FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:(b)

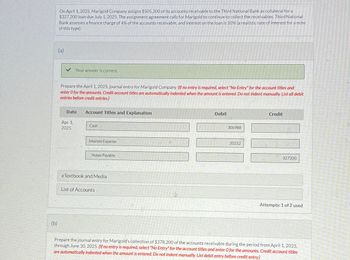

On April 1, 2025, Marigold Company assigns $505,300 of its accounts receivable to the Third National Bank as collateral for a

$327,200 loan due July 1, 2025. The assignment agreement calls for Marigold to continue to collect the receivables. Third National

Bank assesses a finance charge of 4% of the accounts receivable, and interest on the loan is 10% (a realistic rate of interest for a note

of this type).

(a)

Your answer is correct.

Prepare the April 1, 2025, journal entry for Marigold Company. (If no entry is required, select "No Entry" for the account titles and

enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit

entries before credit entries.)

Date

Account Titles and Explanation

Apr. 1,

Cash

2025

Interest Expense

Notes Payable

eTextbook and Media

List of Accounts

Debit

306988

20212

Credit

327200

Attempts: 1 of 2 used

Prepare the journal entry for Marigold's collection of $378,200 of the accounts receivable during the period from April 1, 2025,

through June 30, 2025. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles

are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 1, 2020, RB Company assigned on a non-notification basis accounts receivable of Php6,000,000 to a bank in consideration for a loan of 80% of the accounts less a 5% service fee on the accounts assigned. The entity signed a note for the bank loan. On December 31, 2020, the entity collected assigned accounts of Php2,000,000 less discount of Php200,000. The entity remitted the collections to the bank in partial payment for the loan. The bank applied first the collection to the interest and the balance to the principal. The agreed interest is 1% per month on the loan balance. The entity accepted sales returns of Php100,000 on the assigned accounts and wrote off assigned accounts totaling Php300,000. What is the equity of the assignor in assigned accounts on December 31, 2020?arrow_forwardOn December 31, 2023, Concord Corporation has $8.21 million of short-term debt in the form of notes payable that are due in 2024 to Provincial Bank. On January 28, 2024, Concord enters into a refinancing agreement with the bank that permits it to refinance its debt by up to 63% of the gross amount of its accounts receivable. Receivables are expected to range between a low of $5.3 million in February and a high of $8.0 million in October during 2024. The interest cost of the maturing short-term debt is 12%, and the new agreement calls for a fluctuating interest rate at 2% above the prime rate (currently prime is 8%) with the notes due in 2025. Concord informed the bank that it wishes to refinance as much of its debt as possible prior to its December 31, 2023 balance sheet being issued on February 15, 2024. (a) Assuming that Concord follows ASPE, prepare a partial balance sheet for Concord at December 31, 2023, that shows how its $8.21 million of short-term debt should be presented.…arrow_forward. On April 30, 2022, Lenny Inc. borrowed $10 million cash from Colonial Bank and issued a 5-month, noninterest-bearing note, priced to yield an effective interest rate of 10%. The stated discount rate on this loan is: A. More than the effective interest rate. B. Less than the effective interest rate. C. Equal to the effective interest rate. D. Unrelated to the effective interest ratearrow_forward

- Vishanuarrow_forward$120,000 of its accounts receivable to 2nd National Bank as collateral for a $70,000 loan due August 1 of the same year. The assignment agreement calls for Bay Co. to continue to collect the receivables. The bank assesses a finance charge of 3% of the accounts receivable. The interest rate on the loan is 8% which is a realistic interest rate for this type of loan. Prepare the journal entry that Bay Co. would make on February 1 Prepare the journal entry for Bay's collection of $50,000 of the receivables between February 1 and July 31. Prepare the journal entry to record Bay Co.'s payment to the bank.arrow_forwardAccarrow_forward

- Waterway Corporation factors $260,800 of accounts receivable with Kathleen Battle Financing, Inc. on a with recourse basis. Kathleen Battle Financing will collect the receivables. The receivables records are transferred to Kathleen Battle Financing on August 15, 2025. Kathleen Battle Financing assesses a finance charge of 2% of the amount of accounts receivable and also reserves an amount equal to 4% of accounts receivable to cover probable adjustments. (b) Assume that the conditions are met for a transfer of receivables with recourse to be accounted for as a sale. Prepare the journal entry on August 15, 2025, for Waterway to record the sale of receivables, assuming the recourse obligation has a fair value of $5,000. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.)arrow_forwardOn October 1, 2017, Chung, Inc. assigns $1,000,000 of its accounts receivable to Seneca National Bank as collateral for a $750,000 note. The bank assesses a finance charge of 2% of the receivables assigned and interest on the note of 9%. Prepare the October 1 journal entries for both Chung and Seneca.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education