Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

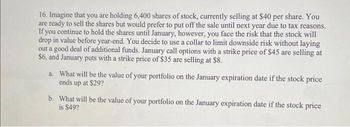

Transcribed Image Text:16. Imagine that you are holding 6,400 shares of stock, currently selling at $40 per share. You

are ready to sell the shares but would prefer to put off the sale until next year due to tax reasons.

If you continue to hold the shares until January, however, you face the risk that the stock will

drop in value before year-end. You decide to use a collar to limit downside risk without laying

out a good deal of additional funds. January call options with a strike price of $45 are selling at

$6, and January puts with a strike price of $35 are selling at $8.

a. What will be the value of your portfolio on the January expiration date if the stock price

ends up at $29?

b. What will be the value of your portfolio on the January expiration date if the stock price

is $49?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 2. You have just purchased 200 shares of a biotechnology stock at $15 per share. You will sell the stock when its market price doubles. If you expect the stock price to increase 12% per year, how long do you expect to wait before selling the stock?arrow_forwardStock options are one of the riskiest and potentially lucrative financial instruments available to investors. Stock options give the investor the right to buy or sell a particular stock for a stated price within a specified period of time. For example, on December 20th, an investor who believed that the stock of Apple Computer, Inc. was underpriced at $171.54, could buy an option to purchase 100 shares of Apple for $176.00 per share at any time until December 31st. The price of the option was $2.60 per share. Assume the investor purchased the option for $260.00 and Apple stock rose to $179.85 on Dec 23rd. Further, assume the investor exercised the option and bought the stock for $176.00 per share on Dec 23rd and immediately sold the stock for $179.85 per share. What rate of return did the investor make in 3 days from Dec 20th to the 23rd? (Round the final answer to two decimal places.) The rate of return is _________%.arrow_forwardOn July 1, an investor holds 50000 shares of a certain stock. The market price is $50 per share. The investor is interested in hedging against movements in the market over the next month and decides to use the September Mini S&P 500 futures contract. The index is currently 1500 and one contract is for delivery of $50 times the index. The beta of the stock is 1.5. What strategy should the investor follow? Under what circumstances will it be profitable?arrow_forward

- Please correct answer and don't use hand ratingarrow_forwardSuppose you think company Y’s share is going to appreciate substantially in value next year. The current share of company Y is $150. One call option of this company’s share expiring in one year is currently available at $15 with an exercise price of $150. With $150,000 to invest, you are considering three investment strategies: a. Invest all $150,000 b. Invest all $150,000 in options c. Buy 5,000 options and invest the remaining amount in treasury bills paying 5% annually What is the value of your portfolio and your rate of return for each strategy for the following share prices one year from now? Summarise your results in a table and draw a graph showing return for each alternative (Hint: show return on Y axis and share price on X axis). Share prices $130, $140, $150, $160 and $170arrow_forwardSuppose you think AppX stock is going to appreciate substantially in value in the next year. Say the stock's current price, SO, is $50, and a call option expiring in one year has an exercise price, X, of $50 and is selling at a price, C, of $9. With $18, 900 to invest, you are considering three alternatives. a. Invest all $18, 900 in the stock, buying 378 shares. b. Invest all $18,900 in 2, 100 options (21 contracts). c. Buy 100 options (one contract) for $900, and invest the remaining $18,000 in a money market fund paying 6% in interest over 6 months (12% per year). What is your rate of return for each alternative for the following four stock prices in 6 months? (Leave no cells blank - be certain to enter "0" wherever required. Negative amounts should be indicated by a minus sign. Round the "Percentage return of your portfolio (Bills + 100 options)" answers to 2 decimal places.) The total value of your portfolio in six months for each of the following stock prices is: The percentage…arrow_forward

- On January 1 2021 you buy shares of an s&p index ETF at $370 each. You are concerned about the possible drop in value of the large cap equities before year end. The S&P 500 currently is at $4,669. You decide to buy an at-the – money put option on the s&p 500 index to insulate your portfolio from a decline in equity prices. Each put ( assume one put per ETF share)is prived at $56 and expires on 31 december. If the s&p is at $4680 on 31 december an dyour ETF position is priced at $468, what is the annualized percent return on entire investment in the ETF, including the putarrow_forwardIn the coming week, the outcomes from a class action lawsuit will result in a significant shock to the price of "M", which may be positive or negative. Thus, you decide to follow a Straddle strategy using a call option and a put option with strike 105, which have premiums of 16 and 9, respectively. If the stock price is 87 today, what is the total profit of your portfolio? Keep in mind that each call option contract controls 100 shares. Please round your answer to the nearest three decimals.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education