FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

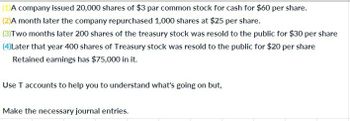

Transcribed Image Text:(1)A company issued 20,000 shares of $3 par common stock for cash for $60 per share.

(2) A month later the company repurchased 1,000 shares at $25 per share.

(3)Two months later 200 shares of the treasury stock was resold to the public for $30 per share

(4)Later that year 400 shares of Treasury stock was resold to the public for $20 per share

Retained earnings has $75,000 in it.

Use T accounts to help you to understand what's going on but,

Make the necessary journal entries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- California Surf Clothing Company issues 1,000 shares of $1 par value common stock at $20 per share. Later in the year, the company decides to purchase 100 shares at a cost of $23 per share. Record the transaction if California Surf resells the 100 shares of treasury stock at $25 per share. Record the sale of treasury stock.arrow_forwardSheffield Corporation began business by issuing 401000 shares of $5 par value common stock for $24 per share. During its first year, the corporation sustained a net loss of $39200. The year-end balance sheet would show O Common stock of $2005000. O Common stock of $9624000. O Total paid-in capital of $2044200. O Total paid-in capital of $9584800.arrow_forwardEhrlichCo. had the following transactions during the current period. Mar. 2 Issued 5,000 shares of $5 par value common stock to attorneys in payment of a bill for $40,000 for services performed in helping the company to incorporate.June 12 Issued 60,000 shares of $5 par value common stock for cash of $365,000.July 11 Issued 1,000 shares of $100 par value preferred stock for cash at $110 per share. Aug. 15 Issued 20,000 shares of common stock for a building with an asking price of $150,000 and a fair value of $140,000Nov. 28 Purchased 2,000 shares of treasury stock for $80,000. Dec. 15 Sold 500 shares of the treasury stock for $45 per shareInstructions: 1. Journalize the transactions. 2. Prepare the stockholders' equity section of the balance sheet. Use the following example as a guide. For Retained Earnings for this example, you can use $1,050,000. Stockholders’ equity Paid-in capital: Capital stock: 9% preferred stock, $100 par value,…arrow_forward

- Aggregate Mining Corporation was incorporated five years ago. It is authorized to issue 500,000 shares of $100 par value 10% preferred stock. It is also authorized to issue 750,000 shares of $1 par value common stock. It has issued only 40,000 of the common shares and none of the preferred shares. In its sixth year, the corporation has the following transactions: Mar. 1 Declares a cash dividend of $2 per share. Mar. 30 Pays the cash dividend. Jul. 10 Declares a 5% stock dividend when the stock is trading at $20 per share. Aug. 5 Issues the stock dividend. Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank. Mar. 1 fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 Mar. 30 fill in the blank 8 fill in the blank 9 fill in the blank 11 fill in the blank 12 Jul. 10 fill in the blank 14 fill in the blank 15 fill in the blank 17 fill in the blank 18…arrow_forwardOn May 1, Z Company repurchased (bought back) 12,000 shares of its own $2 par common stock as treasury stock at a cost of $10 per share. On September 1, Z Company resold 5,000 shares of its treasury stock when the market prices was $15 per share. What is the ending balance in Treasury Stock? What is the ending balance in in the Paid-In Treasury Stock?arrow_forwardPlease show all work and answers: 1. On January 1st, ZYX company purchased 1,000 shares of its own stock at $37 per share. On January 20th, ZYX later reissues or sells 199 shares of treasury stock for $12 per share. On January 20th, the balance in Additional paid in capital-Treasury stock is credit balance of $0. What is the amount debited to Retained earnings on January 20th? 2. ABC issues 14,000 shares of common stock to investors on January 1 for cash, with the investors paying cash of $24 per share. The par value of the stock is $5 per share. What is the amount applied to additional paid in capital? 3. On January 1st, ABC company issues a stock dividend of 18%. ABC has 101,000 shares outstanding with a par value of $1. ABC also has 210,000 shares authorized. The market price per share January 1st is $32. What is number of new shares issued for stock dividend? 4. On January 1st, ZYX company purchased 1,200 shares of its own stock at $36 per share. On January 20th, ZYX later reissues…arrow_forward

- Sunshine Clothing Company issues 1,000 shares of $1 par value common stock at $33 per share. Later in the year, the company decides to purchase 100 shares at a cost of $36 per share. Determine the financial statement effects of the purchase of treasury stock. (Amounts to be deducted should be entered with minus sign.) Revenues Assets Income Statement Expenses Balance Sheet Liabilities Net Income Stockholders' Equityarrow_forwardA company issues 20,000 common shares for $15 each. Later in the year, the same company issues another 35,000 common shares for $27 each. Two weeks later, it repurchases 5,000 shares for 19 per share. The entry to record the repurchase would be which of the following? Debit Cash for $95,000 & Contributed Capital - Retirement of Common Shares for $18,200, credit Common Shares for $113,200. Debit Common Shares for $95,000 & Retained Earnings for $18,200, credit Cash for $113,200. Debit Common Shares for $95,000, credit Cash for $95,000. Debit Common Shares for $113,200, credit Contributed Capital - Retirement of Common Shares for $18,200 & Cash for $95,000.arrow_forwardAgri Gold Ltd. began operations on January 1, 1983 by issuing 54,000 common shares at $13 per share and 26,000 $8 cumulative preferred shares at $20 per share. During 1983 Agri Gold Ltd issued an additional 8,000 common shares at $11 per share and 2,000 preferred shares at $30 per share. 2019 profit was $355,000 and the Board declared $81,000 in dividends. Required: Prepare the Shareholders' Equity section of Agri Gold Ltds Balance Sheet at December 31, 1983.arrow_forward

- EllaJane Corporation was organized several years ago and was authorized to issue 4,000,000 shares of $50 par value 8% preferred stock. It is also authorized to issue 1,750,000 shares of $1 par value common stock. In its fifth year, the corporation has the following transactions: Mar. 1 Purchased 3,000 shares of its own common stock at $16 per share. Apr. 10 Reissued 1,500 shares of its common stock held in the treasury for $20 per share. Jun. 12 Reissued 1,500 shares of common stock at $14 per share. Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank Mar 1. Apr. 10 Jun. 12arrow_forwardTerrance Company reported $20,000 retained earnings at the beginning of the year. The company repurchased 200 shares at $50 per share during the year for the first time. Later, during the year the company sold 100 shares of these treasury shares for $45 per share. Terrance earned $15,000 net income during the year. The company also declared and paid dividends on 500 outstanding 4% preferred stock with $100 par value. Based on this information alone, compute the retained earnings balance at the end of the year. O $34,500 O $35,000 O $32,500 O $32,000 O $37,500arrow_forwardChoctaw Company completed the following transactions in Year 1, the first year of operation: 1. Issued 20,000 shares of $10 par common stock for $10 per share. 2. Issued 3,000 shares of $20 stated value preferred stock for $20 per share. 3. Purchased 1,000 shares of common stock as treasury stock for $12 per share. 4. Declared a $2,000 cash dividend on preferred stock. 5. Sold 500 shares of treasury stock for $14 per share. 6. Paid $2,000 cash for the preferred dividend declared in Event 4. 7. Earned cash revenues of $78,000 and incurred cash expenses of $41,000. 8. Closed revenue, expense, and dividend accounts to the retained earnings account. 9. Appropriated $8,000 of retained earnings. Required a-1. Prepare journal entries to record these transactions. a-2. Post the entries to T-accounts. b. Prepare a balance sheet as of December 31, Year 1.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education