Required: 1. Assuming the use of a periodic inventory system, prepare a summarized income statement through gross profit for the month of January under each method of inventory: (a) average cost (round the average cost per unit to the nearest cent), (b) FIFO, (c) LIFO, and (d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. Show the inventory computations in detail. 2. Between FIFO and LIFO, which method results in the higher pretax income? Which method results in the higher EPS? 3. Between FIFO and LIFO, which method results in the lower income tax expense? Explain, assuming a 30 percent average tax rate. 4. Between FIFO and LIFO, which method produces the more favorable cash flow? Explain.

Required: 1. Assuming the use of a periodic inventory system, prepare a summarized income statement through gross profit for the month of January under each method of inventory: (a) average cost (round the average cost per unit to the nearest cent), (b) FIFO, (c) LIFO, and (d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. Show the inventory computations in detail. 2. Between FIFO and LIFO, which method results in the higher pretax income? Which method results in the higher EPS? 3. Between FIFO and LIFO, which method results in the lower income tax expense? Explain, assuming a 30 percent average tax rate. 4. Between FIFO and LIFO, which method produces the more favorable cash flow? Explain.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter5: Inventories And Cost Of Goods Sold

Section: Chapter Questions

Problem 5.24MCE

Related questions

Topic Video

Question

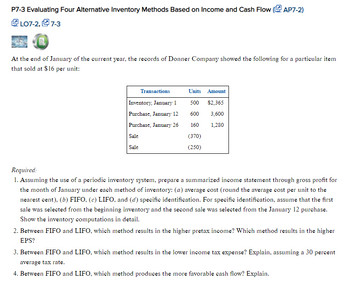

Transcribed Image Text:P7-3 Evaluating Four Alternative Inventory Methods Based on Income and Cash Flow (AP7-2)

LO7-2,7-3

At the end of January of the current year, the records of Donner Company showed the following for a particular item

that sold at $16 per unit:

Transactions

Inventory, January 1

Purchase, January 12

Purchase, January 26

Sale

Sale

Units Amount

500 $2,365

600

3,600

160

1,280

(370)

(250)

Required:

1. Assuming the use of a periodic inventory system, prepare a summarized income statement through gross profit for

the month of January under each method of inventory: (a) average cost (round the average cost per unit to the

nearest cent), (b) FIFO, (c) LIFO, and (d) specific identification. For specific identification, assume that the first

sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase.

Show the inventory computations in detail.

2. Between FIFO and LIFO, which method results in the higher pretax income? Which method results in the higher

EPS?

3. Between FIFO and LIFO, which method results in the lower income tax expense? Explain, assuming a 30 percent

average tax rate.

4. Between FIFO and LIFO, which method produces the more favorable cash flow? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

answer questions 2-4

Transcribed Image Text:P7-3 Evaluating Four Alternative Inventory Methods Based on Income and Cash Flow (AP7-2)

LO7-2,7-3

At the end of January of the current year, the records of Donner Company showed the following for a particular item

that sold at $16 per unit:

Transactions

Inventory, January 1

Purchase, January 12

Purchase, January 26

Sale

Sale

Units Amount

500 $2,365

600

3,600

160

1,280

(370)

(250)

Required:

1. Assuming the use of a periodic inventory system, prepare a summarized income statement through gross profit for

the month of January under each method of inventory: (a) average cost (round the average cost per unit to the

nearest cent), (b) FIFO, (c) LIFO, and (d) specific identification. For specific identification, assume that the first

sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase.

Show the inventory computations in detail.

2. Between FIFO and LIFO, which method results in the higher pretax income? Which method results in the higher

EPS?

3. Between FIFO and LIFO, which method results in the lower income tax expense? Explain, assuming a 30 percent

average tax rate.

4. Between FIFO and LIFO, which method produces the more favorable cash flow? Explain.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning