FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

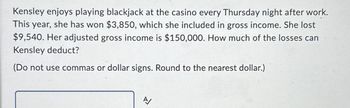

Transcribed Image Text:Kensley enjoys playing blackjack at the casino every Thursday night after work.

This year, she has won $3,850, which she included in gross income. She lost

$9,540. Her adjusted gross income is $150,000. How much of the losses can

Kensley deduct?

(Do not use commas or dollar signs. Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Dorothie paid the following amounts during the current year: Interest on her home mortgage (pre-12/16/17) $9,250 Service charges on her checking account 48 Credit card interest 168 Auto loan interest 675 Interest from a home equity line of credit (HELOC) 2,300 Interest from a loan used to purchase stock 1,600 Credit investigation fee for loan 75 Dorothie's residence has a fair market value of $250,000. The mortgage is secured by the home at the time of purchase and has a balance of $180,000. Dorothie used the same home to secure her HELOC with a balance of $50,000. Dorothie used the proceeds of her HELOC to pay for college and to buy a new car. Dorothie has $1,000 of net investment income. Compute Dorothie's interest deduction in the following scenarios: a. Calculate Dorothie's interest deduction (on Schedule A) for 2021. b. Same as part a, and Dorothie used the HELOC proceeds to add a new bedroom to her home. c. Same as part a, but Dorothie's home is valued at $1,200,000 and her…arrow_forwardDonald Jefferson and his wife, Maryanne, live in a modest house located in a Los Angeles suburb. Donald has a job at Pittsford Cast Iron that pays him $50,000 annually. In addition, he and Maryanne receive $2,500 interest from bonds that they purchased 10 years ago. To supplement his annual income, Donald bought rental property a few years ago. Every month he collects $3,500 in rent from all of the property he owns. Maryanne manages the rental property, and she is paid $15,000 annually for her work. During 2015, Donald had to have the plumbing fixed in the houses that he rents as well as the house in which he and Maryanne live. The plumbing bill was $1,250 for the rented houses and $550 for the Jeffersons’ personal residence. In 2015, Donald paid $18,000 for mortgage interest and property taxes—$12,650 was for the rental houses, and the remaining $5,350 was for the house occupied by him and his wife. The couple has three children who have graduated from medical school and now are…arrow_forwardRhett made his annual gambling trip to Uwin Casino. On this trip Rhett won $430 at the slots and $1,380 at poker. Also this year, Rhett made several trips to the racetrack, but he lost $790 on his various wagers. What amount must Rhett include in his gross income?arrow_forward

- Frankie purchased a house for $185,000 . He put 20% of the purchase down as a down payment. He financed the house for 4.25% for 15 years. The annual taxes are $1250 and the annual insurance is $1056. What is his monthly principal, interest, tax and insurance (PITI) mortgage payment.arrow_forwardJessica is a professional consultant. She agrees to consulting services for Joe for $2,000. After she finishes, Joe does not have cash to pay Jessica, but he has an antique, collectible baseball card with a fair market value of $2,000 that he gives her to satisfy the payment. The baseball card cost Joe $500. How much should Jessica include in her gross income?arrow_forwardJimmy has fallen on hard times recently. Last year he borrowed $343,000 and added an additional $73,000 of his own funds to purchase $416,000 of undeveloped real estate. This year the value of the real estate dropped dramatically, and Jimmy’s lender agreed to reduce the loan amount to $316,000. For each of the following independent situations, indicate the amount Jimmy must include in gross income: (Leave no answer blank. Enter zero if applicable.) Problem 5-60 Part-c (Algo) c. The real estate is worth $277,800 and Jimmy has $47,200 in other assets but no other liabilities. Amount Included in Gross Incomearrow_forward

- Bill recently had his truck slide off a gravel road and strike a tree. Bill's vehicle suffered $17,500 in damage. The truck has a book value of $40,000. Bill carried collision insurance with a $500 deductible. How much will Bill be reimbursed by his policy?arrow_forwardAt the start of the year, Josh has assets worth $500,000. He has debts worth $350,000. Over the year, he earns $200,000 of which he pays $50,000 in tax. He spends $50,000 on goods and services. He pays interest on his debt at 10% of $350,000. He pays off $30,000 of his debts.His assets go up in value by $25,000. What is his net worth at the end of year.arrow_forwarda mother earned $15000.00 from royalties on her cookbook. She set aside 20% of this for a down payment for a new home. The balance will be used for her son's future education. She invested a portion of the money in a bank certificate of a deposit (cd account) that earns 4% and the remainder in a savings bond that earns 7%. IF the total interest earned after one year is $720.00, how much money was invested at each rate?arrow_forward

- Gerry likes driving small cars and buys nearly identical ones whenever the old one needs replacing. Typically, he trades in his old car for a new one costing about $15,000. A new car warranty covers all repair costs above standard maintenance (standard maintenance costs are constant over the life of the car) for the first two years. After that, his records show an average repair expense (over standard maintenance) of $2500 in the third year (at the end of the year), increasing by 50 percent per year thereafter. If a 30 percent declining-balance depreciation rate is used to estimate salvage values and interest is 9 percent, how often should Gerry get a new car? Click the icon to view the table of compound interest factors for discrete compounding periods when i = 9%. Gerry should get a new car every years, which has the (Round to the nearest whole number as needed.) EAC of $arrow_forwardLeo bought a used car for $4,500. While in class at George Brown, his car was damaged by an unidentified automobile. The damage to the vehicle was estimated at $1,000. If the cash value of Leo's car at the time of the loss is $3,000, how much money would Leo receive if he files a claim for damages? Assume he has an Ontario Automobile Insurance policy with a $500 deductible and all perils coverage. $3,000 $2,500 $1,000 $500 None of the above. He's not covered.arrow_forwardNoor Patel has had a busy year! She decided to take a cross-country adventure. Along the way, she won a new car on The Price Is Right (valued at $14,600) and $500 on a scratch-off lottery ticket (the first time she ever played). She also signed up for a credit card to start the trip and was given a sign-up bonus of $100. How much from these will she have to include in her federal taxable income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education