FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

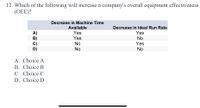

Transcribed Image Text:12. Which of the following will increase a company's overall equipment effectiveness

(OEE)?

Decrease in Machine Time

Available

Decrease in Ideal Run Rate

Yes

Yes

A)

B)

C)

D)

Yes

No

No

Yes

No

No

A. Choice A

B. Choice B

C. Choice C

D. Choice D

Expert Solution

arrow_forward

Step 1

Overall Equipment Effectiveness (OEE) refers to measure or criteria or standard of, as the name suggests, the effectiveness of a manufacturing operation against its potential in its entirety (full potential).

It depicts the percentage of productive manufacturing time.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Enabled: Chapter 5 What-If Analysis for Linear . 0 Saved Based on the following sensitivity analysis, which of the following products would be considered most sensitive to changes or errors in the objective function coefficient? Variable Cells Final Allowable Allowable Objective Coefficient Cell Name Value Reduced Cost Increase Decrease $B$2 13 4. Product_1 Product_2 Product_3 -2 25 $B$3 175 25 14 11 $B$4 -1.5 25 13 7 Constraints Final Shadow Constraint Allowable Allowable Cell Name Value Price R.H.Side Increase Decrease $H$9 Resource A 100 1E+30 100 $H$10 Resource B 525 800 1E+30 275 SH$11 Resource C 700 1.75 700 366.6666667 700 O Product 3 O Product 2 O Product 1arrow_forwardTime left 1:46 Which of the following statements about CVP analysis is false? O a. Unit selling price, unit variable costs, and total fixed costs are known and remain constant. Ob. All of the given answers are true. Oc. Managers use (CVP) analysis to study the behavior of and relationship among the elements such as total revenues, total costs, and income O d. Total revenues and total costs are linear in relation to output units. O e. Operating income calculations in CVP analysis are based on contribution margin not gross margin. 14:13 A O A d0 ENG 15-04-2021 re to search hp end brt sc delete home & num 23 + backspace 24 4. lock 8. 3. 6 7 V 8 A home enter 5 0 D F G J K L. pause 51 B ↑ shift 11 2 N M end alt ctrl insarrow_forward6. What of the following might result from dropping an unprofitable customer? a. Sales levels would decrease b. Future business relations could suffer c. Costs would decline d Costs could stay the same in the short-term e. All of the above bearrow_forward

- Solve 2 questions numbers 5 and 9 with steps please.arrow_forwardView Policies Current Attempt in Progress Variable costs O vary in total as activity varies. O vary on a per unit basis as activity varies. O are unpredictable. O none of the above. eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answerarrow_forwardI need the answer as soon as possiblearrow_forward

- Which of the following is true when referring to fixed costs? I. Fixed costs remain constant in total throughout the relevant range. II. The trend in companies today is toward greater fixed costs relative to variable costs. III. As volume increases, unit fixed cost and total fixed cost will change. IV. Fixed costs increase in total throughout the relevant range. a. II only b. All but IV c. I and II d. All but III e. None of thesearrow_forwardsde • The most likely strategy to reduce the break-even point should be to 1. Increase fixed costs 2. Decrease selling price 3. Increase variable costs 4. Increase selling price O 1 O 2 O 3 O 4 Question 20 • In break-even analysis, which of the following is not an assumption over the relevant range 1. Unit selling price are constant 2. Unit variable costs are constant 3. Total costs are constant 4. Total fixed costs are constant O 1 O 2 O 3 04 MacBook Proarrow_forward7arrow_forward

- Question 10 An increate in Fixed Cost per unit maybe attributed with decrease in production. A. True B. Falsearrow_forwardi have the answer but i want to know why?arrow_forwardIndustry is evaluating two different manufacturing systems (Alpha and Beta): Possible Outcome Probability Rate of Return Alpha System Rate of Return Beta System Optimistic .35 .40 .15 Most likely .45 .25 .30 Pessimistic .20 (.10) (.20) Which manufacturing system provides the lowest expected return? why? Alpha System Beta System Not enough informationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education