Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

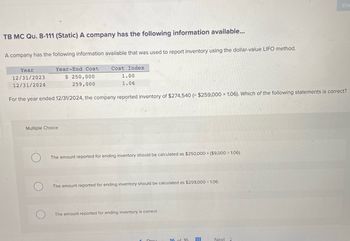

Transcribed Image Text:TB MC Qu. 8-111 (Static) A company has the following information available...

A company has the following information available that was used to report inventory using the dollar-value LIFO method.

Year

12/31/2023

12/31/2024

Year-End Cost

$ 250,000

259,000

Cost Index

1.00

1.06

For the year ended 12/31/2024, the company reported inventory of $274,540 (= $259,000 x 1.06). Which of the following statements is correct?

Multiple Choice

The amount reported for ending inventory should be calculated as $250,000 + ($9,000 ÷ 1.06).

The amount reported for ending inventory should be calculated as $259,000+ 1.06.

The amount reported for ending inventory is correct.

Proy

16 of 16

HH

Ch

Next

Expert Solution

arrow_forward

Step 1

The cost index represents the cost fluctuations incurred by businesses as a result of the procurement of supplies for an agreement or arrangement. The cost index shows variations in cost element prices compared to the chosen base year. Cost indexes are determined using a formula that weights various cost elements together based on their shares of overall expenses.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Beginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the October 22 purchase, (b) the cost of goods sold on October 29, and (c) the inventory on October 31.arrow_forwardInventory Analysis Singleton Inc. reported the following information for the current year: Required: Compute Singletons (a) gross profit ratio, (b) inventory turnover ratio, and (c) average days to sell inventory. (Note: Round all answers to two decimal places.)arrow_forwardBeginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the October 22 purchase, (b) the cost of the merchandise sold on October 29, and (c) the inventory on October 31.arrow_forward

- Basga Company uses the periodic inventory system. Beginning inventory amounted to 241,072. A physical count reveals that the latest inventory amount is 256,339. Record the adjusting entries, using T accounts.arrow_forwardCompare the calculations for gross margin for B76 Company, based on the results of the perpetual inventory calculations using FIFO, LIFO, and AVG.arrow_forwardHurst Companys beginning inventory and purchases during the fiscal year ended December 31, 20-2, were as follows: There are 1,200 units of inventory on hand on December 31, 20-2. REQUIRED 1. Calculate the total amount to be assigned to the cost of goods sold for 20-2 and ending inventory on December 31 under each of the following periodic inventory methods: (a) FIFO (b) LIFO (c) Weighted-average (round calculations to two decimal places) 2. Assume that the market price per unit (cost to replace) of Hursts inventory on December 31 was 18. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods: (a) FIFO lower-of-cost-or-market (b) Weighted-average lower-of-cost-or-market 3. In addition to taking a physical inventory on December 31, Hurst decides to estimate the ending inventory and cost of goods sold. During the fiscal year ended December 31, 20-2, net sales of 100,000 were made at a normal gross profit rate of 35%. Use the gross profit method to estimate the cost of goods sold for the fiscal year ended December 31 and the inventory on December 31.arrow_forward

- Calculate the cost of goods sold dollar value for A74 Company for the sale on March 11, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average (AVG).arrow_forwardRefer to the information for Morgan Inc. above. If Morgan uses a perpetual inventory system, what is the cost of ending inventory under FIFO at April 30? a. $32,500 b. $38,400 c. $63,600 d. $69,500arrow_forwardInventory Analysis Callahan Company reported the following information for the current year. Required: 1. Compute Callahans (a) gross profit ratio, (b) inventory turnover ratio, and (c) average days to sell inventory. (Round all answers to two decimal places.) 2. Explain the meaning of each number.arrow_forward

- Lower-of-cost-or market inventory Data on the physical inventory of Moyer Company as of December 31, 20Y9, are presented below. Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions Determine the inventory at cost and at the lower of cost or market, using the first-in, first-out method. Record the appropriate unit costs on an inventory sheet and complete the pricing of the inventory. When there are two different unit costs applicable to an item, proceed as follows: 1. Draw a line through the quantity, and insert the quantity and unit cost of the last purchase. 2. On the following line, insert the quantity and unit cost of the next-to-the-last purchase. 3. Total the cost and market columns and insert the lower of the two totals in the LCM column. The first item on the inventory sheet has been completed below as an example.arrow_forwardRE7-8 Johnson Company uses a perpetual inventory system. On October 23, Johnson purchased 100,000 of inventory on credit with payment terms of 1/15, net 45. Using the net price method, prepare journal entries to record Johnsons purchases on October 23 and the subsequent payment on October 31. Using the information from RE7-8, prepare journal entries to record Johnsons purchase on October 23 and the subsequent payment on November 30.arrow_forwardInventory by three cost flow methods Details regarding the inventory of appliances on January 1, 20Y7, purchases invoices during the year, and the inventory count on December 31. 2O’7. of Amsterdam Appliances are summarized as follows: Instructions Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,