are considering the purchase of an outstanding bond that was issued on January 1, 2019. It has an 8.5% annual coupon and had a 15-year original maturity. (It matures on December 31, 2033.) There is 5 years of call protection (until December 31, 2023), after which time it can be called at 108-that is, at 108 % of par, or $1,080. Interest rates have declined since it was issued, and it is now selling at 111.55% of par, or $1,115.50. a. What is the yield to maturity? Do not round Intermediate calculations. Round your answer to two decimal places. What is the yield to call? Do not round Intermediate calculations. Round your answer to two decimal places. % b. If you bought this bond, which return would you actually earn? I. Investors would expect the bonds to be called and earn the YTC because the YTC is less than the YTM. II. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. III. Investors would not…arrow_forwardyou are interested in a corporate bond with a current market price of $973.36 and yield to a maturity of 7%. the bond carries a coupon rate of 6%, paid semi annually. if you buy the bond today, how many semi- annual coupon payments will you receive until the final maturity?arrow_forwardPlease provide complete step by step asnwer: You purchased an annual interest coupon bond one year ago that had six years remaining to maturity at that time. The coupon interest rate was 10%, and the par value was $1,000. At the time you purchased the bond, the yield to maturity was 8%. If you sold the bond after receiving the first interest payment and the yield to maturity continued to be 8%, your annual total rate of return on holding the bond for that year would have been A) 7.00%. B) 7.82%. C) 8.00%. D) 11.95%. E) None of the options are correct.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education