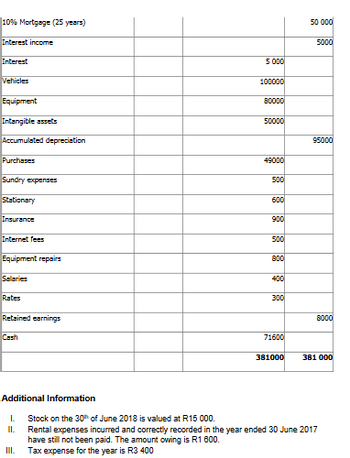

10% Mortgage (25 years) Interest income Interest Vehicles Equipment Intangible assets Accumulated depreciation Purchases Sundry expenses Stationary Insurance Internet fees Equipment repairs Salaries Rates Retained earnings Cash Additional Information I. II. III. 5 000 100000 80000 50000 49000 500 600 900 500 800 400 300 71600 381000 50 000 5000 95000 8000 381 000 Stock on the 30th of June 2018 is valued at R15 000. Rental expenses incurred and correctly recorded in the year ended 30 June 2017 have still not been paid. The amount owing is R1 000. Tax expense for the year is R3 400

10% Mortgage (25 years) Interest income Interest Vehicles Equipment Intangible assets Accumulated depreciation Purchases Sundry expenses Stationary Insurance Internet fees Equipment repairs Salaries Rates Retained earnings Cash Additional Information I. II. III. 5 000 100000 80000 50000 49000 500 600 900 500 800 400 300 71600 381000 50 000 5000 95000 8000 381 000 Stock on the 30th of June 2018 is valued at R15 000. Rental expenses incurred and correctly recorded in the year ended 30 June 2017 have still not been paid. The amount owing is R1 000. Tax expense for the year is R3 400

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

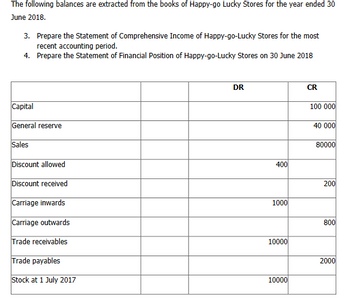

The following balances are extracted from the books of Happy-go Lucky Stores for the year ended 30

June 2018. The two images attached form part of the same table

3. Prepare the Statement of Comprehensive Income of Happy-go-Lucky Stores for the most

recent accounting period.

4. Prepare the Statement of Financial Position of Happy-go-Lucky Stores on 30 June 2018

Transcribed Image Text:10% Mortgage (25 years)

Interest income

Interest

Vehicles

Equipment

Intangible assets

Accumulated depreciation

Purchases

Sundry expenses

Stationary

Insurance

Internet fees

Equipment repairs

Salaries

Rates

Retained earnings

Cash

Additional Information

L

II.

III.

5 000

100000

80000

50000

49000

500

600

900

500

800

400

300

71600

381000

50 000

5000

95000

8000

381 000

Stock on the 30th of June 2018 is valued at R15 000.

Rental expenses incurred and correctly recorded in the year ended 30 June 2017

have still not been paid. The amount owing is R1 800.

Tax expense for the year is R3 400

Transcribed Image Text:The following balances are extracted from the books of Happy-go Lucky Stores for the year ended 30

June 2018.

3. Prepare the Statement of Comprehensive Income of Happy-go-Lucky Stores for the most

recent accounting period.

4. Prepare the Statement of Financial Position of Happy-go-Lucky Stores on 30 June 2018

Capital

General reserve

Sales

Discount allowed

Discount received

Carriage inwards

Carriage outwards

Trade receivables

Trade payables

Stock at 1 July 2017

DR

400

1000

10000

10000

CR

100 000

40 000

80000

200

800

2000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Hi, the question is looking for :

1) Statement of Comprehensive Income of Happy-go-Lucky Stores for the most

recent accounting period.

2) Statement of Financial Position of Happy-go-Lucky Stores on 30 June 2018

Extracted from the books of Happy-go Lucky Stores for the year ended 30

Transcribed Image Text:The following balances are extracted from the books of Happy-go Lucky Stores for the year ended 30

June 2018.

3. Prepare the Statement of Comprehensive Income of Happy-go-Lucky Stores for the most

recent accounting period.

4. Prepare the Statement of Financial Position of Happy-go-Lucky Stores on 30 June 2018

Capital

General reserve

Sales

Discount allowed

Discount received

Carriage inwards

Carriage outwards

Trade receivables

Trade payables

Stock at 1 July 2017

DR

400

1000

10000

10000

CR

100 000

40 000

80000

200

800

2000

Transcribed Image Text:10% Mortgage (25 years)

Interest income

Interest

Vehicles

Equipment

Intangible assets

Accumulated depreciation

Purchases

Sundry expenses

Stationary

Insurance

Internet fees

Equipment repairs

Salaries

Rates

Retained earnings

Cash

Additional Information

L

II.

III.

5 000

100000

80000

50000

49000

500

600

900

500

800

400

300

71600

381000

50 000

5000

95000

8000

381 000

Stock on the 30th of June 2018 is valued at R15 000.

Rental expenses incurred and correctly recorded in the year ended 30 June 2017

have still not been paid. The amount owing is R1 800.

Tax expense for the year is R3 400

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education