FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

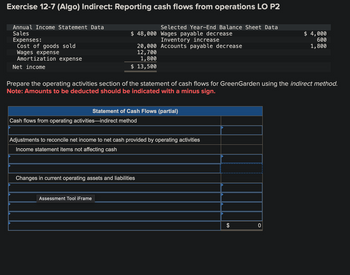

Transcribed Image Text:Exercise 12-7 (Algo) Indirect: Reporting cash flows from operations LO P2

Selected Year-End Balance Sheet Data

Wages payable decrease

Annual Income Statement Data

Sales

Expenses:

Cost of goods sold

Wages expense

Amortization expense

Net income

$ 48,000

Inventory increase

20,000 Accounts payable decrease

12,700

1,800

$ 13,500

Prepare the operating activities section of the statement of cash flows for GreenGarden using the indirect method.

Note: Amounts to be deducted should be indicated with a minus sign.

Statement of Cash Flows (partial)

Cash flows from operating activities-indirect method

Adjustments to reconcile net income to net cash provided by operating activities

Income statement items not affecting cash

Assessment Tool iFrame

Changes in current operating assets and liabilities

$ 4,000

600

1,800

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cash Flows from Operating Activities—Indirect Method Staley Inc. reported the following data: Net income $446,400 Depreciation expense 59,100 Loss on disposal of equipment 39,800 Increase in accounts receivable 27,200 Increase in accounts payable 10,700 Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Staley Inc. Statement of Cash Flows (partial) Cash flows from operating activities: $ Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: Net cash flow from operating activities $arrow_forwardProvide tablearrow_forwardKennedy, Inc., reported the following data: Net income $122,135 Depreciation expense 12,690 Loss on disposal of equipment (8,856) Gain on sale of building 18,988 Increase in accounts receivable 8,409 Decrease in accounts payable (2,837) Prepare the operating activities section of the statement of cash flows using the indirect method. Use the minus sign to indicate cash outflows, a decrease in cash, cash payments, or any negative adjustments. Kennedy, Inc.Statement of Cash Flows Cash flows from (used for) operating activities: $- Select - Adjustments to reconcile net income to net cash flows from (used for) operating activities: - Select - - Select - - Select - Changes in current operating assets and liabilities: - Select - - Select -arrow_forward

- 1.2 Hampton Company reports the following information for its recent calendar year. Income Statement Data Selected Year-End Balance Sheet Data Sales $ 77,000 Accounts receivable increase $ 7,000 Expenses: Inventory decrease 3,000 Cost of goods sold 41,000 Salaries payable increase 800 Salaries expense 10,000 Depreciation expense 8,000 Net income $ 18,000 Required:Prepare the operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)arrow_forwardHamburger Heaven's income statement for the current year and selected balance sheet data for the current and prior years ended December 31 are presented below. Income Statement Sales Revenue $1,860 Expenses: Cost of Goods Sold 850 Depreciation Expense Salaries and Wages Expense Rent Expense 150 450 200 Insurance Expense 75 Interest Expense Utilities Expense 45 Net Income 35 Selected Balance Sheet Accounts Current Year Prior Year 72 Inventory Accounts Receivable 55 355 400 Accounts Payable Salaries/Wages Payable Utilities Payable Prepaid Rent Prepaid Insurance 225 260 39 25 25 10 14 TIP: Prepaid Rent decreased because the amount taken out of Prepaid Rent (and subtracted from net income as Rent Expense) was more than the amount paid for rent in cash during the current year. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)arrow_forwardCreate a statement of cash flow for the current year using Wright Co's income statement and balance sheet. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Income Statement: Current Year Revenue 4,742.00 Cost of Goods Sold 2,323.58 Gross Margin 2,418.42 SG&A 524.00 EBITDA 1,894.42 Depreciation Expense 504.00 EBIT 1,390.42 Interest Expense 164.20 EBT 1,226 Taxes 429.18 Net Income 797.04 Dividends 410 Addition to Retained Earnings 387.04 Balance Sheet: Assets Prior Year Current Year Cash 800 ???? Accounts Receivables 400 452.00 Inventory 300 358.00 Total Current Assets 1,500 ???? Net Fixed Assets 5,000 5,211.00 Total Asset 6,500 ???? Liabilities and Equity Prior Year Current Year Accounts Payable 300 320.00 Notes Payable 1,000 919.00 Total Current Liabilities 1,300 1,239.00 Long-Term Debt 2,000 2,365.00 Total Liabilities 3,300 ???? Common Stock and Paid-in Capital 2,200 2,200…arrow_forward

- Cash Flows from Operating Activities—Indirect Method Staley Inc. reported the following data: Net income $298,400 Depreciation expense 59,600 Loss on disposal of equipment 24,800 Increase in accounts receivable 13,200 Increase in accounts payable 11,800 Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments.arrow_forwardUsing the Exhibit below, assume that the balance of Accounts Payable was $60,000 at the beginning of the current year. Furthermore, assume that the balance of Accounts Payable is $65,000 at the end of the current year. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of accounts payable on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on disposal of…arrow_forwardPrepare the operating activities section of the statement of cash flows using the indirect method. Note: Amounts to be deducted should be indicated with a minus sign. The following income statement and additional year-end information is provided. SONAD COMPANY Income Statement For Year Ended December 31 Sales $ 2,189,000 Cost of goods sold 1,072,610 Gross profit 1,116,390 Operating expenses Salaries expense $ 299,893 Depreciation expense 52,536 Rent expense 59,103 Amortization expenses—Patents 6,567 Utilities expense 24,079 442,178 674,212 Gain on sale of equipment 8,756 Net income $ 682,968 Accounts receivable $ 46,450 increase Accounts payable $ 12,900 decrease Inventory 13,500 increase Salaries payable 5,150 decreasearrow_forward

- Staley Inc. reported the following data: Net income Depreciation expense Loss on disposal of equipment Increase in accounts receivable Increase in accounts payable Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. $485,300 57,200 30,500 22,400 12,100 Staley Inc. Statement of Cash Flows (partial) Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: Net cash flow from operating activitiesarrow_forwardCalculate the operating cash index for the below quarter.arrow_forwardThe comparative balance sheets for Layton Company show these changes in noncash current asset accounts: Accounts receivable decrease: $83,700, Prepaid expenses increase: $27,180, and Inventories increase: $29,290. Compute net cash provided by operating activities using the indirect method assuming that net income is $180,980.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education