Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:on

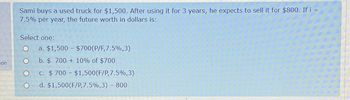

Sami buys a used truck for $1,500. After using it for 3 years, he expects to sell it for $800. If i =

7.5% per year, the future worth in dollars is:

Select one:

O

O

a. $1,500 – $700(P/F,7.5%,3)

b. $ 700 + 10% of $700

c. $700 - $1,500 (F/P,7.5%,3)

d. $1,500 (F/P,7.5%,3) - 800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Dan is planning to buy a new home that costs $130000 Find the following if Dan make a 5% downpayment. How much will Dan's down payment be? (Round to the nearest cent) How much will Dan owe after he makes the down payment? (Round to the nearest cent)arrow_forwardA. If i buy a car from a dealership for $27000 with 2.5% paying monthly for a total of 3 years how much will i owe? B. If i buy a car from the dealership with 2% APR for 60 months with sticker price of $30,000 how much will i owe? C. If i buy the car for 10,000 with 10% interest for 6 years how much would it cost. Which option is better?arrow_forwardAmr Al Kaitoob wants to buy the house in 3 years (at end of Year 3) and he is currently saving for down payment. He plans to save $5,000 at the end of the first year (at end of Year 1). Amr anticipates his annual savings will increase by 10% annually thereafter. His expected annual return is 7%. Calculate the amount of money that Amr will have for the down payment at the end of Year 3.arrow_forward

- a. In the next five years, Jerome is planning to buy a specialized piece of machinery to replace the old one in his restaurant. He estimates that the machine would cost $250 000. Given that the existing interest rate is 8 %how much money should he invest now? b. He has an option to invest in a fixed deposit account at an interest rate of 10%How much should he invest at the beginning of each year for the next five (5) years in order to achieve his goal? c. If the interest rate increases from 10% to 12%, by how much would the annual investment in part (b) above change ? d. You inherited $ 6,000 from your grandfather . You want to buy a piece of equipment costing $ 7,000 two years from now . Will you have enough money to buy the equipment if you deposit this money in an account paying 8 % compounded semi -annually ?arrow_forwardAllison has a golden goose that will lay an egg every year until forever. The first egg will be out next year, and each egg is worth $500. Allison's friend, Eric, offers a price to buy the golden goose from Allison today. The interest rate is 10%. From the cost-benefit analysis, under which of the following offers would Allison be willing to sell the goose to Eric? O A $4,500 OB. $5,500 OC. Allison would want to sell it to Eric with both $4,500 and $5.500. D. Allison wouldn't want to sell it anyway since the eggs would be laid out forever.arrow_forwardCoparrow_forward

- Dusty would like to buy a new car in five years. He currently has $11,500 saved. He's considering buying a car for around $15,500 but would like to add a Turbo engine to increase the car's performance. This would increase the price of the car to $19,500. Required: 1-a. If Dusty can earn 10% interest, compounded annually, how much will he have in five years? (EV of $1, PV of $1, EVA of $1, and PVA of $1) 1-b. Will he be able to get a car with a Turbo engine in five years? Complete this question by entering your answers in the tabs below. Req 1A Req 18 If Dusty can earn 10% interest, compounded annually, how much will he have in five years? (Use tables, Excel, or a financial calculator. Round your answer to 2 decimal places.) Future value Reg 1A Req 18 >arrow_forward1.) Starting with $15,000, how much will you have in 10 years if you can earn 6 percent on your money? 2.) If you can earn only 4 percent? If the average new home costs $275,000 today, how much will it cost in 10 years if the price increases by 5 percent each year? 3.) If you can earn 4 percent, how much will you have to save each year if you want to retire in 35 years with $1 million?arrow_forwardTristan Sandino is selling his motorcycle. His friend, Rudy, is offering to pay cash in the amount of $8,800. Another friend, Costa, has offered payments of $300 monthly for 4 years. What is the present value of Costa's payments? Assume money is worth 3.5%, compounded monthly.arrow_forward

- Pete Air wants to buy a used Jeep in 6 years. He estimates the Jeep will cost $17,400. Assume Pete invests $12,400 now at 12% interest compounded semiannually. a. Calculate the maturity value of the investment. (Use the Table provided.) (Do not round intermediate calculations. Round your answer to the nearest cent.) Maturity value b. Will Pete have enough money to buy the Jeep at the end of 6 years? O Yes No Sce S.arrow_forwardMary Smith plans to buy a truck for $20,000 after two years if the interest rate is 4% how much money should Mary set aside today for the purchasearrow_forward12–25. Pete Air wants to buy a used Jeep in 5 years. He estimates the Jeep will cost $15,000. Assume Pete invests $10,000 now at 12% interest compounded semiannually. Will Pete have enough money to buy his Jeep at the end of 5 years? PROVIDE THE FOLLOWING FOR EACH PROBLEM N= I= PV= PMT= FV= C/Y= P/Y =arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education