FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

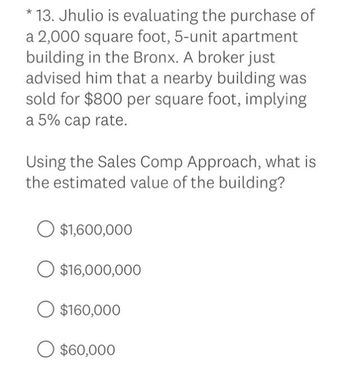

Transcribed Image Text:* 13. Jhulio is evaluating the purchase of

a 2,000 square foot, 5-unit apartment

building in the Bronx. A broker just

advised him that a nearby building was

sold for $800 per square foot, implying

a 5% cap rate.

Using the Sales Comp Approach, what is

the estimated value of the building?

$1,600,000

O $16,000,000

$160,000

O $60,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- OLA #10.3 Dylan purchased two trucks for his warehouse for a total of $54,000. This investment saved him $14,000 every year for 9 years. At the end of year 9, he sells both the trucks for a total of $8,500. A. What is the Net Present Value (NPV) of the investment if the required rate of return is 7%? B. Does the investment meet the required rate of return? Yes No Please reply using algebra with detailsarrow_forwardCo. has an investment opportunity (Project B) that requires a cash outlay of $18,000 today. They estimate that they will receive in exchange $6,200 in year 1, $6,500 in year 2, and $8,200 in year 3. Our Co 10. Marvelous me a) What are the IRR and the NPV of Project B? b) If the discount rate is 10%, would you invest in Project B? c) Let's imagine that we had a second project (Project B) that has an IRR of 18%. If the crossover rate between these two projects is 13%, which project would you choose when the appropriate discount rate is below that crossover rate?arrow_forward10arrow_forward

- Here is what we know: We are looking at purchasing a Townhome in Gvegas Purchase price $190,000 Yearly taxes $1,400/yr, but if it's in the city limits, then add another $800/yr Yearly Home Owners Insurance $ 1,200/yr HOA (Home Owners Association) $900/yr Projected repair costs $900/yr Vacancy Rate 1 months rent Things to consider.... What if the AC unit goes out? • Vacancy Rates (What is that?) • Vetting Renters (What does that mean?) Tax benefits (Are there any?) Depreciation (How so) ⚫ Appreciation (How does it work)arrow_forwardam. 124.arrow_forwardYou would like to buy a new car. The car costs will be $81 500. If you can earn 12% per annum, how much do you have to invest today to buy the car in three years? Select one: a. None of the given answers is correct. b. $58 244.14 c. $58 145.32 d. $58 010.09arrow_forward

- 1. Your client has been offered the opportunity to invest in a project which will pay $1,000 per month at the end of months 1 to 10 and $2,000 per month at the end of months 21 to 30. The interest rate over the period of the investment is a nominal rate of 8% p.a. If your client can buy the investment today for $25,000 would you recommend that this is a good investment? Why or why not?arrow_forwardWhat is the internal rate of return for this rental condominium investment?arrow_forwardA real estate development company is considering the purchase of a new piece parcel of land in manhattan that will cost $34,000,000. The land will generate $6,500,000 of rent each year for the next 20 years. what is the IRR for this new investment? NOTE: enter amount to two decimal (e.g., 78.76 or 40.00) IRR= ______ %arrow_forward

- Alia wants to open up a sandwich shop in Amman. She collects data on the initial cost, operating and maintenance cost, yearly benefit (revenue from sandwich sales), and salvage value of the equipment she buys for the sandwich shop when she closes down the business in 5 years. Determine the best alternative using the annual cash flow analysis method for an interest rate of 8%. Do nothing is a possible alternative. Alt B $45,000 $25,000 $10,000 $4,000 $18,000 $13,000 $3,000 $6,000 Alt A First Cost Benefit per yr O&M annua st Salvage Value Life in years 5 (35 Points) Alt C $20,000 $1,900 $9,000 $4,600 Alt A $45,000 $10,000 and $18,000 Alt B $25,000 $4,000 $13,000 Alt C $20,000 $1.900 $9,000 First Cost Benefit per year Operations maintenance cost Salvage Value Life in years $3,000 $6.000 $4,600arrow_forwardSolve what is asked.arrow_forwardon Sami buys a used truck for $1,500. After using it for 3 years, he expects to sell it for $800. If i = 7.5% per year, the future worth in dollars is: Select one: O O a. $1,500 – $700(P/F,7.5%,3) b. $ 700 + 10% of $700 c. $700 - $1,500 (F/P,7.5%,3) d. $1,500 (F/P,7.5%,3) - 800arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education