FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

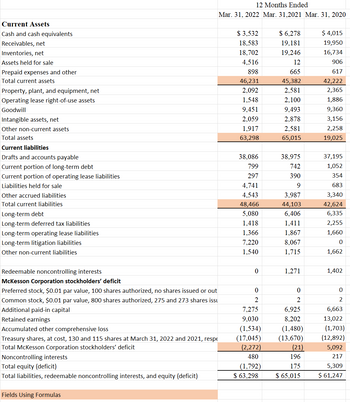

review the picture below and correct any lines that involve formulas and add any lines that arent highlighted that need formulas by adding forumlas where they are needed

Transcribed Image Text:Current Assets

Cash and cash equivalents

Receivables, net

Inventories, net

Assets held for sale

Prepaid expenses and other

Total current assets

Property, plant, and equipment, net

Operating lease right-of-use assets

Goodwill

Intangible assets, net

Other non-current assets

Total assets

Current liabilities

Drafts and accounts payable

Current portion of long-term debt

Current portion of operating lease liabilities

Liabilities held for sale

Other accrued liabilities

Total current liabilities

Long-term debt

Long-term deferred tax liabilities

Long-term operating lease liabilities

Long-term litigation liabilities

Other non-current liabilities

Redeemable noncontrolling interests

McKesson Corporation stockholders' deficit

Preferred stock, $0.01 par value, 100 shares authorized, no shares issued or out

Common stock, $0.01 par value, 800 shares authorized, 275 and 273 shares issu

Additional paid-in capital

Retained earnings

Accumulated other comprehensive loss

Treasury shares, at cost, 130 and 115 shares at March 31, 2022 and 2021, respe

Total McKesson Corporation stockholders' deficit

Noncontrolling interests

Total equity (deficit)

Total liabilities, redeemable noncontrolling interests, and equity (deficit)

12 Months Ended

Mar. 31, 2022 Mar. 31,2021 Mar. 31, 2020

Fields Using Formulas

$3,532

18,583

18,702

4,516

898

46,231

2,092

1,548

9,451

2,059

1,917

63,298

38,086

799

297

4,741

4,543

48,466

5,080

1,418

1,366

7.220

1,540

0

0

2

7,275

9,030

(1,534)

(17,045)

(2,272)

480

(1,792)

$ 63,298

$ 6,278

19,181

19,246

12

665

45,382

2,581

2,100

9,493

2,878

2,581

65,015

38,975

742

390

9

3,987

44,103

6,406

1,411

1,867

8,067

1,715

1,271

0

2

6,925

8,202

(1,480)

(13,670)

(21)

196

175

$ 65,015

$ 4,015

19,950

16,734

906

617

42,222

2,365

1,886

9,360

3,156

2,258

19,025

37,195

1,052

354

683

3,340

42,624

6,335

2,255

1,660

0

1,662

1,402

0

2

6,663

13,022

(1,703)

(12,892)

5,092

217

5,309

$ 61,247

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you please do this problem using an equation.arrow_forwardIn the image you can look at the question . Is asking me to choose the correct answer below and fill in the answer box to complete your choice . How can I solve this type of question ?arrow_forwardPlease correct and incorrect option explain and correct answerarrow_forward

- Create a SQL table using your name with the following features: the columns of your table must include, at least the data types (in this order) and one more of your choice NOTE: You need to specify a 2 column (i.e 2 attribute 1. varchar (n), // where n covers the string length you want to enter 2. Int, 3. decimal, (precision = 8, scale = 3 4. date. 5. ??? your choice here ??? Table constraints: 1. It has a two column primary key 2. a check constraint on 2 columns, on the decimal and the date field 3. Use '2024-02-18' date as the default on the date field 5. write down your relational schema 5. Create the table, insert at least 4 rows, and do a Select * to show them example don't just copy these, change the constraint namesarrow_forwardcan you please show me how to calculate this without using excel? Thanksarrow_forwardFill out the missing columns and show the calculation and formulasarrow_forward

- Will you please provide the formulas (explanation) to understand the results or numbers that were added in the solution?arrow_forwardCan i have the steps in formula form pleasearrow_forwardis there a way to do this question with formulas and a calculator instead of excel? if so please upload the solution this wayarrow_forward

- What is the most efficient way to access data when you have multiple tables?arrow_forwardDoes a user view always require multiple tables to support it? Explain.arrow_forwardThe easiest way to change the order in a chart is in the __________. Multiple Choice underlying spreadsheet slicer chart options chart itselfarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education