Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

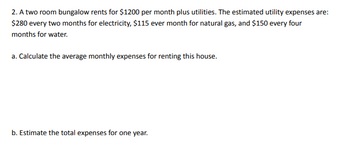

Transcribed Image Text:2. A two room bungalow rents for $1200 per month plus utilities. The estimated utility expenses are:

$280 every two months for electricity, $115 ever month for natural gas, and $150 every four

months for water.

a. Calculate the average monthly expenses for renting this house.

b. Estimate the total expenses for one year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Estimating Savings. Julia brings home $1,900 per month after taxes. Julia's rent is $419 per month, her utilities are $127 per month, and her car payment is $276 per month. Julia is currently paying $237 per month to her orthodontist for her braces. If Julia's groceries cost $76 per week and she estimates her other expenses to be $196 per month, how much will she have left each month to put toward savings to reach her financial goals? Given Julia's expected expenses, the amount she will have left each month to put toward savings to reach her financial goals is $ (?) (round to the nearest dollar)arrow_forwardA couple found a house selling for $115,500.The taxes on the house are $1200 per year, and insurance is $360 per year. They are requesting a conventional loan from the local bank. The bank is currently requiring a 15% down payment and 3 points, and the interest rate is 10%. The couple's gross monthly income is $4850. They have more than 10 monthly payments remaining on a car, a boat, and furniture. The total monthly payments for these items is $420. Their bank will approve a loan that has a total monthly mortgage payment of principal, interest, property taxes, and homeowners' insurance that is less than or equal to 28% of their adjusted monthly income. Complete parts a) through g) below. Part 1 a) Determine the required down payment. The required down payment is $?arrow_forward6. Suppose Deb and Rusty decided to rent an apartment instead of buying a house. Create a column that keeps track of the amount they will spend in rent every year for the next 20 years. Assume the rent is now $1000 a month and will increase by 3% each year.arrow_forward

- Maddie Marlow and Jonah Font have an adjusted gross income of $174,200. They are looking for a new house. Their monthly mortgage payment would be $1,710. Their annual property taxes would be $12,350 and their annual homeowner's premium would be $1080. Calculate their front-end ratio.Front-end ratio = Monthly housing expenses / Monthly gross incomearrow_forwardBen and Carla Covington plan to buy a condominium. They will obtain a $224,000, 30-year mortgage at 7.0 percent. Their annual property taxes are expected to be $2,000. Property insurance is $520 a year, and the condo association fee is $240 a month. Based on these items, determine the total monthly housing payment for the Covingtons. Use Exhibit 7-7. (Round your intermediate calculations and final answer to 2 decimal places.) Total monthly housing paymentarrow_forwardA family spends $40,000 on living expenses. With an annual inflation rate of 3 percent, they can expect to spend approximately _____________blank in one year.arrow_forward

- You own a house that you rent for $1,100 per month. The maintenance expenses on the house average $200 per month. The house cost $219,000 when you purchased it 4 years ago. A recent appraisal on the house valued it at $241,000. If you sell the house you will incur $19,280 in real estate fees. The annual property taxes are $2,500. You are deciding whether to sell the house or convert it for your own use as a professional office. What value should you place on this house when analyzing the option of using it as a professional office?arrow_forwardCondominiums usually require a monthly fee for various services. At $280 a month, how much would a homeowner pay over a period of 12 years for living in this housing facility? Total Feearrow_forwardAssume you are looking to share an apartment with another person, Joe. The rent for a 2-bedroom/2 bath apartment is $1,000 per month. Joe wants to split the rent 50/50. Prior to agreeing to this, you find out the following information: Joe’s bedroom is 20’ x 24’ or 480 square feet with an on suite bath. Your bedroom is 12’ x 10’ or 120 square feet and the bath will be used by visitors too. You think that the rent should be allocated between you and Joe based upon the relative square feet of your rooms. Whose method (Joe’s or yours) represents activity-based costing?arrow_forward

- Maria earned $250, $3,900, $8,940, $2,340, and $5,620 from her home buisiness during the last five months. What was her average monthly income during this period?arrow_forwardA family spends $30,000 a year for living expenses. If prices increase by 5 percent a year for the next three years, what amount will the family need for their living expenses after three years?arrow_forwardprovide correct answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education