EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

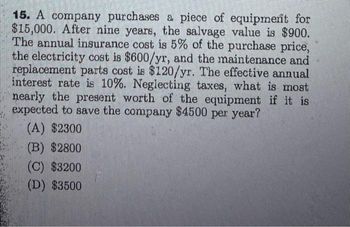

Transcribed Image Text:15. A company purchases a piece of equipment for

$15,000. After nine years, the salvage value is $900.

The annual insurance cost is 5% of the purchase price,

the electricity cost is $600/yr, and the maintenance and

replacement parts cost is $120/yr. The effective annual

interest rate is 10%. Neglecting taxes, what is most

nearly the present worth of the equipment if it is

expected to save the company $4500 per year?

(A) $2300

(B) $2800

(C) $3200

(D) $3500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it is expected to generate net after-tax operating cash flows, including depreciation, of $6,250 per year. The truck has a 5-year expected life. The expected salvage values after tax adjustments for the truck are given here. The company’s cost of capital is 10%. Should the firm operate the truck until the end of its 5-year physical life? If not, then what is its optimal economic life? Would the introduction of salvage values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project?arrow_forward16. A company purchases a piece of construction equipment. The expected income is SAR 3,100 annually for its useful life of 15 years. Expenses are estimated to be SAR 355 annually. If the purchase price is SAR 25,000 and there is no salvage value, what is the rate of return, neglecting taxes? (select the closest answer) a) 5.2% b) 6.4% c) 6.8% d) 7.0%arrow_forwardAuto Detailers is buying some new equipment at a cost of $188,900. This equipment will be depreciated on a straight-line basis to a zero book value its eight-year life. The equipment is expected to generate net income of $11,000 a year for the first four years and $24,000 a year for the last four years. What is the average accounting rate of return? A) 18.09 percent B) 15.48 percent C) 18.53 percent D) 17.76 percent E) 22.68 percentarrow_forward

- Hello. Need help with the solution to question. Calculate the annual straight-line depreciation for a machine that costs $30,000 and has installation and shipping costs that total $2,000. The machine will be depreciated over a period of 15 years. The company’s marginal tax rate is 40 percent. Round your answer to the nearest dollar.arrow_forwardEsc You consider purchasing a new piece of equipment (7yr MACRS property) for your manufacturing process for $120,000. The equipment has a 6-year useful life and no salvage value. The equipment is expected to generate an additional $40,000 of net income before taxes and depreciation each year by using this upgraded system. The combined federal and state income tax rate= 35%. Annual inflation = 4%. a. Fill in the following table assuming MACRS depreciation rates Year 46°F Rain showers 0 1 F1 2 O 2 3 4 5 Pretax income 6 MACRS Taxable Depreciation income F2 - F3 + F4 Ⓡ b. If your MARR = 12%, should you purchase this system based on your real after-tax income? Why or why not? F5 8 C B Tax owed F6 Q Search G After tax income F7 Ca 7 F8 O Inflation adjustment factor O F9 ala LG F10 Real after tax income 0 A I THE F11 - 0 1 asod F12 + Prt Sc ScrLk Post-it sod Ins Post-it Del Backspace Post-it PgUp Home asod> Post-it Mumi 1-10 PgOn End Pause Break 11-15 11-15 Carrow_forwardD1. Accountarrow_forward

- What is the aftertax salvage value?arrow_forward4. The Scampini Supplies Company recently purchased a new delivery truck. The new truck has an after-tax cost of $22,500, and it is expected to generate after-tax cash flows, of $6,250 per year. The truck has a 5- year expected life. The expected year-end abandonment values (after-tax salvage values) for the truck are given here. The company's WACC is 10%. Year Annual After-Tax Cash Flow ($22,500) 6,250 6,250 6,250 6,250 6,250 0 1 2 3 5 After-Tax Abandonment Value $17,500 14,000 11,000 5,000 0 a. .Should the firm operate the truck until the end of its 5-year physical life; if not, what is the truck's optimal economic life? b. Would the introduction of abandonment values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project? Explain.arrow_forward5. Suppose you are considering purchasing a machine or leasing one. The machine has a full economic life of 15 years, and is depreciated linearly to zero. There is no salvage value. For the same machine, you can buy it for $200,000, or lease it for $13,942 per year. Assume a tax rate of 27% and an after-tax cost of debt of 13%. Show work for all parts requiring computation. What is the after-tax lease payment (annual)? What is the depreciation tax shield (annual)? What is the incremental cash flow in absolute value (annual)? What is the net advantage to leasing? Should you lease or buy the machine? Why?arrow_forward

- for this equipment. 0. Calculating Salvage Value Consider an asset that costs $635,000 and is depreciated straight-line to zero over its eight-vear tax life. The asset is to be used in a five-year project; at the end of the project, the asset can be sold for S105,000. If the relevant tax rate is 22 percent, what is the aftertax cash flow from the sale of this asset? LO 2arrow_forward(Ignore income taxes in this problem.) Your Company’s cost of capital is 3%, It is contemplating the purchase of equipment to replace equipment that it is currently leasing. The useful life of the equipment is seven years. What is the net present value of purchasing the equipment? Cost of equipment $650,000 Current lease payments $95,000 Working capital needed $80,000 Repair end of year 2 $12,000 Repair end of year 4 $17,000 Salvage value $125,000 Group of answer choices $1,828 $2,103 $3,947 ($62,937) $2,942arrow_forwardhello Sir Please Need Answer of this General Accounting Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning