ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

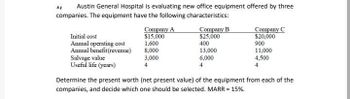

Transcribed Image Text:" Austin General Hospital is evaluating new office equipment offered by three

companies. The equipment have the following characteristics:

Company A

Initial cost

$15,000

Annual operating cost

1,600

Company B

$25,000

400

Annual benefit(revenue)

8,000

13,000

Salvage value

3,000

6,000

Useful life (years)

4

Company C

$20,000

900

11,000

4,500

Determine the present worth (net present value) of the equipment from each of the

companies, and decide which one should be selected. MARR = 15%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2-8 Consider the accompanying breakeven graph for an investment, and answer the following questions as they pertain to the graph. Euros (x104) €40r 585850 35 30 25 20 15 10 s 0 Total Revenue Total Cost 250 500 750 1000 1250 1500 1750 Output (units/year) Give the equation to describe total revenue for x units per year. (b) Give the equation to describe total costs for x units per year. (c) What is the "breakeven" level of x in terms of costs and revenues? (d) If you sell 1500 units this year, will you have a profit or loss? How much?arrow_forwardIPS Corp. will upgrade its package-labeling machinery. It costs $850,000 to buy the machinery and have it installed. Operation and maintenance costs, which are $11,000 per year for the first 3 years, increase by $1000 per year for the machine’s 10-year life. The machinery has a salvage value of 12% of its initial cost. Interest is 25%. What is the future worth of cost of the machinery? dont use excel. dont write answer in a paper becouse of handwriting. thanksarrow_forwardThe table below provides the total revenues and costs for a small landscaping company in a recent year. Total Revenues ($) 250 000 Total Costs ($) wages and salaries 150 000 - risk-free return of 2% on owner's capital of $20 000 400 - interest on bank loan 1500 cost of supplies 27 000 depreciation of capital equipment 8000 - additional wages the owner could have earned in next best alternative 30-000 800 - risk premium of 4% on owner's capital of $20 000 a. Refer to Table calculate explicit costs for this firm? b. Refer to Table calculate implicit costs for this firm? C. Refer to Table, what is the accounting profits for this firm are? d. Refer to Table, calculate he economic profits for this firm?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education