FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

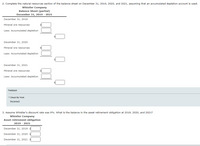

Transcribed Image Text:2. Complete the natural resources section of the balance sheet on December 31, 2019, 2020, and 2021, assuming that an accumulated depletion account is used.

Whistler Company

Balance Sheet (partial)

December 31, 2019 - 2021

December 31, 2019

Mineral ore resources

Less: Accumulated depletion

December 31, 2020

Mineral ore resources

Less: Accumulated depletion

December 31, 2021

Mineral ore resources

Less: Accumulated depletion

Feedback

V Check My Work

Incorrect

3. Assume Whistler's discount rate was 9%. What is the balance in the asset retirement obligation at 2019, 2020, and 2021?

Whistler Company

Asset retirement obligation

2019 - 2021

December 31, 2019

December 31, 2020

December 31, 2021

Transcribed Image Text:Depletion

On January 2, 2019, Whistler Company purchased land for $410,000, from which it is estimated that 370,000 tons of ore could be extracted. It estimates that the present value of the cost necessary to restore the land is $52,000, after which it could be sold for

$26,000.

During 2019, Whistler mined 75,000 tons and sold 56,000 tons. During 2020, Whistler mined 98,000 tons and sold 99,000 tons. At the beginning of 2021, Whistler spent an additional $110,000, which increased the reserves by 70,000 tons. In 2021, Whistler

mined 148,000 tons and sold 142,000 tons. Whistler uses a FIFO cost flow assumption.

Required:

If required, round the depletion rate to the nearest cent and round the final answers to the nearest dollar.

1. Calculate the depletion included in the income statement and ending inventory for 2019, 2020, and 2021.

2019

Depletion deducted from income

66,080

Depletion included in inventory

2020 Depletion deducted from income

116.820

Depletion included in inventory

2021

Depletion deducted from income

Depletion included in inventory

Feedback

Check My Work

2. Complete the natural resources section of the balance sheet on December 31, 2019, 2020, and 2021, assuming that an accumulated depletion account is used.

Whistler Company

Balance Sheet (partial)

December 31, 2019 - 2021

December 31, 2019

Mineral ore resources

Less: Accumulated depletion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardCalculate depreciation and fill out the form 4562 for 2022 year based on the following information: Depreciable assets: Recovery Prior Description Placed in Service Cost Method Convention Period Depreciation $32,963 MACRS/ 01/01/2020 $85,000 HY 7 200DB 01/15/2021 $13,930 HY 7 $1,991 04/15/20XX $1,900 7 Tools Equipment Sprayer MACRS/ 200DB MACRS/ 200DB HY Prior AMT Depreciation $32,963 $1,492 The S corporation has elected not to take the Section 179 deduction for the full amount of the cost of the sprayer or bonus depreciation.arrow_forwardHow would accumulated depreciation be classified on the balance sheet? current asset fixed asset current liability O long term liabilityarrow_forward

- Consider the following accounting information for a computer system: Cost basis of the asset, I = $10,000, Useful life, N = 5 years, Estimated salvage value, S = $0. Use the double-declining-depreciation method to compute the annual depreciation allowances and the resulting book values.arrow_forwardneed help answering part D on total assets for 2022arrow_forwardUse the information below to answer the questions that follow. The business's year-end is December 31. Cost of equipment = 120000 Useful life in years = 10 Residual value = 0 Date purchased = February 1, 2021 Date of disposal = October 31, 2023 Cash received on disposal = 85000 What is the accumulated depreciation on the date of the disposal? What is the book value of the equipment on the date of the disposal? What is the amount of the gain or loss on the disposal?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education