ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

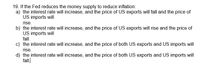

Transcribed Image Text:19. If the Fed reduces the money supply to reduce inflation:

a) the interest rate will increase, and the price of US exports will fall and the price of

US imports will

rise.

b) the interest rate will increase, and the price of US exports will rise and the price of

US imports will

fall.

c) the interest rate will increase, and the price of both US exports and US imports will

rise.

d) the interest rate will increase, and the price of both US exports and US imports will

fall.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Figure 1, Money Supply and Money Demand Money Supply. MS, Money Supply. MS Value of money, 1/P 1/P1 1/P2 MD Quantity of Money, M (billions of dollars) S900 S950 Ceteris paribus, if the Fed increases the money supply from MS1 to MS2, as indicated in the diagram above, it follows that, in the short run, there will be pressure on the price level, and pressure on nominal interest rates. Select one: O a. upward; upward O b. downward; upward O c. upward, downward O d. downward; downwardarrow_forwardSuppose the Fed sells $300 billion in government securities and the reserve ratio is 0.2 Calculate the resulting change in the money supply. Be certain to include a negative sign. change in the money supply: !$ billion Next, show the impact this open market operation will have on the graph in the short run. 10 Solow growth curve Short-run aggregate supply 8 7 50 3 2 Aggregate demand 0 0 8 9 10 Real GDP growth rate (%) Which statement describes the impact on inflation and real GDP the Fed's policy has in the short run? Inflation decreases and real GDP increases. Inflation decreases and real GDP decreases.arrow_forwardI would like to ask how to calculate c and darrow_forward

- Ceteris paribus, if the Fed was targeting the quantity of money supplied and money demand increased, the Fed would likely If the Fed was instead targeting interest rates and money demand increased, the Fed would likely O increase the money supply: decrease the money supply decrease the money supply: do nothing O increase the money supply: do nothing do nothing: increase the money supply do nothing: decrease the money supplyarrow_forwardAn increase in the money supply creates A. An excess supply of money that is eliminated by rising prices B. An excess supply of money that is eliminated by falling prices C. An excess demand for money that is eliminated by rising prices D. An excess demand for money that is eliminated by falling pricesarrow_forwardIf the Fed lowers interest rates, the value of the US dollar will___ which will lead do a(n)____ in spending on US goods. a) increase, decrease b) decrease , decrease c) decrease, increase d) increase, increasearrow_forward

- If the Fed decided to decrease the Federal Funds Rate, (*the overnight rate that they lend to other banks) This means they are attempting to.. O Decrease the supply of money O Slow the economy because inflation is escalating O React to the trade war with China and restrict imports O Increase the supply of moneyarrow_forwardSh 10 Economicsarrow_forwardExplain the Fed's policy tools and briefly describe how each works. The Fed uses its policy tools to _______. A. regulate the amount of money circulating in the United States by printing enough money each year for the purchase of consumer goods and services B. influence the exchange rate and the country's trade balance by adjusting the interest rate C. keep the government budget debt under $20 trillion by adjusting loans to Congress D. influence the interest rate and regulate the amount of money circulating in the United States by adjusting the reserves of the banking systemarrow_forward

- Suppose that the money supply increases by 20 percent. If there is no inflation, what does the quantity theory of money tell us must happen to real GDP? (Assume that the velocity of money is constant.) Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a It must increase by more than 20% It must increase by less than 20% C It stays the same d. It must increase by 20%arrow_forward16 A change in-----------leads to a change in-----------as well. a) the money supply indirectly; investment b) the interest rate; government purchases c) the money supply; government purchases d) consumption expenditures; the money supplyarrow_forwardAnswer the following questions in your own words. Start a new thread while replying. 1. What are the determinants of price elasticity of demand? Explain the determinants. 2. What is the difference between inelastic demand and elastic demand? Provide an example of each from real life. 3. Refer to the graph below: Price 22 20 + 18 +- 16 + 14 B 12 10 + 4 Demand +++ 100 200 300 400 500 600 700 800 900 Buaxtity From the graph above calculate: a. Price elasticity of demand from point A to point B (use the mid-point method). Is it an elastic situation or an inelastic situation? b. Price elasticity of demand from point B to point C (use the mid-point method). Is it an elastic situation or an inelastic situation?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education