FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

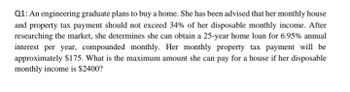

Transcribed Image Text:Q1: An engineering graduate plans to buy a home. She has been advised that her monthly house

and property tax payment should not exceed 34% of her disposable monthly income. After

researching the market, she determines she can obtain a 25-year home loan for 6.95% annual

interest per year, compounded monthly. Her monthly property tax payment will be

approximately $175. What is the maximum amount she can pay for a house if her disposable

monthly income is $2400?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An acquaintance asks Kara to borrow money today to help her repair her car. The person will be able to repay Kara $500 in one year, and Kara is fully expects she will be repaid on time (risk free). If Kara requires a 5.0% return, what (largest) amount should she lend to her acquaintance?$525.00$495.00$475.00$476.19$471.43arrow_forwardI need the answer of the question attached. Please provide all possible answers. Thank you!arrow_forwardConor is comparing two potential housing options. Conor plans to stay in the home for 4 years, after which he plans to move again. Conor earns 12% annually on his other investments. He determines the following information about each option: OPTION 1: Purchase a home • Purchase a $270,000 home with a 30-year fixed mortgage • Loan amount = $270,000 (100% financing) • Annual mortgage interest rate = 6.00% Monthly mortgage payments = $1,618.79 • Additional monthly costs (insurance, taxes, maintenance) = $350.00 • Real estate growth rate = 5% annually .arrow_forward

- Please Do both questions Edie wants to borrow $325,000 to purchase a new condominium in New York. What are her monthly payments for a fully amortizing 30-year fixed rate mortgage with a 4.5% contract rate? Ans:___ what are her monthly payments for a partially amortizing 25-year fixed rate mortgage with a 4.5% contract rate and 5-year maturity? Ans:___arrow_forwardPlease answer all subparts with explanation. I know it's not according to your guidelines. Thanks I will really upvotearrow_forwardTobin is buying a new apartment. He can afford a mortgage payment of $1990 a month, and a down payment of $11000. He obtained a 16-year loan at 6.05% compounded monthly. Use Excel to determine what the most expensive apartment he can buy under these terms. How much will Tobin pay in interest over the 16-year years? Apartment price = $ Interest paid = $arrow_forward

- Lynne needs to borrow $10000 for cosmetic surgery. She obtains a loan from her grandmother for 24 months at a simple interest rate of 6.9%. What is the loans future value?arrow_forwardMary has found a beautiful home on Richmond Rd. that she loves.The price of the home is $285,000. If Mary and George qualify for a30-year loan at a fixed interest rate of 3.99%, can they afford thehome? (Hint: Don't forget about the down payment!)arrow_forwardTom and Kyra Courtney are considering buying a house and are researching the potential costs. Their adjusted gross income is $144,000. The monthly mortgage payment for the house they want would be $1,450. The annual property taxes would be $9,400, and the homeowner’s insurance premium would cost them $876 per year. What is the front end ratio and will they be able to qualify?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education