FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

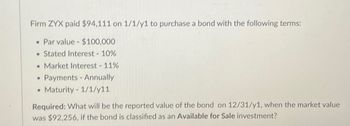

Transcribed Image Text:Firm ZYX paid $94,111 on 1/1/y1 to purchase a bond with the following terms:

• Par value - $100,000

⚫ Stated Interest -10%

• Market Interest - 11%

•

•

Payments - Annually

Maturity 1/1/y11

Required: What will be the reported value of the bond on 12/31/y1, when the market value

was $92,256, if the bond is classified as an Available for Sale investment?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Dhapaarrow_forwardIf the market rate of interest is 7%, the price of 6% bonds paying interest semiannually with a face value of $500,000 will be O a. greater than or less than $500,000, depending on the maturity date of the bonds O b. less than $500,000 c. greater than $500,000 O d. equal to $500,000arrow_forwardIdentify the types of bond being referred to in the following case: A P5,000,000-face value bond. It requires annual principal payment of P500,000 for ten years. It is secured with the issuing entity’s equipment.a. Straight; Fixed-rated; Junkb. Straight; Zero-coupon; Collateral Trustc. Serial; Fixed-rated; Junkd. Serial; Zero-coupon; Equipment Trustarrow_forward

- A 14-year, $1,000 par value Fingen bond pays 6% interest annually (assume semi- annual payments). The price of the bond is $1,100 and the market's required yield to maturity on a comparable-risk bond is 5.50%. a. Compute the bonds yield to maturity. b. Determine the value of the bond to you, given your required rate of return (the YTM on a comparable-risk bond). c. Should you purchase the bond? a. b. Coupon rate Par (FV) Years (n) m PMT PV (price) YTM Coupon rate Par (FV) Years (n) m PMT PV (price) YTM 6.0% $1,000 14 2 $30 Calculation $1,100 6.0% $1,000 14 2 $30 Calculation Note: if you want PV to be a positive number, you must use a minus sign for both pmt and FV 5.50%arrow_forwardABC Corporation plans to issue a 9%, 10-year, P5,000,000 face value bonds. It will incur P500,000 as underwriting fee. What is the cost of the bond based on the following methods? 1. Yield to maturity formula 2.Trial and error method (closest percent, 3 decimal places)arrow_forwardAssume that a bond is issued with the following characteristics: Date of bonds: January 1, 2023; maturity date: Dec. 31, 2027; face value: $200,000; Coupon interest rate: 10 percent paid semiannually; market interest rate: 12 percent; issue price: $185,280; bond discount is amortized using the effective interest method of amortization. What is the amount of bond discount amortization for the June 30, 2023, adjusting entry? A) $559 B) $1,117 C) $10,000 D) $11,117arrow_forward

- The Sisyphean Company has a bond outstanding with a face value of $1,000 that reaches maturity in 8 years. The bond certificate indicates that the stated coupon rate for this bond is 8% and that the coupon payments are to be made semiannually. Assuming the appropriate YTM on the Sisyphean bond is 11.8%, then the price that this bond trades for will be closest to: OA. $968 OB. $1,129 OC. $807 D. $645arrow_forwardHelp pleasearrow_forwardBlueLtd. Issued a $1,164,000, 10-year bond dated January 1, 2020. The bond was sold to yield 12% effective interest. The bond paid 10% interest on January 1 and July 1 each year. The company's year-end was December 31, and Blue followed IFRS. Using 1 factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for the bond, and any discount or premium on the bond. Click here to view the tactor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITYOF 1 (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answers to 0 decimal places, e.g. 5,275.) Proceeds from sale of bond : on bond Prepare the journal entries for above transactions. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the…arrow_forward

- Marwick Corporation issues 10%, 5 year bonds with a par value of $1,050,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 8%. What is the bond's issue (selling) price, assuming the following Present Value factors: n= 5 10 5 10 i= 10% 5% 8% 4% Multiple Choice O Present Value of an Annuity 3.7908 7.7217 3.9927 8.1109 C $624,178 $1,475,822 $1.135.202 Present value of $1 0.6209 0.6139 0.6806 0.6756arrow_forwardAll parts sirplsarrow_forwardIf a Company plans to issue $1,000,000 of 6% bonds at a time when the market rate for similar bonds is 3%, the bonds are to sell at: A: The face amount B: Premium C: Discount D: None of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education