Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

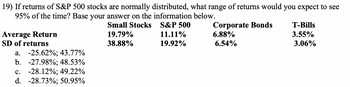

Transcribed Image Text:19) If returns of S&P 500 stocks are normally distributed, what range of returns would you expect to see

95% of the time? Base your answer on the information below.

Small Stocks

S&P 500

Corporate Bonds

T-Bills

Average Return

19.79%

11.11%

6.88%

3.55%

SD of returns

38.88%

19.92%

3.06%

a. -25.62%; 43.77%

b. -27.98%; 48.53%

c. -28.12%; 49.22%

d. -28.73%; 50.95%

6.54%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Report the beta of each stock and demonstrate a clear understanding of the concept of market efficiency.arrow_forwardReview the following market information: Current Stock Market Return 11.25% Current T-Bill Price $979.43 Historic T-Bill Average Return 2.80% Historic Stock Market Average Return 8.10% Stock Beta 1.23 What is the required return (rounded to two places)?arrow_forwardWhat is the required rate of return on a preferred stock with a $50 par value, a stated annual dividend of 12% of par, and a current market price of (a) $25, (b) $34, (c) $42, and (d) $63 (assume the market is in equilibrium with the required return equal to the expected return)? Do not round intermediate calculations. Round the answers to two decimal places. % % % %arrow_forward

- Consider the following annual closing prices of stock A, values of market index (S&P 500) and Treasury bills rate. A B C с D Date Stock A Prices (in $) Market Index Value Risk Free Rate (in %) 2 Period 1 119 3 Period 2 100 11829 11843 9639 88 131 12854 9580 11640 8469 11412 9115 10682 NOSAWNH 1 4 Period 3 Period 4 6 Period 5 7 Period 6 8 Period 7 9 Period 8 10 Period 9 11 Period 10 12 O 1.1 13 What is the value of CAPM beta for stock A? O 1.4666 O 1.8333 O2.0533 82 113 O 0.3666 65 109 95 113 1.48 1.76 1.64 1.2 1.43 1.36 1.3 1.72 1.71 1.77arrow_forwardPlease show working Please answer ALL OF QUESTIONS 1 AND 2A and 2B 1. Stock R has a beta of 1.2, Stock S has a beta of 0.35, the required return on an average stock is 9%, and the risk-free rate of return is 5%. By how much does the required return on the riskier stock exceed the required return on the less risky stock? Round your answer to two decimal places. 2. Harrimon Industries bonds have 6 years left to maturity. Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate of 8%. a. What is the yield to maturity at a current market price of: $759? Round your answer to two decimal places. ________% $1,083? Round your answer to two decimal places. _________% b. Would you pay $759 for each bond if you thought that a "fair" market interest rate for such bonds was 13%-that is, if rd = 13%? You would not buy the bond as long as the yield to maturity at this price is less than the coupon rate on the bond. You would buy the bond as long as the yield…arrow_forwardNonearrow_forward

- Financial analyst of Castle Investment Trust has gathered the following information on FRIVY Inc. and the market: Current market price per share of common stock €76.5Most recent dividend per share paid on common stock € 5.2Expected dividend payout rate 32%Expected return on equity (ROE) 12.5%Beta for the common stock 1.43Expected return on the market portfolio 13.40%Risk-free rate of return 4.20%Using the dividend discount model approach, estimate the cost of common equity for the company.arrow_forwardPlease complete in Excel (and show work): If returns of S&P 500 stocks are normally distributed, what range of returns would you expect to see 95% of the time? Base your answer on Figures 11.3 (left) and 11.4 (right).arrow_forwardBhupatbhaiarrow_forward

- Consider the following data State of Nature Prob. Stock A Return Boom 0.3 16.00% Normal 0.6 14.20% Recession 0.1 8.00% If the current rate on a treasury bill is 4%, what is the risk premium on the stock? (Note: treasury bill rate is generally regarded as risk free rate) Group of answer choices 10.12% 8.14% 14.12% 11.12%arrow_forwardA stock had the following year-end prices and dividends: Year 0 1 23 Multiple Choice O Price $ 60.55 72.46 62.98 73.50 What was the arithmetic average return for the stock? O O 12.61% 10.09% Dividend 9.02% $ 1.29 1.63 1.64arrow_forwardSuppose a market consists of four stocks. The number of shares outstanding for each stock as well as the stock prices in two consecutive days are as follows: Stock A Stock B Stock C Stock D Shares outstanding 200 1000 400 3000 I $5 $30 $100 $40 Ро $15 $25 $80 $50 a) Compute the percentage increase in the price-weighted index for this market. b) Compute the percentage increase in the value-weighted index for this market. P₁arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education