FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Given the information in the preceding balance sheet —and assuming that Blue Hamster Manufacturing Inc. has 50 million shares of common stock outstanding—read each of the following statements, then identify the selection that best interprets the information conveyed by the balance sheet.

Statement #1:Blue Hamster’s pool of relatively liquid assets, which are available to support the company’s current and future sales, decreased from Year 1 to Year 2.

This statement is ----true or false???--- , because which one?

Blue Hamster’s total current liabilities balance decreased by $3,937 million between Year 1 and Year 2

Blue Hamster’s total current liabilities balance increased from $2,363 million to $2,953 million between Year 1 and Year 2

Blue Hamster’s total current asset balance actually increased from $15,750 million to $19,687 million between Year 1 and Year 2

Statement #2: Over the past two years, Blue Hamster Manufacturing Inc. has relied more on the use of short-term debt than on long-term debt financing.

This statement is --TRUE OR FALSE??? , because which one:

Blue Hamster’s total current liabilities decreased by $547 million, while its long-term debt account decreased by $1,640 million

Blue Hamster’s total current liabilities increased by $547 million, while its use of long-term debt increased by $1,640 million

Blue Hamster’s total notes payable increased by $137 million, while its common stock account increased by $4,265 million

Statement #3: The book value of one of Blue Hamster’s fixed assets is calculated as the original cost of the asset minus its annual depreciation expense.

This statement is---TRUE OR FALSE???--- , because which one?:

An asset’s net book value is calculated by subtracting its annual depreciation expense from its total historic and installation costs

An asset’s net book value is calculated by subtracting its accumulated depreciation expense from its total historic and installation costs

An asset’s net book value is calculated by adding its annual depreciation expense to its total historic and installation costs

Based on your understanding of the different items reported on the balance sheet and the information they provide, if everything else remains the same, then the cash and equivalents item on the current balance sheet is likely to (INCREASE, DECREASE, OR REMAIN THE SAME?) if the firm increases the dividends paid on its common stock.

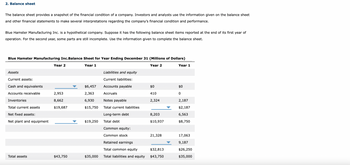

Transcribed Image Text:### 2. Balance Sheet

The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts use the information given on the balance sheet and other financial statements to make several interpretations regarding the company’s financial condition and performance.

Blue Hamster Manufacturing Inc. is a hypothetical company. Suppose it has the following balance sheet items reported at the end of its first year of operation. For the second year, some parts are still incomplete. Use the information given to complete the balance sheet.

#### Blue Hamster Manufacturing Inc. Balance Sheet for Year Ending December 31 (Millions of Dollars)

| **Year 2** | **Year 1** |

|--------------|--------------|

| **Assets** | |

| **Current assets**: | |

| Cash and equivalents | $6,457 |

| Accounts receivable | $2,953 | $2,363 |

| Inventories | $8,662 | $6,930 |

| **Total current assets** | $19,687 | $15,750 |

| **Net fixed assets**: | |

| Net plant and equipment | $19,250 |

| **Total assets** | $43,750 | $35,000 |

| | |

| **Liabilities and equity** | |

| **Current liabilities**: | |

| Accounts payable | $0 | $0 |

| Accruals | $410 | $0 |

| Notes payable | $2,324 | $2,187 |

| **Total current liabilities** | | $2,187 |

| Long-term debt | $8,203 | $6,563|

| **Total debt** | $10,937 | $8,750|

| **Common equity**: | |

| Common stock | $21,328 | $17,063|

| Retained earnings | | $9,187 |

| **Total common equity** | $32,813 | $26,250 |

| **Total liabilities and equity** | $43,750 | $35,000 |

### Explanation of the Balance Sheet Items:

**Current Assets:**

- Cash and equivalents are equivalent to liquid assets like cash and bank deposits. For Year 1, it is $6,457 million.

- Accounts receivable indicate the amount of money the company claims from customers or clients who have purchased on credit. For Year 2,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The balance sheet for Quinn Corporation is shown here in market value terms. There are 12,000 shares of stock outstanding. Cash Fixed assets Total Will Market Value Balance Sheet $ 49,300 355,000 Equity $ 404,300 Total In lieu of a dividend of $1.45, the company has announced it is going to repurchase $17,400 worth of stock. What effect will this transaction have on the equity of the firm? Note: Do not round intermediate calculations. Input the amount as positive value. New shares outstanding $ 404,300 $ 404,300 shareholders' equity by How many shares will be outstanding after the repurchase? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Share price What will the price per share be after the repurchase? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forwardNeed help with this questionarrow_forward[The following information applies to the questions displayed below.] Markus Company’s common stock sold for $5.25 per share at the end of this year. The company paid a common stock dividend of $0.63 per share this year. It also provided the following data excerpts from this year’s financial statements: EndingBalance BeginningBalance Cash $ 49,000 $ 44,200 Accounts receivable $ 92,000 $ 68,700 Inventory $ 76,300 $ 92,000 Current assets $ 217,300 $ 204,900 Total assets $ 801,000 $ 875,400 Current liabilities $ 85,500 $ 90,000 Total liabilities $ 206,000 $ 185,400 Common stock, $1 par value $ 165,000 $ 165,000 Total stockholders’ equity $ 595,000 $ 690,000 Total liabilities and stockholders’ equity $ 801,000 $ 875,400 This Year Sales (all on account) $ 1,095,000 Cost of goods sold $ 635,100 Gross margin $ 459,900 Net operating income $ 313,875 Interest expense $ 15,500 Net income $ 208,862 10. What is the…arrow_forward

- How to find the outstanding comon shares? This statement is correct. The per-share book value is calculated by dividing the company’s total common equity by the number of outstanding shares of common stock. The book value per share of Blue Hamster Manufacturing Inc.’s stock is the accounting value of assets that the company’s common shareholders would receive if the company was liquidated. It is listed as total common equity on the balance sheet (total assets minus total debt) and is calculated by dividing the value of total common equity by the outstanding shares. In this case, $32,813 million / 50 million shares = $656.26 per share.arrow_forwardThe year-end balance sheet of Star Inc. shows total assets of $12,407 million, operating assets of $9,849 million, operating liabilities of $5,291 million, and shareholders’ equity of $5,532 million.The company's year-end net operating assets are: Select one: a. $9,849 million b. $17,698 million c. $15,140 million d. None of these are correct. e. $4,558 millionarrow_forward[The following information applies to the questions displayed below.] Markus Company’s common stock sold for $5.25 per share at the end of this year. The company paid a common stock dividend of $0.63 per share this year. It also provided the following data excerpts from this year’s financial statements: EndingBalance BeginningBalance Cash $ 49,000 $ 44,200 Accounts receivable $ 92,000 $ 68,700 Inventory $ 76,300 $ 92,000 Current assets $ 217,300 $ 204,900 Total assets $ 801,000 $ 875,400 Current liabilities $ 85,500 $ 90,000 Total liabilities $ 206,000 $ 185,400 Common stock, $1 par value $ 165,000 $ 165,000 Total stockholders’ equity $ 595,000 $ 690,000 Total liabilities and stockholders’ equity $ 801,000 $ 875,400 This Year Sales (all on account) $ 1,095,000 Cost of goods sold $ 635,100 Gross margin $ 459,900 Net operating income $ 313,875 Interest expense $ 15,500 Net income $ 208,862 2. What is the…arrow_forward

- 1. The following is a data transaction from PT Colorpop's records as the basis for making a Statement of Comprehensive Income for the period ended 31 December 2020: Rent Revenue $ 44,000 Interest Expense $ 20,000 Unrealized gain on non-trading equity securities, net of tax $ 35,000 Selling expenses $ 140,000 Income tax $ 30,600 Administrative expenses $ 185,000 Cost of goods sold $ 500,000 Net sales $ 954,000 Loss on sale of plant assets $ 10,000 Loss from Fixed Assets Revaluation, net of tax $2,000 Instructions: Create a Statement of Comprehensive Income using a two-statement approach! Calculate the value of Ending Per Share for 2020 if the number of shares outstanding is 100,000 shares.arrow_forwardThe following balance sheet information (in $ millions) comes from the Annual Report to Shareholders of Merry International Incorporated for the 2024 fiscal year. The following additional information from an analysis of Merry's financial position is available: Current ratio = 1.352272; Acid - test ratio = 0.5769817; Debt to equity ratio = 0.6063000. Required: Compute the missing amounts in the balance sheet. Note: Enter your answers in millions of dollars. Round your intermediate and final answers to the nearest whole dollar. MERRY INTERNATIONAL INCORPORATED Balance Sheet At December 31, 2024 ($ in millions) Assets Current assets \table[[Cash and cash equivalents,,510]. [Accounts and notes receivable]. [Inventory], [Other,, 460], [Total current assets], [Property and equipment, net,1,322,], [Intangible assets, net]. [Investments, 260,], [Notes and other receivables, net,1,276,].[Other assets, 1, 152,]. [Total long-term assets], [Total assets]. [Liabilities and Shareholders' Equity],…arrow_forward[The following information applies to the questions displayed below.] Markus Company’s common stock sold for $5.25 per share at the end of this year. The company paid a common stock dividend of $0.63 per share this year. It also provided the following data excerpts from this year’s financial statements: EndingBalance BeginningBalance Cash $ 49,000 $ 44,200 Accounts receivable $ 92,000 $ 68,700 Inventory $ 76,300 $ 92,000 Current assets $ 217,300 $ 204,900 Total assets $ 801,000 $ 875,400 Current liabilities $ 85,500 $ 90,000 Total liabilities $ 206,000 $ 185,400 Common stock, $1 par value $ 165,000 $ 165,000 Total stockholders’ equity $ 595,000 $ 690,000 Total liabilities and stockholders’ equity $ 801,000 $ 875,400 This Year Sales (all on account) $ 1,095,000 Cost of goods sold $ 635,100 Gross margin $ 459,900 Net operating income $ 313,875 Interest expense $ 15,500 Net income $ 208,862 5. What is the return…arrow_forward

- If a firm has retained earnings of $3.4 million, a common shares account of $5.4 million, and additional paid-in capital of $10.8 million, how would these accounts change in response to a 10 percent stock dividend? Assume market value of equity is equal to book value of equity. (Enter your answers in dollars not in millions. Input all amounts as positive values. Indicate the direction of the effect by selecting "increase," "decrease," or "no change" from the drop-down menu.)arrow_forwardLei Materials' balance sheet lists total assets of $1.05 billion, $127 million in current liabilities, $435 million in long-term debt, $488 million in common equity, and 54 million shares of common stock. If Lei's current stock price is $51.38, what is the firm's market-to-book ratio?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education