FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

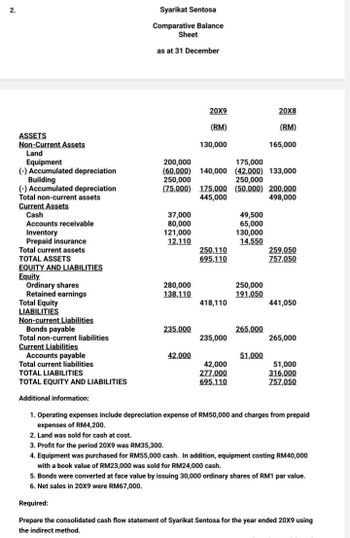

Transcribed Image Text:2.

ASSETS

Non-Current Assets

Land

Equipment

(-) Accumulated depreciation

Building

(-) Accumulated depreciation

Total non-current assets

Current Assets

Cash

Accounts receivable

Inventory

Prepaid insurance

Total current assets

TOTAL ASSETS

EQUITY AND LIABILITIES

Equity

Ordinary shares

Retained earnings

Total Equity

LIABILITIES

Non-current Liabilities

Bonds payable

Total non-current liabilities

Current Liabilities

Syarikat Sentosa

Comparative Balance

Sheet

as at 31 December

200,000

(60,000)

250,000

(75,000)

37,000

80,000

121,000

12,110

280,000

138,110

235,000

20X9

(RM)

130,000

42,000

175,000

140,000 (42,000) 133,000

250,000

175,000 (50,000) 200,000

445,000

498,000

250,110

695,110

418,110

235,000

49,500

65,000

130,000

14,550

42,000

277,000

695,110

250,000

191,050

265,000

20X8

(RM)

165,000

51,000

259,050

757,050

Accounts payable

Total current liabilities

TOTAL LIABILITIES

TOTAL EQUITY AND LIABILITIES

Additional information:

1. Operating expenses include depreciation expense of RM50,000 and charges from prepaid

expenses of RM4,200.

2. Land was sold for cash at cost.

3. Profit for the period 20X9 was RM35,300.

4. Equipment was purchased for RM55,000 cash. In addition, equipment costing RM40,000

with a book value of RM23,000 was sold for RM24,000 cash.

441,050

265,000

51,000

316,000

757,050

5. Bonds were converted at face value by issuing 30,000 ordinary shares of RM1 par value.

6. Net sales in 20X9 were RM67,000.

Required:

Prepare the consolidated cash flow statement of Syarikat Sentosa for the year ended 20X9 using

the indirect method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Assets Current assets Cash and cash equivalents Accounts receivable, net Supplies Other current assets Total current assets Property and equipment Accumulated depreciation Net property and equipment Goodwill Deferred charges Other Total assets Liabilities and equity Current liabilities Accounts payable Accrued liabilities Current maturities of long-term debt Total current liabilities Operating lease liabilities non-current Long-term debt Other non-current liabilities Total liabilities Total liabilities Common stock Cummulative dividends Retained earnings Other Total equity Total liabilities and equities Revenue, net Operating charges Salaries, wages, and benefits Other operating expenses Supplies expense Depreciation and amortization Lease and rental expense Total operating charges Income from operations Interest expense, net Other (income) expense, net Income before income taxes Provision for income taxes Net income $61,268 1,560,847 Cost of debt (%) Cost of equity (%) Weighted…arrow_forwardFor each of the following assets or liabilities, state whether it is current or non-current: Accounts Payable Cash Property, Plant, and Equipment Note Payable Inventoryarrow_forwardTr.5.arrow_forward

- QUESTION 10 Which of the following in accounts would be classified as current assets on the balance sheet? a. Accounts receivable, inventory, cash equivalents b. Pre-paid expenses, goodwill, long term investments C. Property, plant and equipment, inventory and goodwill d. Marketable securities, accounts payable, property plant and equipmentarrow_forwardJournalize the selected transactionsarrow_forwardWhile accounting for provisions, contingent assets, and contingent liabilities if probability of occurrence of assets is 51% to 95%, then what treatment is required for the recognition of assets? a. Book provisions b. Disclosure notes c. Ignore assets d. Recognize assetsarrow_forward

- Deposits held as compensating balances a. if legally restricted and held against long-term credit may be included among current assets b. if legally restricted and held against short term credit may be included as cash c. if not legally restricted and held against short-term credit should be included in the cash balance. d. if not legally restricted and held against short-term credit should be reported separately from cash but is included among the current assets.arrow_forwardEquity equals to: O A. Total liabilities plus current assets O B. Current assets plus non-current assets less total liabilities. O C. Capital plus drawings. O D. Total assets less total liabilities.arrow_forwardOut of which equation is NOT CORRECT ? Please remember to select "WHICH IS NOT CORRECT" Select one: a. Capital = Total Assets - Total Liabilities b. Total Assets = Tangible Assets + Intangible Assets + Investments + Current Assets c. Total Liabilities = Total Assets - Shareholder's funds - Capital d. Owner's equity = Share capital + Reserve and Surplusarrow_forward

- Which of the following will be reflected in the "Cash flows from operating activities" of a Statement of Cash Flows? O A. Adjustment for depreciation O B. Purchase of equipment O C. Increase or decrease in loans O D. Purchase of inventory Previous page nttps://mancosaconnectacza/mad/ouiz/attempt.php?attempt=446654&cmid=D181433&page=18%3D Tume bere to search IIarrow_forwardAssets Current assets Cash and cash equivalents Accounts receivable, net Supplies Other current assets Total current assets Property and equipment Accumulated depreciation Net property and equipment Goodwill Deferred charges Other Total assets Liabilities and equity Current liabilities Accounts payable Accrued liabilities Current maturities of long-term debt Total current liabilities Operating lease liabilities non-current Long-term debt Other non-current liabilities Total liabilities Total liabilities Common stock Cummulative dividends Retained earnings Other Total equity Total liabilities and equities Revenue, net Operating charges Salaries, wages, and benefits Other operating expenses Supplies expense Depreciation and amortization Lease and rental expense Total operating charges Income from operations Interest expense, net Other (income) expense, net Income before income taxes Provision for income taxes Net income $61,268 1,560,847 Cost of debt (%) Cost of equity (%) Weighted…arrow_forward2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education