FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

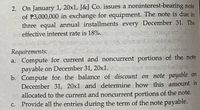

Transcribed Image Text:2. On January 1, 20x1, J&J Co. issues a noninterest-bearing note

of P3,000,000 in exchange for equipment. The note is due in

three equal annual installments every December 31. The

effective interest rate is 18%.

Saibp an

Requirements:

a. Compute for current and noncurrent portions of the note

payable on December 31, 20x1.

b. Compute for the balance of discount on note payable on

December 31, 20x1 and determine how this amount is

allocated to the current and noncurrent portions of the note.

c. Provide all the entries during the term of the note payable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- On January 1, YR01, Toyota Co. issued a two-year $1,000 note payable. The note bears interest of 7% paid yearly each December 31st. In addition, the principal amount will be paid back in two installments as follows: $400 will be paid back with the interest payment on December 31, YR01 and $600 will be paid back with the interest payment on December 31, YR02. At the date the note was issued, the market rate for similar notes payable was 6%. What is the present value of the note payable at the issue date of January 1, YR01 (assume an annual discounting period and round your final answer to the nearest penny)? a. $1,000.00 b. $1,014.77 c. $1,026.25 d. $ 1, 103.23 e. None of the answers provided are correctarrow_forwardOn June 8, Williams Company issued an $74,068, 8%, 120-day note payable to Brown Industries. Assuming a 360-day year for your calculations, what is the maturity value of the note? When required, round your answer to the nearest dollar. a.$79,993 b.$76,043 c.$74,068 d.$5,925arrow_forwardOn January 1, 20X1, Bouncy House, Inc. obtains a $50,000, 6 year, 8% installment note for the latest and greatest bouncy house. Bouncy House is required to make annual payments. The first payment occurs on December 31, 20X1. а. Calculate your annual payment amount. b. Create the loan amortization schedule (table). Record the first three journal entries. d. How much total interest does Bouncy House pay on this installment note? С.arrow_forward

- Rakesharrow_forwardOn January 26, Nova Co. borrowed cash from Conrad Bank by issuing a 90-day note with a face amount of \( \$ 44, 400 \). Assume a 360-day year. a. Determine the proceeds of the note, assuming the note carries an interest rate of \(8\% \). b. Determine the proceeds of the note, assuming the note is discounted at \(8\% \),arrow_forwardTORR, Inc. issues a $300,000, 6%, five-year note payable on January 1, 20X1. If the monthly payment is $5,800, what is the note's carrying value after the first month's payment is made on January 31, 20X1? Select one: a. $294,200 b. $300,000 c. $298,500 d. $295,700 e. $298,214arrow_forward

- West County Bank agrees to lend Wildhorse Co. $472000 on January 1. Wildhorse Co. signs a $472000, 6%, 6-month note. What entry will Wildhorse Co. make to pay off the note and interest at maturity assuming that interest has been accrued to June 30? Notes Payable 486160 Cash 486160 Interest Payable 7080 Notes Payable 472000 Interest Expense 7080 Cash 486160 Notes Payable 472000 Interest Payable 14160 Cash 486160 Interest Expense 14160 Notes Payable 472000 Cash 486160arrow_forwardA company sold goods to a customer in exchange for a 5-year, zero-interest-bearing note on January 1, 2021. The note has a face amount of $308,000. The company imputes a 10% interest rate on this zero-interest note transaction. Present value factor for 10% and 5 years, single sum is 0.62. In the journal entry made on 12/31/2022, the company will record Discount on Notes Receivable by $__________. (Please do not use your own present value tables or financial calculator.) (Please do not round your answer in any part of the computation.) (DO NOT put a plus or minus sign in front of the amount.)arrow_forwardOn June 8, Williams Company issued an $80,000, 5%, 120-day note payable to Brown Industries. Assuming a 360-day year, what is the maturity value of the note? When required, round your answer to the nearest dollar. a. $82,600 b. $84,000 c. $81,333 d. $88,200arrow_forward

- Vishanuarrow_forwardProblem: ABC Company issued a promissory note to RCBC Bank. Details from the promissory note are as follows: Date of note: November 1, 2020 Term of note: 180 days Principal: P120,000 Interest rate: 12% Determine the following: 1. What is the account to be credited on the adjusting entry on December 31, 2020? 2. How much is the amount to be credited on December 31, 2020? 3. How much is the total interest expense for the full term of the note.arrow_forwardOn June 8, Alton Co. issued an $75,537, 7%, 120-day note payable to Seller Co. Assuming a 360-day year for your calculations, what is the maturity value of the note? When required, round your answer to the nearest dollar. Select the correct answer. $5,288$75,537$80,825$77,300arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education