FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:13

S

ch

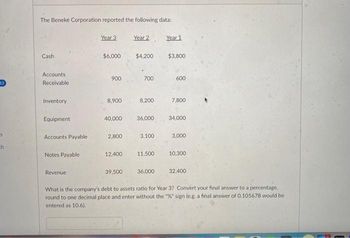

The Beneke Corporation reported the following data:

Cash

Accounts

Receivable

Inventory

Equipment

Accounts Payable

Notes Payable

Revenue

Year 3

$6,000

900

8,900

40,000

2,800

12,400

39,500

Year 2

$4,200

700

8,200

36,000

3,100

11.500

36,000

Year 1

$3,800

600

7,800

34,000

3,000

10,300

32,400

What is the company's debt to assets ratio for Year 3? Convert your final answer to a percentage.

round to one decimal place and enter without the "%" sign (e.g. a final answer of 0.105678 would be

entered as 10.6).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Statement of Financial Position Cash 10,000 Accounts payable $15,000 Accounts receivable 70,548 Notes payable 35,548 Inventory 20,000 Current liabilities $50,548 Current assets $100,548 Long-term debt 200,000 Fixed assets 500,000 Equity $350,000 Total assets $600,548 Total liabilities & equity $600,548 Questions: What are the three components of a credit policy? Does the company’s current credit policy satisfy these three components? What are the effective annual costs for the two proposed credit policy alternatives? If the average borrowing rate for the company’s customers is 15%, will these credit policies be attractive to these customers?arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forwardPrepare a balance sheet and income statement for Builtrite Corporation from the following information. inventory $6,500 Common stock 45,000 Cash 16,550 General & admin expenses 1,350 Notes payable 600 Interest expense 900 Depreciation expense 500 Net sales 12,800 Accounts receivable 9,600 Accounts payable 4,800 Long-term debt 55,000 Cost of goods sold 5,750 Buildings and equipment 122,000 Taxes 1,440 Accumulated depreciation 34,000 Retained earnings (___)arrow_forward

- Excerpts from Sydner Corporation's most recent balance sheet appear below: Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Total current liabilities Year 2 Year 1 $ 140 $ 160 210 230 240 200 10 10 $ 600 $ 600 $360 $ 330 Sales on account in Year 2 amounted to $1,390 and the cost of goods sold was $900. The accounts receivable turnover for Year 2 is closest to:arrow_forwardThe following data is available for Quick Serve Trading Ltd. Required: a) Calculate the operating cycle and the cash cycle b) Interpret and explain the outcomesarrow_forwardA company has $1,364 in inventory, $4,809 in net fixed assets, $652 in accounts receivable, $290 in cash, $610 in accounts payable, and $5,404 in equity. What is the company's long-term debt? Multiple Choice O $1,711 $1,138 O$1,280 $1,669arrow_forward

- The current asset section of the Excalibur Tire Company's balance sheet consists of cash, marketable securities, accounts receivable, and inventory. The balance sheet revealed the following: Inventory Total assets Current ratio Acid-test ratio Debt to equity ratio $ 880,000 $ 3,200,000 1. Current assets 2. Shareholders' equity 3. Long-term assets 4. Long-term liabilities 2.50 1.50 1.5 Required: Determine the following balance sheet items:arrow_forwardplease give me answerarrow_forwardNewark Company has provided the following information:Cash sales, $600,000Credit sales, $1,500,000Selling and administrative expenses, $480,000Sales returns and allowances, $105,000Gross profit, $1,510,000Increase in accounts receivable, $70,000Bad debt expense, $48,000Sales discounts, $58,000Net income, $1,030,000How much are Newark's net sales?how would i find net sales without revenue? I think it what I am trying to findarrow_forward

- What is the debit to asset ratio?arrow_forwardThe current assets and current liabilities sections of the balance sheet of Keane Co. appear as follows. Cash $18,000 Accounts payable $28,000 Accounts receivable $39,000 Notes payable 14,000 Less: Allowance for doubtful accounts 2,000 37,000 Unearned revenue 3,000 Inventory 62,000 Total current liabilities $45,000 Prepaid expenses 6,000 Total current assets $123,000 The following errors in the corporation’s accounting have been discovered: 1. Keane collected $4,400 on December 20, 2017 as a down payment for services to be performed in January, 2018. The company’s controller recorded the amount as revenue. 2. The inventory amount reported included $3,200 of merchandise that had been received on December 31, 2017 but for which no purchase invoices had been received or entered. Of this amount, $1,800 had been received on consignment; the remainder was purchased f.o.b. destination, terms 2/10, n/30.…arrow_forwardCondensed financial data are presented below for the Tulsa Corporation: Accounts receivable Inventory C. d. Total current assets Total assets Current liabilities Long-term liabilities Sales Cost of goods sold Interest expense Net income Tax rate 2021 $277,500 310,000 675,000 800,000 700,000 250,000 200,000 77,500 75,000 1,640,000 985,000 10,000 130,000 25% 2020 $230,000 250,000 565,000 The profit margin used to calculate return on assets for 2021 is (rounded): a. b. 8.9% 16.3% 17.2% 18.3%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education