FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

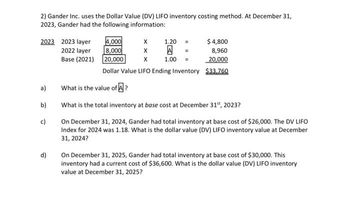

Transcribed Image Text:2) Gander Inc. uses the Dollar Value (DV) LIFO inventory costing method. At December 31,

2023, Gander had the following information:

2023 2023 layer

2022 layer

Base (2021)

a)

b)

c)

d)

4,000

8,000

X

20,000 X

Dollar Value LIFO Ending Inventory $33,760

X 1.20

A

1.00

$ 4,800

8,960

20,000

What is the value of A?

What is the total inventory at base cost at December 31st, 2023?

On December 31, 2024, Gander had total inventory at base cost of $26,000. The DV LIFO

Index for 2024 was 1.18. What is the dollar value (DV) LIFO inventory value at December

31, 2024?

On December 31, 2025, Gander had total inventory at base cost of $30,000. This

inventory had a current cost of $36,600. What is the dollar value (DV) LIFO inventory

value at December 31, 2025?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Inventory, 12/31/25 Purchases Purchase returns Purchase discounts Gross sales (before employee discounts) Sales returns Markups Markup cancellations Markdowns Markdown cancellations Freight in Employee discounts granted Loss from breakage (normal) Cost $158,500 752,100 42,300 11,400 37400 Retail $265.000 1,357,000 75,400 1,243,000 53,600 67,200 15,200 82,200 21,500 10.500 8.800arrow_forwardCrane Ltd. had the following items in inventory as at December 31, 2024: Item No. Quantity Unit Cost NRV དྷྭ སྒྲ སཱུ སྦ 340 $4.00 $4.30 370 3.00 2.90 380 8.00 9.00 400 7.00 6.80 Assume that Crane uses a perpetual inventory system. Fill in the table below for the lower of cost and net realizable value per unit, the inventory dollar amount at the lower of cost and net realizable value, and the dollar amount of the inventory at cost. ntity Unit Cost NRV Unit LC & NRV 340 $4.00 $4.30 S 370 3.00 2.90 Dollar LC & NRV 4.00 $ 2.90 1360 1073 380 8.00 9.00 8.00 3040 400 7.00 6.80 6.80 2720 Dollar Cost 1360 1110 3040 2800 $ 8193 $ 8310 Prepare any necessary adjusting entry at December 31, 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry) Account Titles Debit Creditarrow_forwardTB MC Qu. 8-111 (Static) A company has the following information available... A company has the following information available that was used to report inventory using the dollar-value LIFO method. Year 12/31/2023 12/31/2024 Year-End Cost $ 250,000 259,000 Cost Index 1.00 1.06 For the year ended 12/31/2024, the company reported inventory of $274,540 (= $259,000 x 1.06). Which of the following statements is correct? Multiple Choice The amount reported for ending inventory should be calculated as $250,000 + ($9,000 ÷ 1.06). The amount reported for ending inventory should be calculated as $259,000+ 1.06. The amount reported for ending inventory is correct. Proy 16 of 16 HH Ch Nextarrow_forward

- Sunland Corporation had the following items in inventory as at December 31, 2023: Item No. A1 84 C2 D3 (a) Quantity 4 120 110 190 120 Inventory 1 Unit Cost $3.20 Inventory 1.70 8.50 7.50 Your answer is partially correct. Assume that Sunland uses a periodic inventory system, and that none of the inventory items can be grouped together for accounti purposes. The opening inventory on January 1, 2023, was $3,200 in total. Account Titles and Explanation Allowance to Reduce Inventory to NRV NRV $3.80 1.10 Prepare the year-end adjusting entries required to adjust to the lower of cost or net realizable value using the direct method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts. List all debit entries before credit entries.) 10.30 7.10 (To transfer out beginning inventory balance) Allowance to Reduce Inventory to NRV (To record ending inventory at…arrow_forwardPresented below is information related to Splish Company. December 31, 2022 December 31, 2023 December 31, 2024 December 31, 2025 December 31, 2026 December 31, 2027 2022 2023 Date 2024 2025 2026 2027 $ $ $ $ $ Ending Inventory (End-of-Year Prices) $ $83,600 117,832 Compute the ending inventory for Splish Company for 2022 through 2027 using the dollar-value LIFO method. 116,501 131,709 157,765 190,224 Ending Inventory 83,600 207,802 Price Index 100 100 104 119 129 139 144arrow_forwardnot use ai pleasearrow_forward

- On January 1, 2019, Lexor Company adopted the dollar-value-LIFO method of inventory costing. Lexor's ending inventory records appear as follows: Year Current cost Index 2019 $ 42,000 100 (1.00) 2020 58,000 110 (1.10) 2021 60,100 120 (1.20) 2022 68,200 130 (1.30) Compute the ending inventory for the years 2019, 2020, 2021, and 2022, using the dollar-value LIFO method. Round to the nearest dollar. Show all work. You can use the previous homework template that you used forarrow_forwardbholaarrow_forwardPresented below is information related to Sheffield Company. December 31, 2022 December 31, 2023 December 31, 2024 December 31, 2025 December 31, 2026 December 31, 2027 2022 2023 2024 2025 Date 2026 2027 Ending Inventory (End-of-Year Prices) $ $82,100 117,104 114,835 129,516 154,985 183,168 Compute the ending inventory for Sheffield Company for 2022 through 2027 using the dollar-value LIFO method. Price Index Ending Inventory 100 104 119 129 139 144arrow_forward

- 2. The following information is obtained from Lynbrook's inventory records. Based on your recommendation, Lynbrook uses the dollar-value LIFO retail method. 2021 2022 2023 Cost Retail Cost Retail Cost Retail Purchases $ 200,000 $ 420,000 $ 250,000 $ 550,000 $ 240,000 $ 500,000 Net additional markups Net markdowns 20,000 30,000 10,000 10,000 40,000 20,000 Sales 400,000 600,000 450,000 Lynbrook adopted LIFO on January 1, 2021, when the cost and retail values of the inventory were $50,000 and $100,000, respectively. The company experienced the following price indexes: January 1, 2021 December 31, 2021 100 December 31, 2022 115 108 December 31, 2023 120 Required: Compute the cost of the ending inventory for 2021 and 2022. (round the cost-to-retail ratio to 3 decimal places) Reminder: Continue using proper excel formulas in your solution.arrow_forwardanswer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardaj.5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education