FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:In October, Nicole eliminated all existing Inventory of cosmetic items. The trouble of ordering and tracking each product

line had exceeded the profits earned. In December, a supplier asked her to sell a prepackaged spa kit. Feeling she could

manage a single product line, Nicole agreed. Nicole's Getaway Spa (NGS) would make monthly purchases from the

supplier at a cost that included production costs and a transportation charge. NGS would keep track of its new inventory

using a perpetual Inventory system.

On December 31 of last year, NGS had 20 units at a total cost of $5.50 per unit. Nicole purchased 40 more units at $7.50

in February. In March, Nicole purchased 20 units at $9.50 per unit. In May, 50 units were purchased at $9.30 per unit. In

June, NGS sold 50 units at a selling price of $11.50 per unit and 60 units at $11.30 per unit.

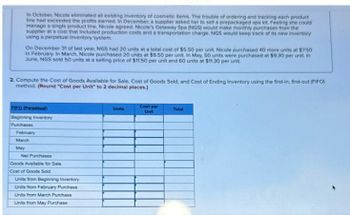

2. Compute the Cost of Goods Available for Sale, Cost of Goods Sold, and Cost of Ending Inventory using the first-in, first-out (FIFO)

method. (Round "Cost per Unit" to 2 decimal places.)

FIFO (Perpetual)

Beginning Inventory

Purchases

February

March

May

Net Purchases

Goods Available for Sale i

Cost of Goods Sold

Units from Beginning Inventory

Units from February Purchase

Units from March Purchase

Units from May Purchase

Units

Cost per

Unit

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Compute the cost assigned to ending inventory using FIFO. 2. Compute the cost assigned to ending inventory using Weighted Average. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the cost assigned to ending inventory using Weighted Average. (Round average cost per unit to 2 decimal places.) Average Cost Ending Inventory Date March 1 March 5 March 18 March 25 Total Cost of Goods Available for Sale Cost of Goods Available for Sale $5,000.00 100 400 $ 22,000.00 120 $ 7,200.00 200 $ 12,400.00 820 $59.80 $ 46,600.00 # of units Average Cost per unit # of units sold Cost of Goods Sold Average Cost per Unit 580 $ 59.80 240 Average Cost per unit $59.80 Ending Inventory $ 14,352arrow_forwardHello, This question is using a periodic inventory system. For this question, how do I determine the cost of ending inventory and cost of goods sold using: a) First in, First out b) Average cost Thanksarrow_forwardCompute cost of goods sold using the following information. Merchandise inventory, beginning Cost of merchandise purchased Merchandise inventory, ending $12,200 45.200 18,200 Cost of Goods Sold is Computed an Cost of goods sold $ Heip have t Subitarrow_forward

- Determine the unit value that should be used for inventory costing following "lower-of-cost-or-market value". (Round answers to 2 decimal places, e.g. 52.75.) A B C D E F Cost $2.80 $2.44 $2.80 $2.62 $2.44 $2.44 Replacement cost 2.25 3.00 2.25 2.60 2.37 2.46 Net realizable value 2.95 2.95 2.95 2.41 2.50 2.50 Net realizable value less normal profit 2.70 2.75 2.85 2.25 2.30 2.30 Case A $ Case B $ Case C $ Case D Case E $ Case F $arrow_forwardCalculate the value of ending inventory and cost of goods soldarrow_forwardEf 36.arrow_forward

- Sheffield Corp. markets CDs of numerous performing artists. At the beginning of March, Sheffield had in beginning inventory 2,500 CDs with a unit cost of $8. During March, Sheffield made the following purchases of CDs. March 5. March 13 1,900 @ 3,500 @ $9 $10 March 21 March 26 5,200 @ $11 $12 1,900 @ During March 11,500 units were sold. Sheffield uses a periodic inventory system.arrow_forwardSnow-Tech Inc. sells an Xpert ski that is popular with ski enthusiasts. The following information shows Snow-Tech's purchases and sales of Xpert skis during November: Date Nov. 1 Beginning inventory 5 12 19 22 Explanation 25 Purchases Sales Purchases Sales Purchases Unit Units Cost/Price $296 301 34 23 (40) 42 (48) 33 44 461 306 513 311arrow_forwardOn the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 10. Product InventoryQuantity Cost PerUnit Market Value per Unit(Net Realizable Value) Class 1: Model A 16 $162 $169 Model B 32 190 198 Model C 34 152 148 Class 2: Model D 31 298 309 Model E 42 72 78 Question Content Area a. Determine the value of the inventory at the lower of cost or market applied to each item in the inventory. Inventory at the Lower of Cost or Market Product InventoryQuantity Costper Unit Market Valueper Unit(Net Realizable Value) Cost Market Lower of Cost or Market Model A fill in the blank 1b67cb01c017023_1 $fill in the blank 1b67cb01c017023_2 $fill in the blank 1b67cb01c017023_3 $fill in the blank 1b67cb01c017023_4 $fill in the blank 1b67cb01c017023_5 $fill in…arrow_forward

- Identify each item as describing the FIFO method, LIFO method, or average cost method of inventory valuation. A. Involves calculating the total number of units in the warehouse FIFO LIFO Average cost B. To determine cost of goods sold, begin with the earliest goods acquired FIFO LIFO Average cost C. To determine merchandise inventory balance, begin with the earliest goods acquired FIFO LIFO Average costarrow_forwardThe cost of goods sold (Using the FIFO method) $.__________________________ The of cost of the ending Inventory (using the LIFO method) $____________________ The cost of Goods sold (Using the LIFO method) $_______________________________arrow_forwardSubject: accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education